Q3 2022 Investor Presentation

cr

CS

cr

OCS

CI

OC

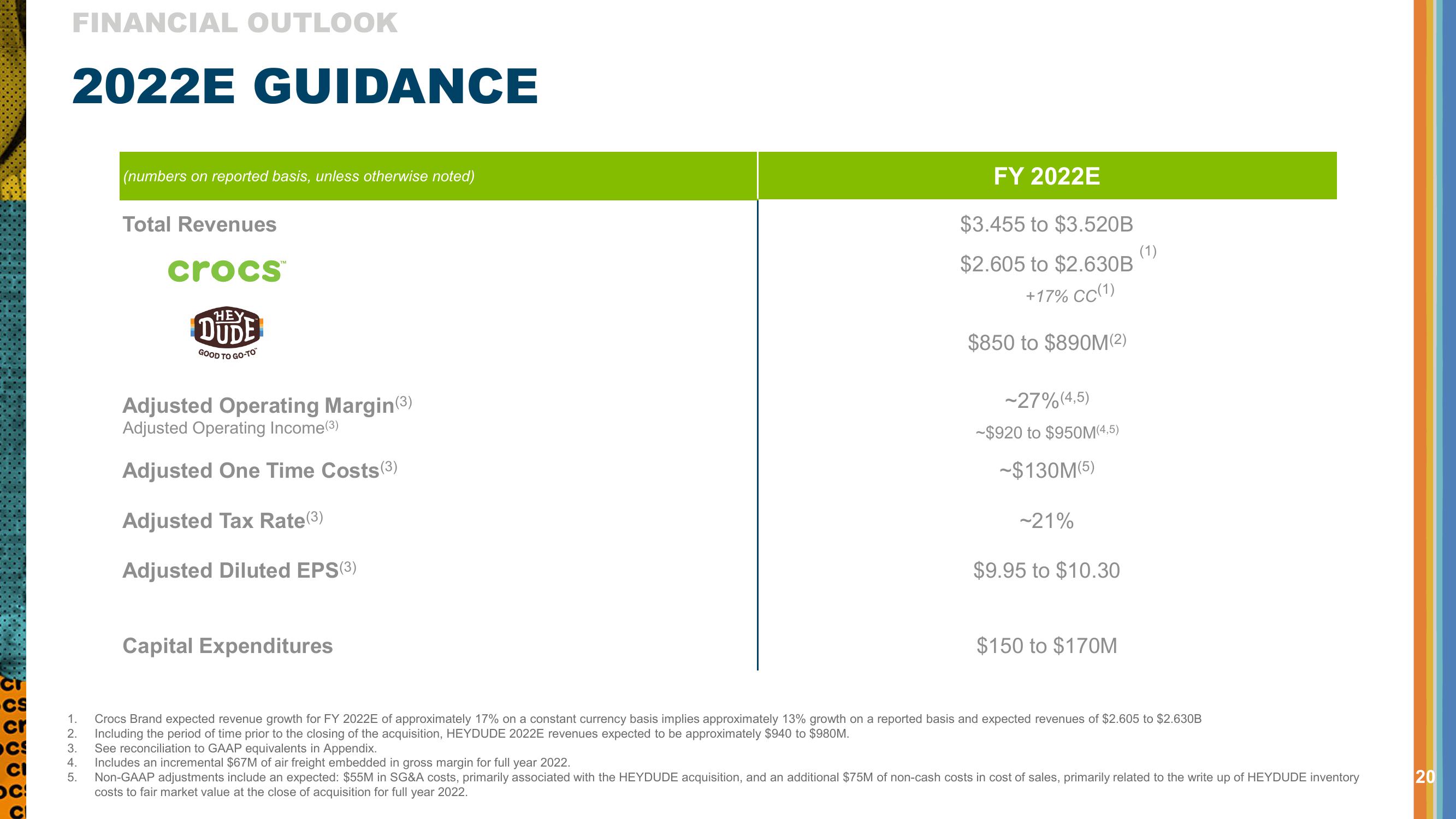

FINANCIAL OUTLOOK

2022E GUIDANCE

(numbers on reported basis, unless otherwise noted)

Total Revenues

crocs™

HEY

DUDE

GOOD TO GO-TO

Adjusted Operating Margin(3)

Adjusted Operating Income (³)

Adjusted One Time Costs (3)

Adjusted Tax Rate(³)

Adjusted Diluted EPS(3)

Capital Expenditures

FY 2022E

$3.455 to $3.520B

$2.605 to $2.630B

+17% CC(1)

$850 to $890M(2)

-27% (4,5)

-$920 to $950M(4,5)

-$130M(5)

~21%

$9.95 to $10.30

$150 to $170M

(1)

1.

Crocs Brand expected revenue growth for FY 2022E of approximately 17% on a constant currency basis implies approximately 13% growth on a reported basis and expected revenues of $2.605 to $2.630B

2. Including the period of time prior to the closing of the acquisition, HEYDUDE 2022E revenues expected to be approximately $940 to $980M.

3.

See reconciliation to GAAP equivalents in Appendix.

4.

Includes an incremental $67M of air freight embedded in gross margin for full year 2022.

5. Non-GAAP adjustments include an expected: $55M in SG&A costs, primarily associated with the HEYDUDE acquisition, and an additional $75M of non-cash costs in cost of sales, primarily related to the write up of HEYDUDE inventory

costs to fair market value at the close of acquisition for full year 2022.

20View entire presentation