Supplemental Presentation on UNFI’s Pending Supervalu Acquisition

Sources of Cost Synergies

●

●

●

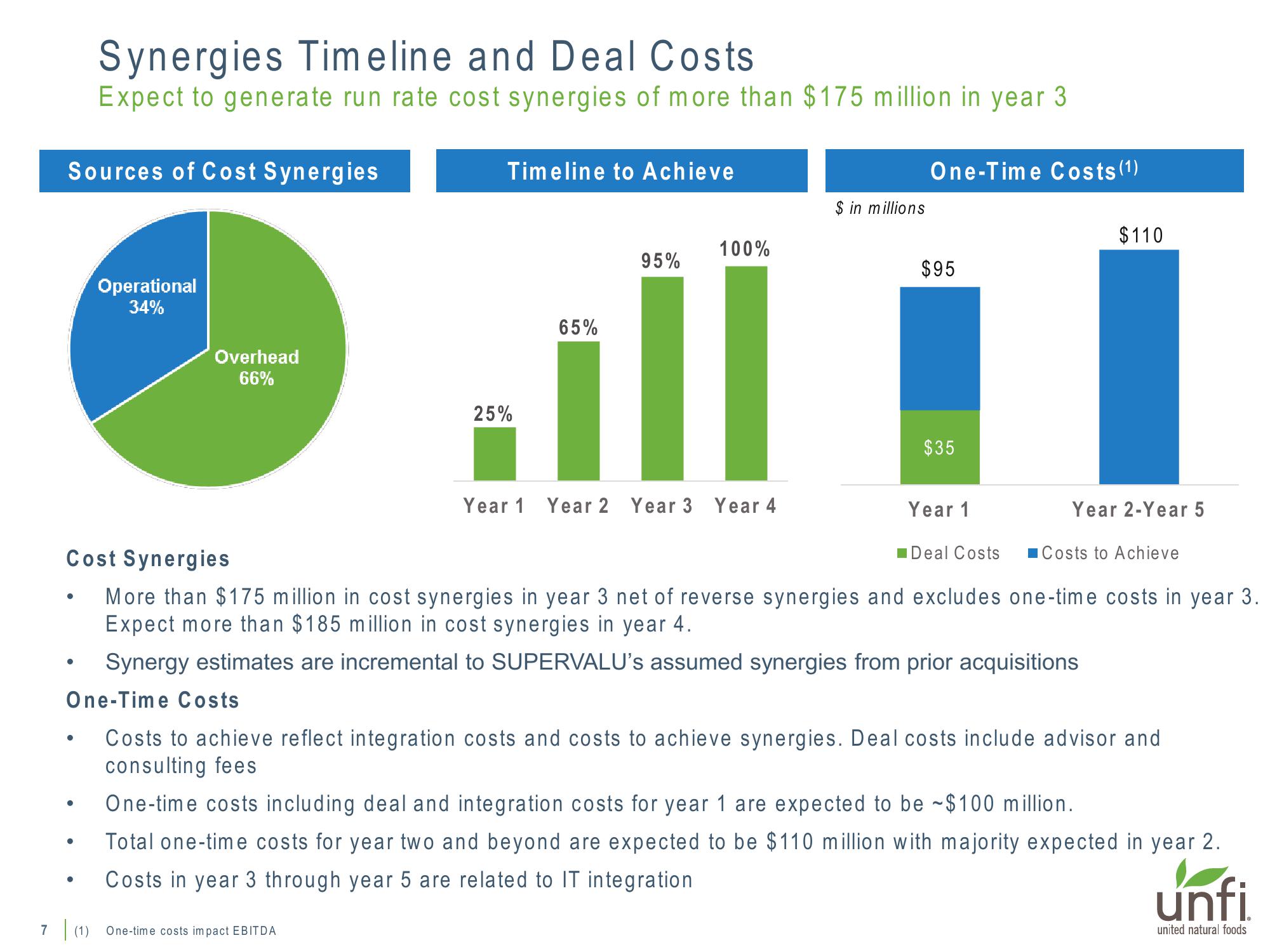

Synergies Timeline and Deal Costs

Expect to generate run rate cost synergies of more than $175 million in year 3

●

●

Operational

34%

7 (1)

Overhead

66%

Timeline to Achieve

25%

65%

One-time costs impact EBITDA

95%

100%

Year 1 Year 2 Year 3 Year 4

$ in millions

Deal Costs Costs to Achieve

Cost Synergies

More than $175 million in cost synergies in year 3 net of reverse synergies and excludes one-time costs in year 3.

Expect more than $185 million in cost synergies in year 4.

Synergy estimates are incremental to SUPERVALU's assumed synergies from prior acquisitions

One-Time Costs (1)

$95

$35

One-Time Costs

Costs to achieve reflect integration costs and costs to achieve synergies. Deal costs include advisor and

consulting fees

Year 1

$110

Year 2-Year 5

One-time costs including deal and integration costs for year 1 are expected to be ~$100 million.

Total one-time costs for year two and beyond are expected to be $110 million with majority expected in year 2.

Costs in year 3 through year 5 are related to IT integration

unfi.

united natural foodsView entire presentation