AlTi SPAC Presentation Deck

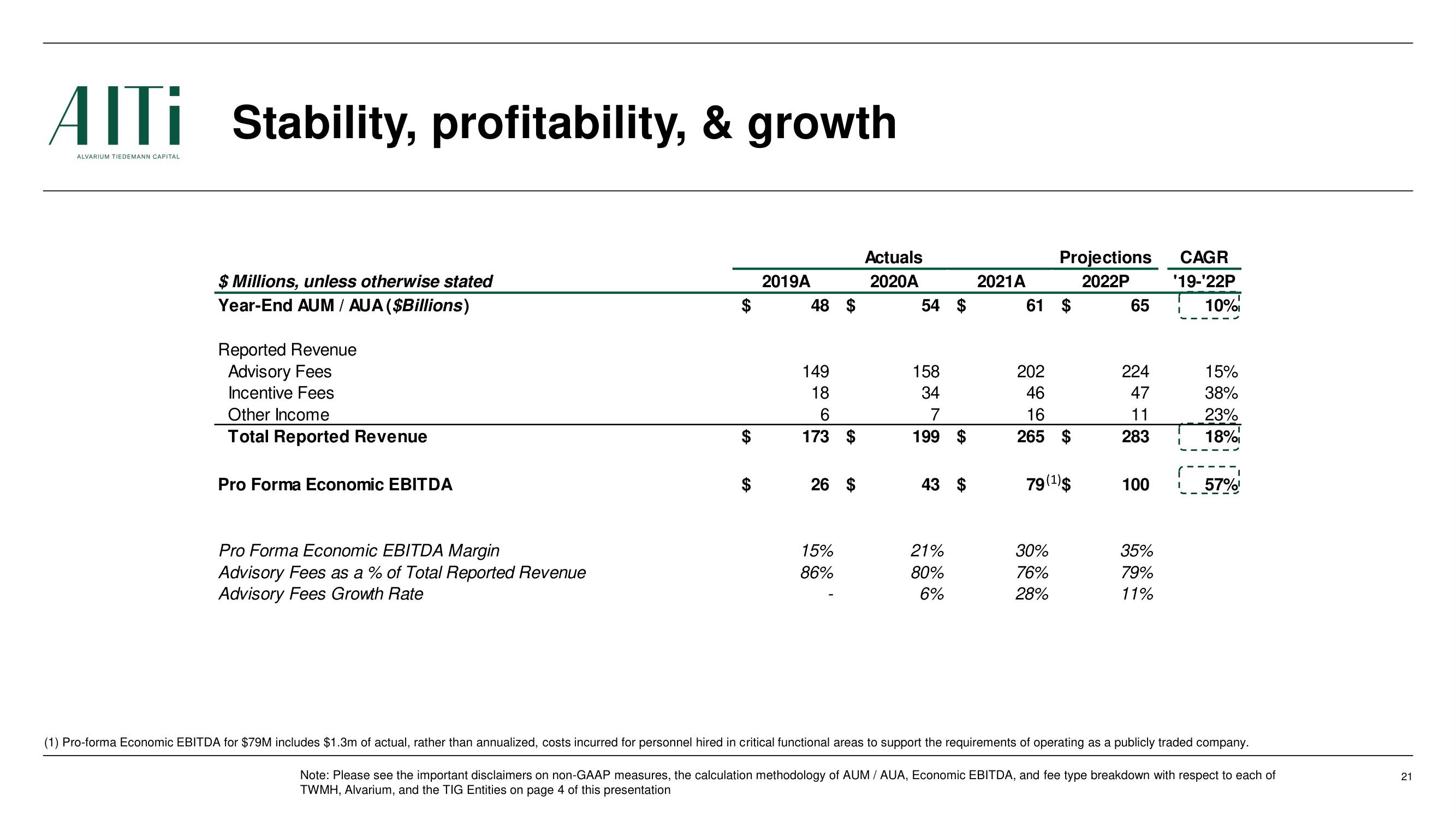

AITI Stability, profitability, & growth

ALVARIUM TIEDEMANN CAPITAL

$ Millions, unless otherwise stated

Year-End AUM/ AUA ($Billions)

Reported Revenue

Advisory Fees

Incentive Fees

Other Income

Total Reported Revenue

Pro Forma Economic EBITDA

Pro Forma Economic EBITDA Margin

Advisory Fees as a % of Total Reported Revenue

Advisory Fees Growth Rate

$

$

2019A

48 $

149

18

6

173 $

26 $

15%

86%

Actuals

2020A

54 $

158

34

7

199

43 $

21%

80%

6%

2021A

61 $

202

46

16

265

Projections

2022P

79(1)$

30%

76%

28%

65

224

47

11

283

100

35%

79%

11%

CAGR

'19-'22P

10%

I

I

15%

38%

23%

18%

57%

(1) Pro-forma Economic EBITDA for $79M includes $1.3m of actual, rather than annualized, costs incurred for personnel hired in critical functional areas to support the requirements of operating as a publicly traded company.

Note: Please see the important disclaimers on non-GAAP measures, the calculation methodology of AUM / AUA, Economic EBITDA, and fee type breakdown with respect to each of

TWMH, Alvarium, and the TIG Entities on page 4 of this presentation

21View entire presentation