Apollo Medical Holdings Investor Presentation Deck

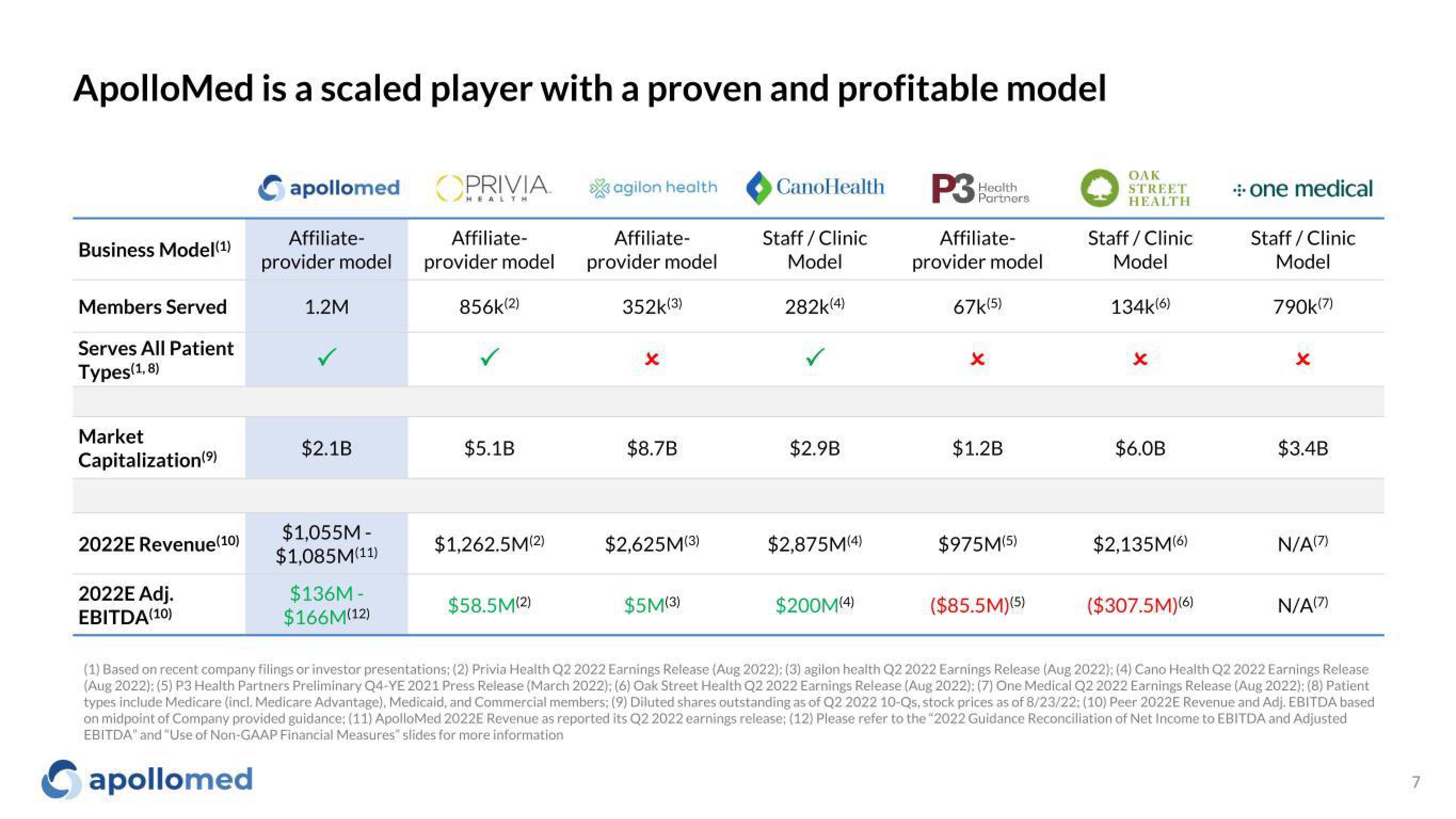

ApolloMed is a scaled player with a proven and profitable model

Business Model (1)

Members Served

Serves All Patient

Types(1,8)

Market

Capitalization (⁹)

2022E Revenue (10)

2022E Adj.

EBITDA (10)

apollomed

Affiliate-

provider model

1.2M

$2.1B

$1,055M-

$1,085M(11)

$136M-

$166M(12)

PRIVIA.

HEALTH

Affiliate-

provider model

856k(2)

$5.1B

$1,262.5M(2)

$58.5M(2)

agilon health

Affiliate-

provider model

352k(3)

x

$8.7B

$2,625M(3)

$5M (3)

CanoHealth P3

Staff / Clinic

Model

282k(4)

$2.9B

$2,875M(4)

$200M(4)

Health

Partners

Affiliate-

provider model

67k(5)

x

$1.2B

$975M (5)

($85.5M) (5)

OAK

STREET

HEALTH

Staff / Clinic

Model

134k(6)

X

$6.0B

$2.135M(6)

($307.5M)(6)

+ one medical

Staff / Clinic

Model

790k(7)

X

$3.4B

N/A(7)

N/A(7)

(1) Based on recent company filings or investor presentations; (2) Privia Health Q2 2022 Earnings Release (Aug 2022); (3) agilon health Q2 2022 Earnings Release (Aug 2022): (4) Cano Health Q2 2022 Earnings Release

(Aug 2022); (5) P3 Health Partners Preliminary Q4-YE 2021 Press Release (March 2022); (6) Oak Street Health Q2 2022 Earnings Release (Aug 2022): (7) One Medical Q2 2022 Earnings Release (Aug 2022); (8) Patient

types include Medicare (incl. Medicare Advantage), Medicaid, and Commercial members; (9) Diluted shares outstanding as of Q2 2022 10-Qs, stock prices as of 8/23/22; (10) Peer 2022E Revenue and Adj. EBITDA based

on midpoint of Company provided guidance; (11) ApolloMed 2022E Revenue as reported its Q2 2022 earnings release; (12) Please refer to the "2022 Guidance Reconciliation of Net Income to EBITDA and Adjusted

EBITDA" and "Use of Non-GAAP Financial Measures" slides for more information

Capollomed

7View entire presentation