Allwyn SPAC

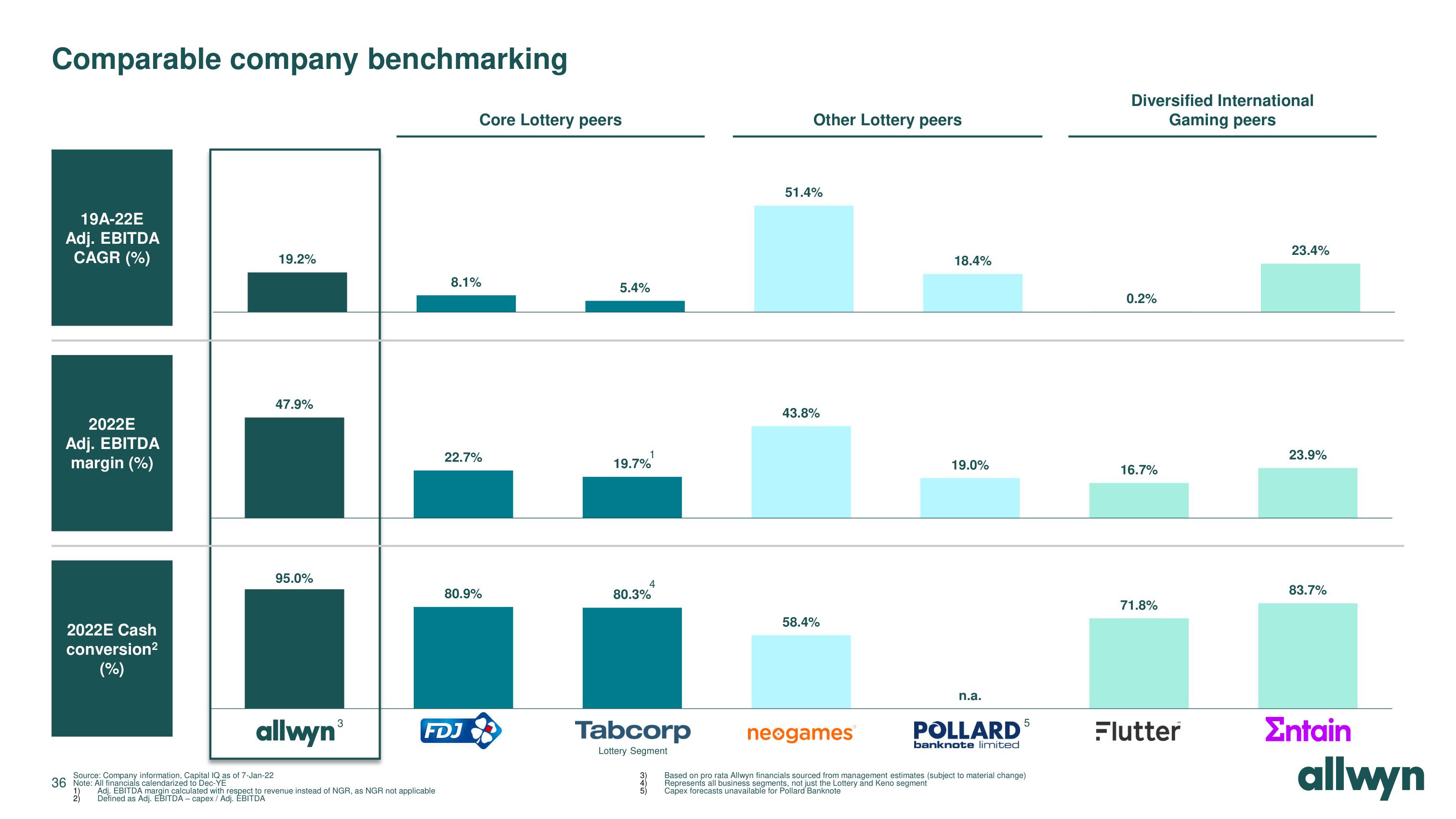

Comparable company benchmarking

19A-22E

Adj. EBITDA

CAGR (%)

2022E

Adj. EBITDA

margin (%)

2022E Cash

conversion²

(%)

Source: Company information, Capital IQ as of 7-Jan-22

36 Note: All financials calendarized to Dec-YE

1)

2)

19.2%

47.9%

95.0%

allwyn

3

Adj. EBITDA margin calculated with respect to revenue instead of NGR, as NGR not applicable

Defined as Adj. EBITDA - capex / Adj. ÉBITDA

Core Lottery peers

8.1%

22.7%

FDJ

80.9%

5.4%

19.7%

1

4

80.3%

3)

Tabcorp

Lottery Segment

Other Lottery peers

51.4%

43.8%

58.4%

18.4%

19.0%

n.a.

POLLARD

5

neogames

Based on pro rata Allwyn financials sourced from management estimates (subject to material change)

Represents all business segments, not just the Lottery and Keno segment

Capex forecasts unavailable for Pollard Banknote

banknote limited

Diversified International

Gaming peers

0.2%

16.7%

71.8%

Flutter

23.4%

23.9%

83.7%

Σntain

allwynView entire presentation