First Busey Results Presentation Deck

2Q23 Earnings Investor Presentation

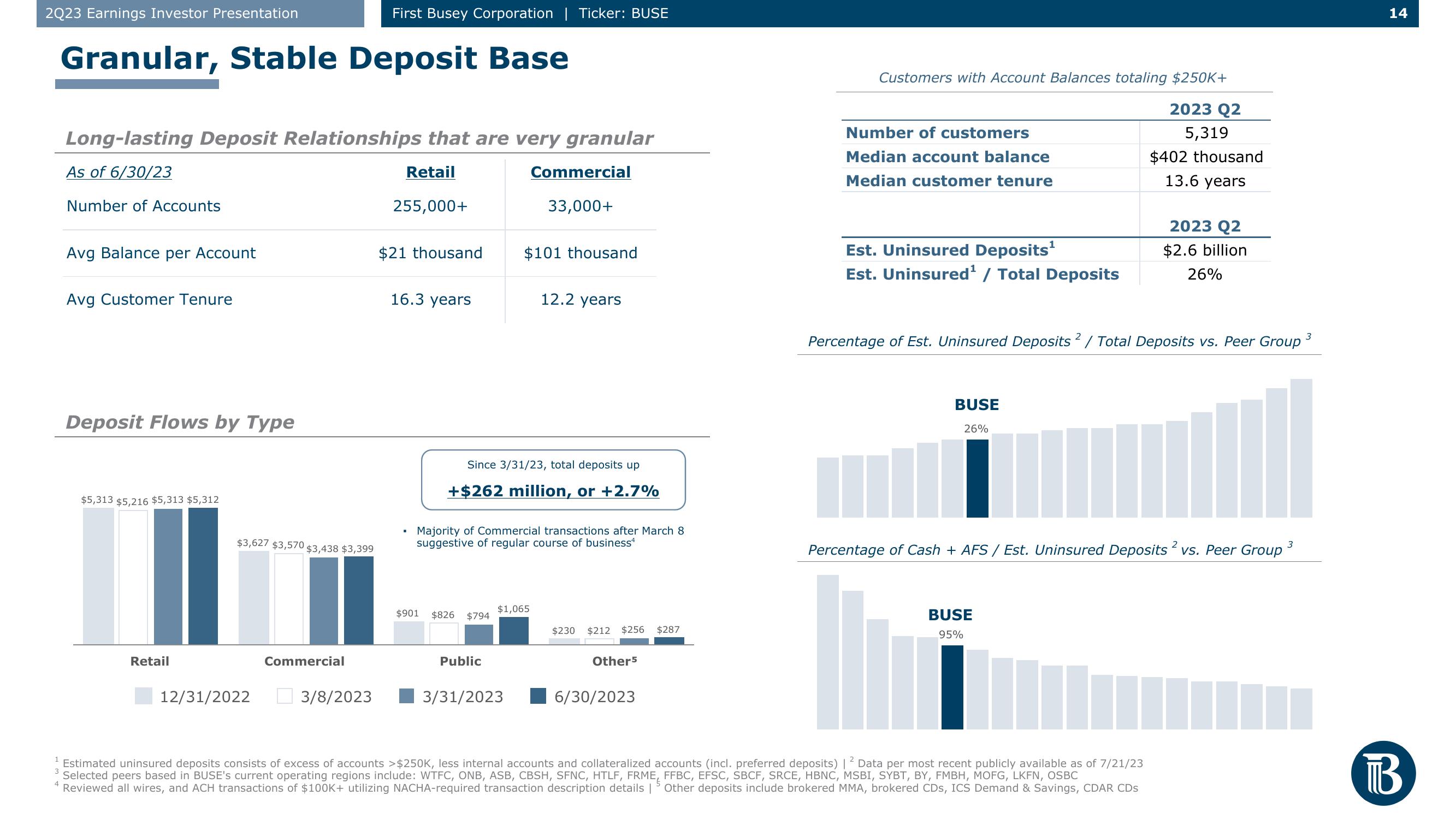

Granular, Stable Deposit Base

Long-lasting Deposit Relationships that are very granular

As of 6/30/23

Retail

Number of Accounts

255,000+

Avg Balance per Account

Avg Customer Tenure

Deposit Flows by Type

$5,313 $5,216 $5,313 $5,312

Retail

$3,627 $3,570 $3,438 $3,399

12/31/2022

First Busey Corporation | Ticker: BUSE

Commercial

3/8/2023

$21 thousand

16.3 years

$901

$826 $794

Since 3/31/23, total deposits up

+$262 million, or +2.7%

Majority of Commercial transactions after March 8

suggestive of regular course of business4

Public

Commercial

33,000+

$101 thousand

$1,065

3/31/2023

12.2 years

$230 $212 $256 $287

Other5

6/30/2023

Customers with Account Balances totaling $250K+

2023 Q2

5,319

$402 thousand

13.6 years

Number of customers

Median account balance

Median customer tenure

Est. Uninsured Deposits¹

Est. Uninsured¹ / Total Deposits

II

3

Percentage of Est. Uninsured Deposits 2 / Total Deposits vs. Peer Group ³

BUSE

26%

2023 Q2

$2.6 billion

26%

Percentage of Cash + AFS / Est. Uninsured Deposits 2 vs. Peer Group

BUSE

95%

¹ Estimated uninsured deposits consists of excess of accounts >$250K, less internal accounts and collateralized accounts (incl. preferred deposits) | 2 Data per most recent publicly available as of 7/21/23

Selected peers based in BUSE's current operating regions include: WTFC, ONB, ASB, CBSH, SFNC, HTLF, FRME, FFBC, EFSC, SBCF, SRCE, HBNC, MSBI, SYBT, BY, FMBH, MOFG, LKFN, OSBC

Reviewed all wires, and ACH transactions of $100K+ utilizing NACHA-required transaction description details | Other deposits include brokered MMA, brokered CDs, ICS Demand & Savings, CDAR CDs

3

14

BView entire presentation