Southland Holdings SPAC Presentation Deck

KEY INVESTMENT HIGHLIGHTS

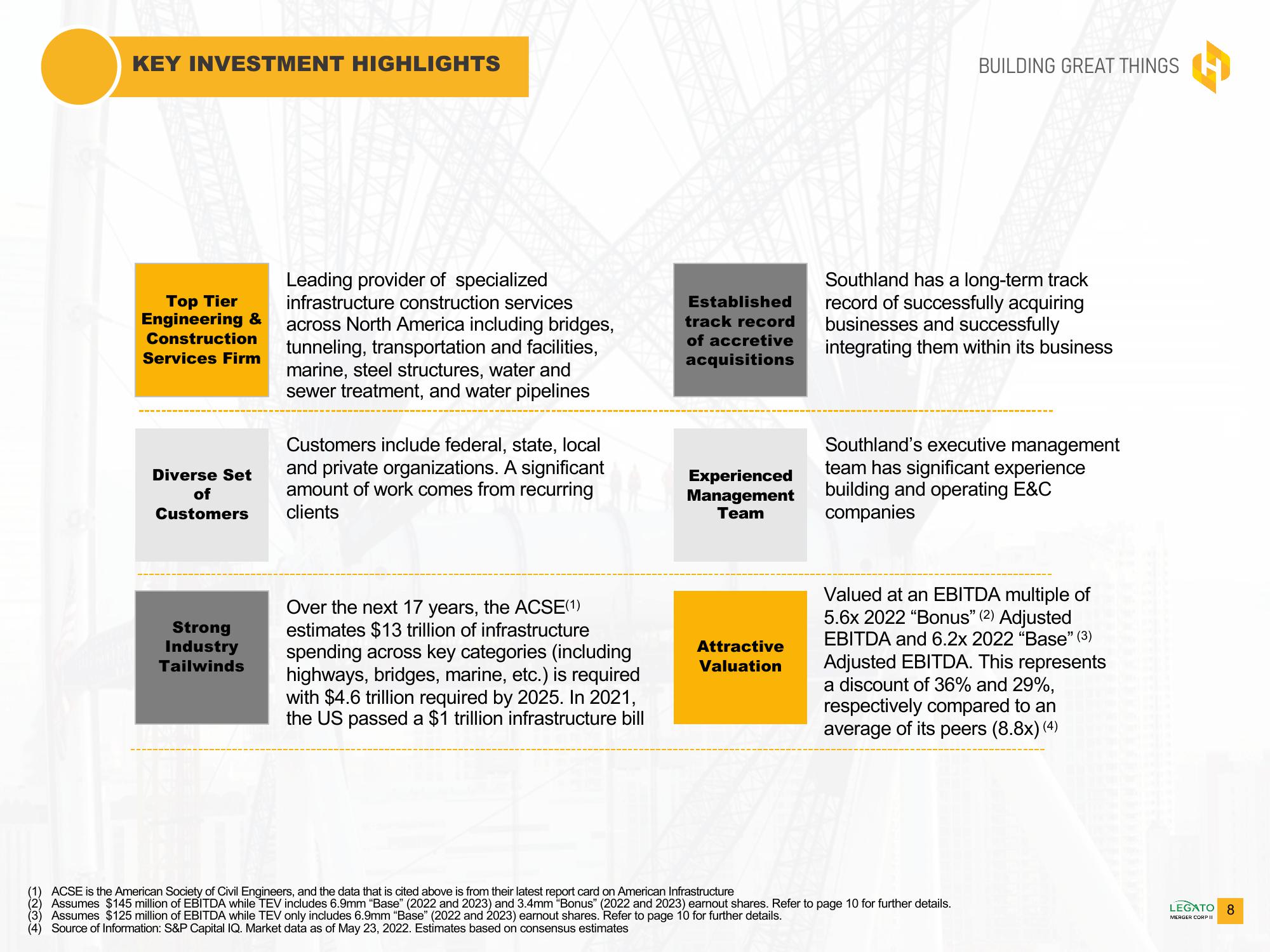

Top Tier

Engineering &

Construction

Services Firm

Diverse Set

of

Customers

Strong

Industry

Tailwinds

Leading provider of specialized

infrastructure construction services

across North America including bridges,

tunneling, transportation and facilities,

marine, steel structures, water and

sewer treatment, and water pipelines

Customers include federal, state, local

and private organizations. A significant

amount of work comes from recurring

clients

Over the next 17 years, the ACSE(1)

estimates $13 trillion of infrastructure

spending across key categories (including

highways, bridges, marine, etc.) is required

with $4.6 trillion required by 2025. In 2021,

the US passed a $1 trillion infrastructure bill

Established

track record

of accretive

acquisitions

Experienced

Management

Team

Attractive

Valuation

BUILDING GREAT THINGS

Southland has a long-term track

record of successfully acquiring

businesses and successfully

integrating them within its business

Southland's executive management

team has significant experience

building and operating E&C

companies

Valued at an EBITDA multiple of

5.6x 2022 "Bonus" (2) Adjusted

EBITDA and 6.2x 2022 "Base" (3)

Adjusted EBITDA. This represents

a discount of 36% and 29%,

respectively compared to an

average of its peers (8.8x) (4)

(1) ACSE is the American Society of Civil Engineers, and the data that is cited above is from their latest report card on American Infrastructure

(2) Assumes $145 million of EBITDA while TEV includes 6.9mm "Base" (2022 and 2023) and 3.4mm "Bonus" (2022 and 2023) earnout shares. Refer to page 10 for further details.

(3) Assumes $125 million of EBITDA while TEV only includes 6.9mm "Base" (2022 and 2023) earnout shares. Refer to page 10 for further details.

(4) Source of Information: S&P Capital IQ. Market data as of May 23, 2022. Estimates based on consensus estimates

LEGATO 8

MERGER CORP IIView entire presentation