Faraday Future Investor Presentation Deck

Faraday Future vs Recent Electric Vehicle Opportunities

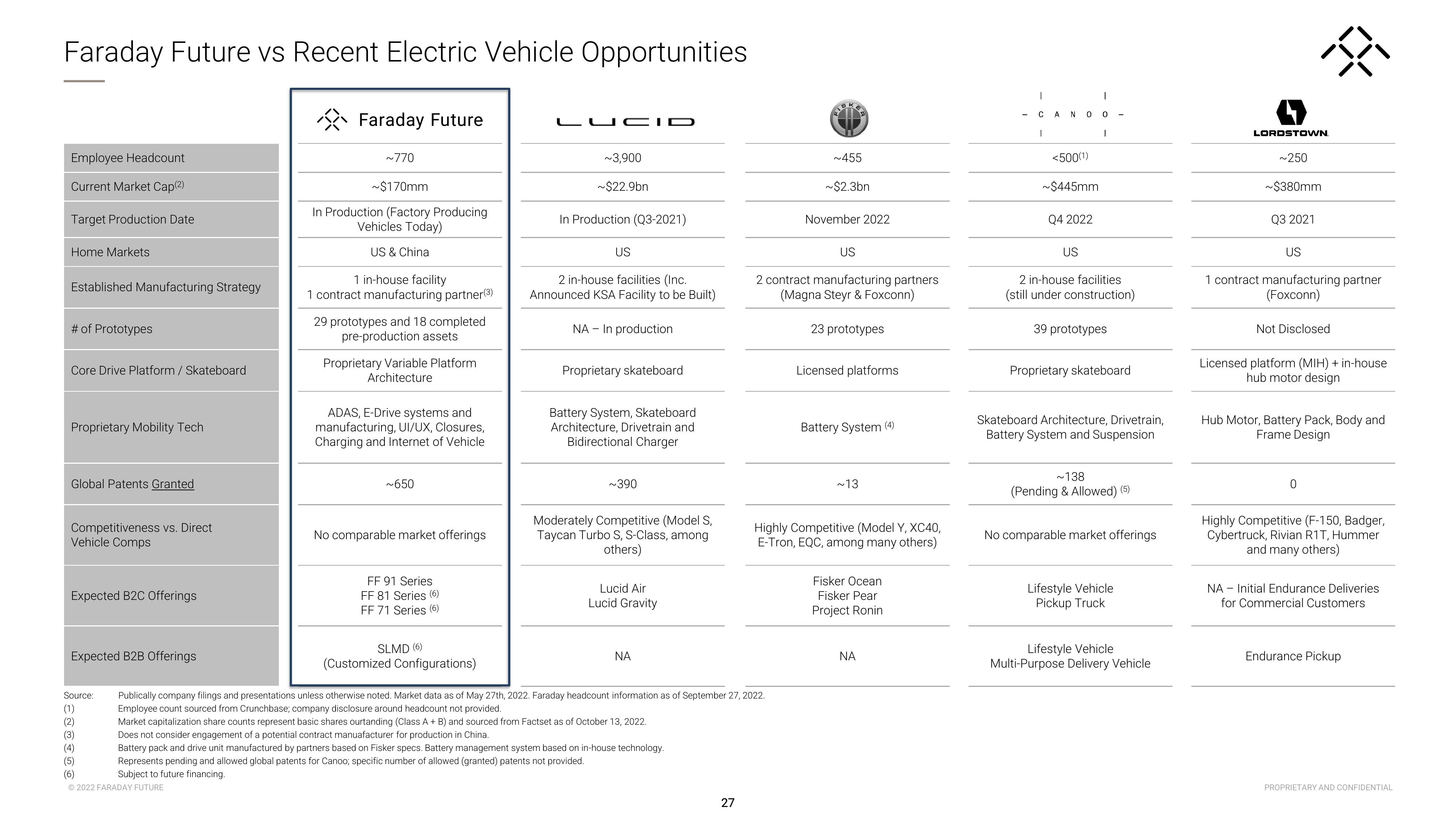

Employee Headcount

Current Market Cap(2)

Target Production Date

Home Markets

Established Manufacturing Strategy

# of Prototypes

Core Drive Platform / Skateboard

Proprietary Mobility Tech

Global Patents Granted

Competitiveness vs. Direct

Vehicle Comps

Expected B2C Offerings

Expected B2B Offerings

Source:

(1)

(2)

(3)

(4)

(5)

(6)

Faraday Future

~770

~$170mm

In Production (Factory Producing

Vehicles Today)

US & China

Ⓒ2022 FARADAY FUTURE

1 in-house facility

1 contract manufacturing partner(3)

29 prototypes and 18 completed

pre-production assets

Proprietary Variable Platform

Architecture

ADAS, E-Drive systems and

manufacturing, UI/UX, Closures,

Charging and Internet of Vehicle

~650

No comparable market offerings

FF 91 Series

FF 81 Series (6)

FF 71 Series (6)

SLMD (6)

(Customized Configurations)

LUCID

~3,900

~$22.9bn

In Production (Q3-2021)

US

2 in-house facilities (Inc.

Announced KSA Facility to be Built)

NA In production

Proprietary skateboard

Battery System, Skateboard

Architecture, Drivetrain and

Bidirectional Charger

~390

Moderately Competitive (Model S,

Taycan Turbo S, S-Class, among

others)

Lucid Air

Lucid Gravity

ΝΑ

Publically company filings and presentations unless otherwise noted. Market data as of May 27th, 2022. Faraday headcount information as of September 27, 2022.

Employee count sourced from Crunchbase; company disclosure around headcount not provided.

Market capitalization share counts represent basic shares ourtanding (Class A + B) and sourced from Factset as of October 13, 2022.

Does not consider engagement of a potential contract manuafacturer for production in China.

Battery pack and drive unit manufactured by partners based on Fisker specs. Battery management system based on in-house technology.

Represents pending and allowed global patents for Canoo; specific number of allowed (granted) patents not provided.

Subject to future financing.

27

~455

~$2.3bn

November 2022

US

2 contract manufacturing partners

(Magna Steyr & Foxconn)

23 prototypes

Licensed platforms

Battery System (4)

~13

Highly Competitive (Model Y, XC40,

E-Tron, EQC, among many others)

Fisker Ocean

Fisker Pear

Project Ronin

ΝΑ

I

- CANOO-

I

<500(1)

~$445mm

Q4 2022

US

I

2 in-house facilities

(still under construction)

39 prototypes

Proprietary skateboard

Skateboard Architecture, Drivetrain,

Battery System and Suspension

~138

(Pending & Allowed) (5)

No comparable market offerings

Lifestyle Vehicle

Pickup Truck

Lifestyle Vehicle

Multi-Purpose Delivery Vehicle

LORDSTOWN

~250

~$380mm

Q3 2021

US

1 contract manufacturing partner

(Foxconn)

Not Disclosed

8

Licensed platform (MIH) + in-house

hub motor design

Hub Motor, Battery Pack, Body and

Frame Design

0

Highly Competitive (F-150, Badger,

Cybertruck, Rivian R1T, Hummer

and many others)

NA Initial Endurance Deliveries

for Commercial Customers

Endurance Pickup

PROPRIETARY AND CONFIDENTIALView entire presentation