Kroger Mergers and Acquisitions Presentation Deck

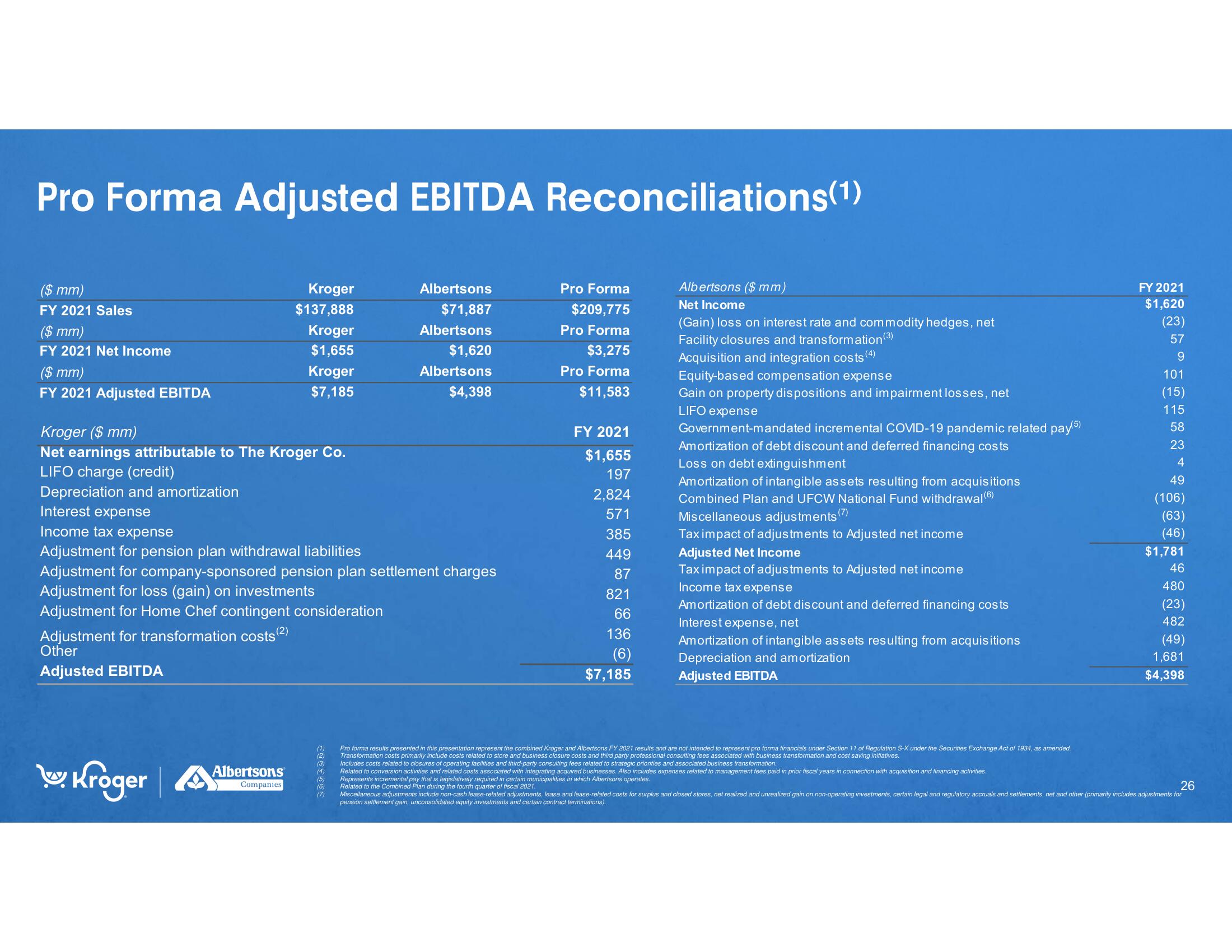

Pro Forma Adjusted EBITDA Reconciliations (1)

Kroger

$137,888

Kroger

Albertsons

$71,887

Albertsons

$1,620

Albertsons

$4,398

$1,655

($ mm)

FY 2021 Sales

($ mm)

FY 2021 Net Income

($ mm)

FY 2021 Adjusted EBITDA

Kroger ($ mm)

Net earnings attributable to The Kroger Co.

LIFO charge (credit)

Depreciation and amortization

Interest expense

Income tax expense

Kroger

$7,185

Adjustment for pension plan withdrawal liabilities

Adjustment for company-sponsored pension plan settlement charges

Adjustment for loss (gain) on investments

Adjustment for Home Chef contingent consideration

Adjustment for transformation costs (2)

Other

Adjusted EBITDA

Kroger

Albertsons

Companies

Pro Forma

$209,775

Pro Forma

$3,275

Pro Forma

$11,583

C

FY 2021

$1,655

197

2,824

571

385

449

87

821

66

136

(6)

$7,185

Albertsons ($ mm)

Net Income

(Gain) loss on interest rate and commodity hedges, net

Facility closures and transformation (3)

Acquisition and integration costs

Equity-based compensation expense

(4)

Gain on property dispositions and impairment losses, net

LIFO expense

Government-mandated incremental COVID-19 pandemic related pay(5)

Amortization of debt discount and deferred financing costs

Loss on debt extinguishment

Amortization of intangible assets resulting from acquisitions

Combined Plan and UFCW National Fund withdrawal (6)

Miscellaneous adjustments (7)

Tax impact of adjustments to Adjusted net income

Adjusted Net Income

Tax impact of adjustments to Adjusted net income

Income tax expense

Amortization of debt discount and deferred financing costs

Interest expense, net

Amortization of intangible assets resulting from acquisitions

Depreciation and amortization

Adjusted EBITDA

(1)

Pro forma results presented in this presentation represent the combined Kroger and Albertsons FY 2021 results and are not intended to represent pro forma financials under Section 11 of Regulation S-X under the Securities Exchange Act of 1934, as amended.

Transformation costs primarily include costs related to store and business closure costs and third party professional consulting fees associated with business transformation and cost saving initiatives.

(2)

(3)

Includes costs related to closures of operating facilities and third-party consulting fees related to strategic priorities and associated business transformation.

(4) Related to conversion activities and related costs associated with integrating acquired businesses. Also includes expenses related to management fees paid in prior fiscal years in connection with acquisition and financing activities.

Represents incremental pay that is legislatively required in certain municipalities in which Albertsons operates.

(5)

(6) Related to the Combined Plan during the fourth quarter of fiscal 2021.

FY 2021

$1,620

(23)

57

9

101

(15)

115

58

23

4

49

(106)

(63)

(46)

$1,781

46

480

(23)

482

(49)

1,681

$4,398

26

Miscellaneous adjustments include non-cash lease-related adjustments, lease and lease-related costs for surplus and closed stores, net realized and unrealized gain on non-operating investments, certain legal and regulatory accruals and settlements, net and other (primarily includes adjustments for

pension settlement gain, unconsolidated equity investments and certain contract terminations).View entire presentation