Hilltop Holdings Results Presentation Deck

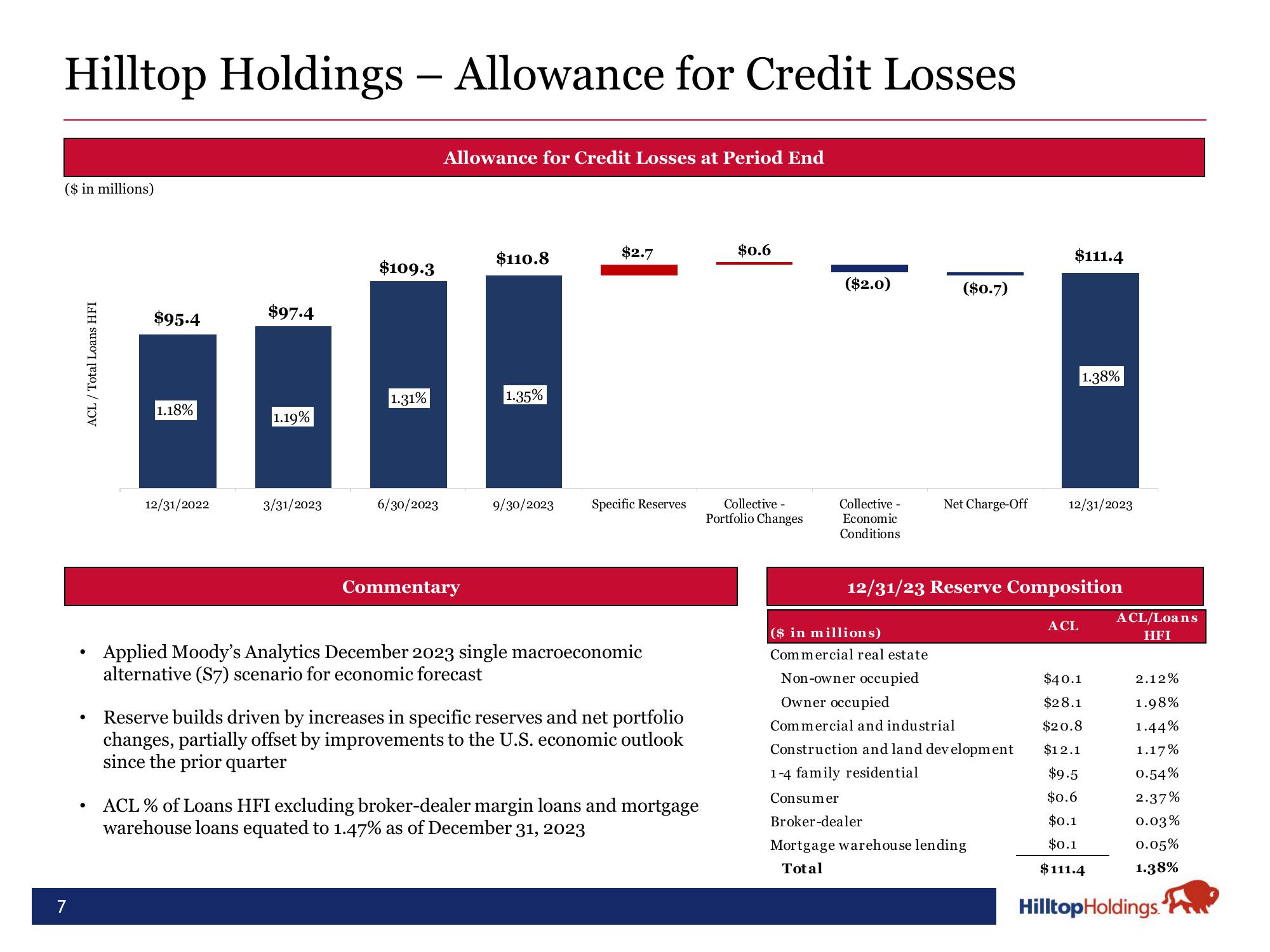

Hilltop Holdings - Allowance for Credit Losses

($ in millions)

7

ACL/Total Loans HFI

●

●

●

$95.4

1.18%

12/31/2022

$97.4

1.19%

3/31/2023

$109.3

1.31%

6/30/2023

Allowance for Credit Losses at Period End

Commentary

$110.8

1.35%

9/30/2023

$2.7

Specific Reserves

Applied Moody's Analytics December 2023 single macroeconomic

alternative (S7) scenario for economic forecast

Reserve builds driven by increases in specific reserves and net portfolio

changes, partially offset by improvements to the U.S. economic outlook

since the prior quarter

ACL % of Loans HFI excluding broker-dealer margin loans and mortgage

warehouse loans equated to 1.47% as of December 31, 2023

$0.6

Collective -

Portfolio Changes

($2.0)

Collective -

Economic

Conditions

($0.7)

Net Charge-Off

($ in millions)

Commercial real estate

Non-owner occupied

Owner occupied

Commercial and industrial

Construction and land development

1-4 family residential

$111.4

Consumer

Broker-dealer

Mortgage warehouse lending

Total

12/31/23 Reserve Composition

1.38%

12/31/2023

ACL

$40.1

$28.1

$20.8

$12.1

$9.5

$0.6

$0.1

$0.1

$111.4

ACL/Loans

HFI

2.12%

1.98%

1.44%

1.17%

0.54%

2.37%

0.03%

0.05%

1.38%

Hilltop HoldingsView entire presentation