Spring 2023 Solar Industry Update

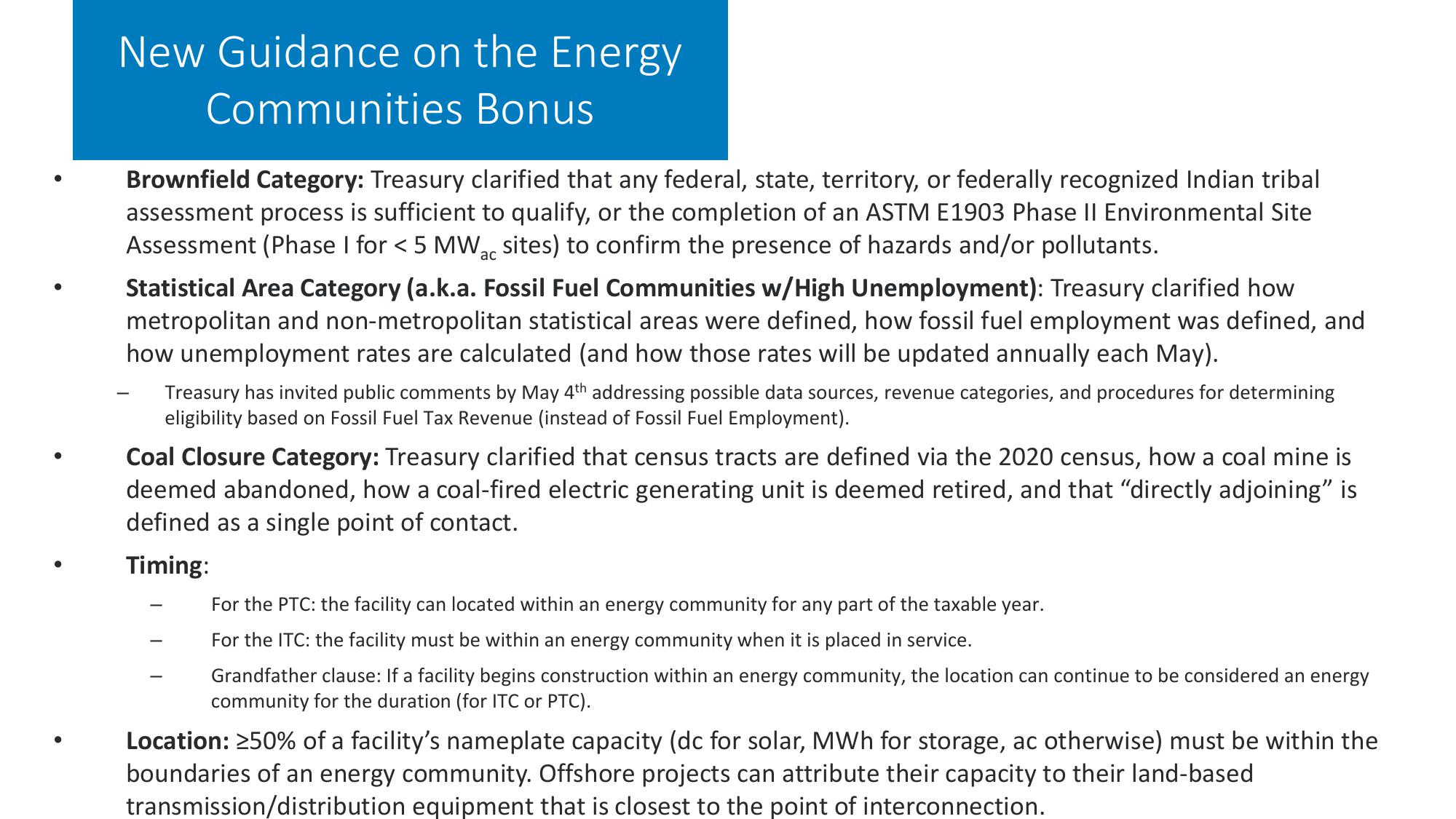

New Guidance on the Energy

Communities Bonus

Brownfield Category: Treasury clarified that any federal, state, territory, or federally recognized Indian tribal

assessment process is sufficient to qualify, or the completion of an ASTM E1903 Phase II Environmental Site

Assessment (Phase I for < 5 MW ac sites) to confirm the presence of hazards and/or pollutants.

Statistical Area Category (a.k.a. Fossil Fuel Communities w/High Unemployment): Treasury clarified how

metropolitan and non-metropolitan statistical areas were defined, how fossil fuel employment was defined, and

how unemployment rates are calculated (and how those rates will be updated annually each May).

Treasury has invited public comments by May 4th addressing possible data sources, revenue categories, and procedures for determining

eligibility based on Fossil Fuel Tax Revenue (instead of Fossil Fuel Employment).

Coal Closure Category: Treasury clarified that census tracts are defined via the 2020 census, how a coal mine is

deemed abandoned, how a coal-fired electric generating unit is deemed retired, and that "directly adjoining" is

defined as a single point of contact.

Timing:

For the PTC: the facility can located within an energy community for any part of the taxable year.

For the ITC: the facility must be within an energy community when it is placed in service.

Grandfather clause: If a facility begins construction within an energy community, the location can continue to be considered an energy

community for the duration (for ITC or PTC).

Location: ≥50% of a facility's nameplate capacity (dc for solar, MWh for storage, ac otherwise) must be within the

boundaries of an energy community. Offshore projects can attribute their capacity to their land-based

transmission/distribution equipment that is closest to the point of interconnection.View entire presentation