Bank of America Investment Banking Pitch Book

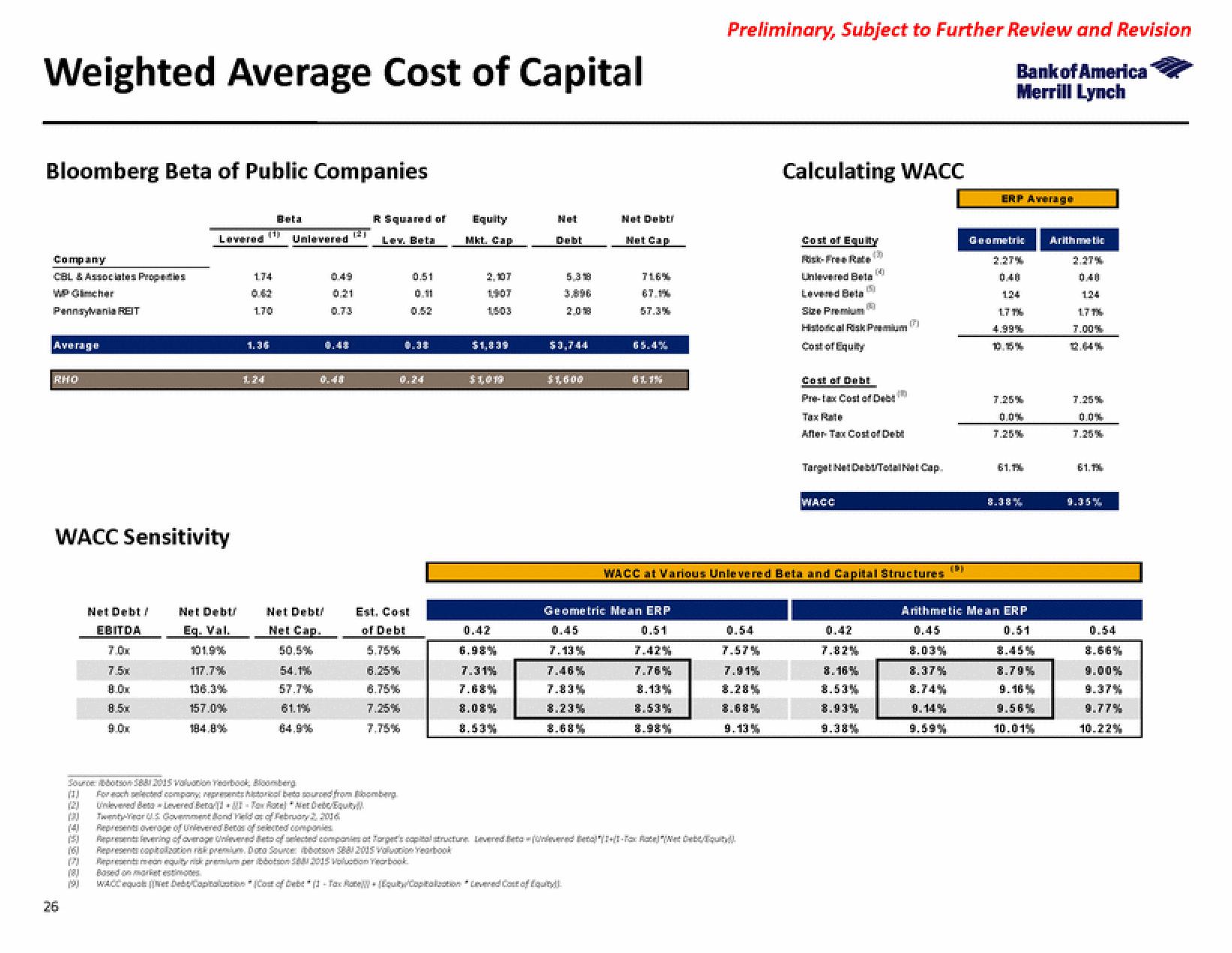

Weighted Average Cost of Capital

Bloomberg Beta of Public Companies

R Squared of

Lev. Beta

Company

CBL & Associates Properties

WP Gicher

Pennsylvania REIT

Average

RHO

WACC Sensitivity

26

Net Debt/

EBITDA

7.0x

7.5x

8.0x

8.5x

9.0x

******

Levered

Net Debt/

Eq. Val.

101.9%

117.7%

136.3%

157.0%

184.8%

174

(8) Based on market estimates

1.70

1.24

Beta

Unlevered

Net Debt!

Net Cap.

50.5%

54.1%

57.7%

61.1%

64.9%

0.21

0.73

0.48

WACC equalse DebCapitaluation (Cost of Debe

121

Source:boton 5881 2015 valvonion Yearbook, Bloomberg

(11

For each selected company represents historical beta sourced from bomberg

(2) Unlevered BetLevered Beta-Fox Rate)*Net Debc/Equity

(3) TwentyYear Govemment Bond Field as of February 2, 2016

(4) Represents overage of Unlevered Betos of selected companies

Est. Cost

of Debt

5.75%

6.75%

7.25%

7.75%

0.51

0.11

0.52

Equity

Mkt. Cap

2,107

1503

$1,839

$1019

0.42

6.98%

7.31%

7.68%

8.53%

Het

Debt

2.08

$3,744

$1,600

Net Debt

0.45

7.13%

7.46%

7.83%

8.23%

8.68%

Net Cap

716%

67.14

57.3%

65.4%

61,3%

Geometric Mean ERP

0.51

7.42%

7.76%

8.13%

8.53%

Preliminary, Subject to Further Review and Revision

Bank of America

Merrill Lynch

0.54

7.57%

7.91%

8.28%

(5) Represents levering of overage Univered Betoof selected companies at Torpet's capital structure. Levered Betanlevered Betal"+1-Tax Ratel "We Debout

boton 588 2015 volvotion Yearbook

Represents copolization rak premium, Doro Source

Represente equity nik premium person

2015 voluton Yearbook

(3-Tax Rate EquityCapitaluation Levered Cost of Equit

9.13%

Calculating WACC

Cost of Equity

Fisk-Free Rate

Unlevered Beta

Levered Beta

Size Premium

Hatorical Risk Premium 11

Cost of Equity

Cost of Debt

Pre-tax Cost of Debt

WACC at Various Unlevered Beta and Capital Structures

Tax Rate

After Tax Cost of Deb

Target NetDebiTotal Net Cap.

WACC

0.42

7.82%

8.16%

8.53%

8.93%

9.38%

(D)

9.14%

9.59%

ERP Average

Geometric Arithmetic

0.48

124

1.77%

4.99%

10.15%

7.25%

0.0%

7.25%

61.7%

8.38%

Arithmetic Mean ERP

0.45

0.51

8.03%

8.37%

8.45%

8.79%

9.16%

9.56%

10.01%

0.40

124

1.71%

7.00%

2.44%

7.25%

0.0%

7.25%

61.7%

9.35%

0.54

9.00%

9.37%

9.77%

10.22%View entire presentation