TPG Results Presentation Deck

Non-GAAP Financial Measures

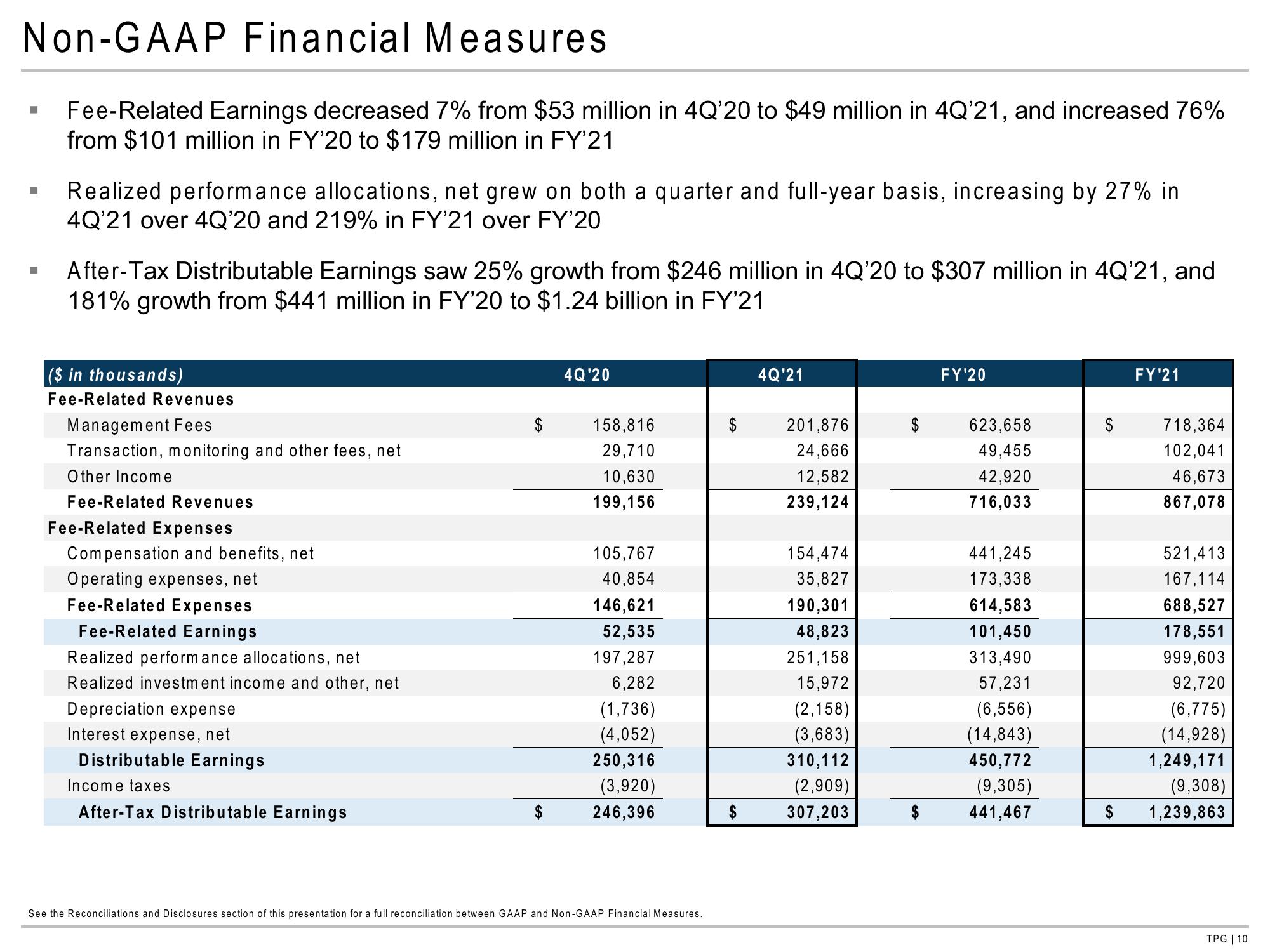

Fee-Related Earnings decreased 7% from $53 million in 4Q'20 to $49 million in 4Q'21, and increased 76%

from $101 million in FY'20 to $179 million in FY'21

■

■

■

Realized performance allocations, net grew on both a quarter and full-year basis, increasing by 27% in

4Q'21 over 4Q'20 and 219% in FY'21 over FY'20

After-Tax Distributable Earnings saw 25% growth from $246 million in 4Q'20 to $307 million in 4Q'21, and

181% growth from $441 million in FY'20 to $1.24 billion in FY'21

($ in thousands)

Fee-Related Revenues

Management Fees

Transaction, monitoring and other fees, net

Other Income

Fee-Related Revenues

Fee-Related Expenses

Compensation and benefits, net

Operating expenses, net

Fee-Related Expenses

Fee-Related Earnings

Realized performance allocations, net

Realized investment income and other, net

Depreciation expense

Interest expense, net

Distributable Earnings

Income taxes

After-Tax Distributable Earnings

4Q'20

158,816

29,710

10,630

199,156

105,767

40,854

146,621

52,535

197,287

6,282

(1,736)

(4,052)

250,316

(3,920)

246,396

See the Reconciliations and Disclosures section of this presentation for a full reconciliation between GAAP and Non-GAAP Financial Measures.

$

4Q'21

201,876

24,666

12,582

239,124

154,474

35,827

190,301

48,823

251,158

15,972

(2,158)

(3,683)

310,112

(2,909)

307,203

FY'20

623,658

49,455

42,920

716,033

441,245

173,338

614,583

101,450

313,490

57,231

(6,556)

(14,843)

450,772

(9,305)

441,467

$

$

FY'21

718,364

102,041

46,673

867,078

521,413

167,114

688,527

178,551

999,603

92,720

(6,775)

(14,928)

1,249,171

(9,308)

1,239,863

TPG | 10View entire presentation