Vroom Investor Day Presentation Deck

forecasted year-end liquidity

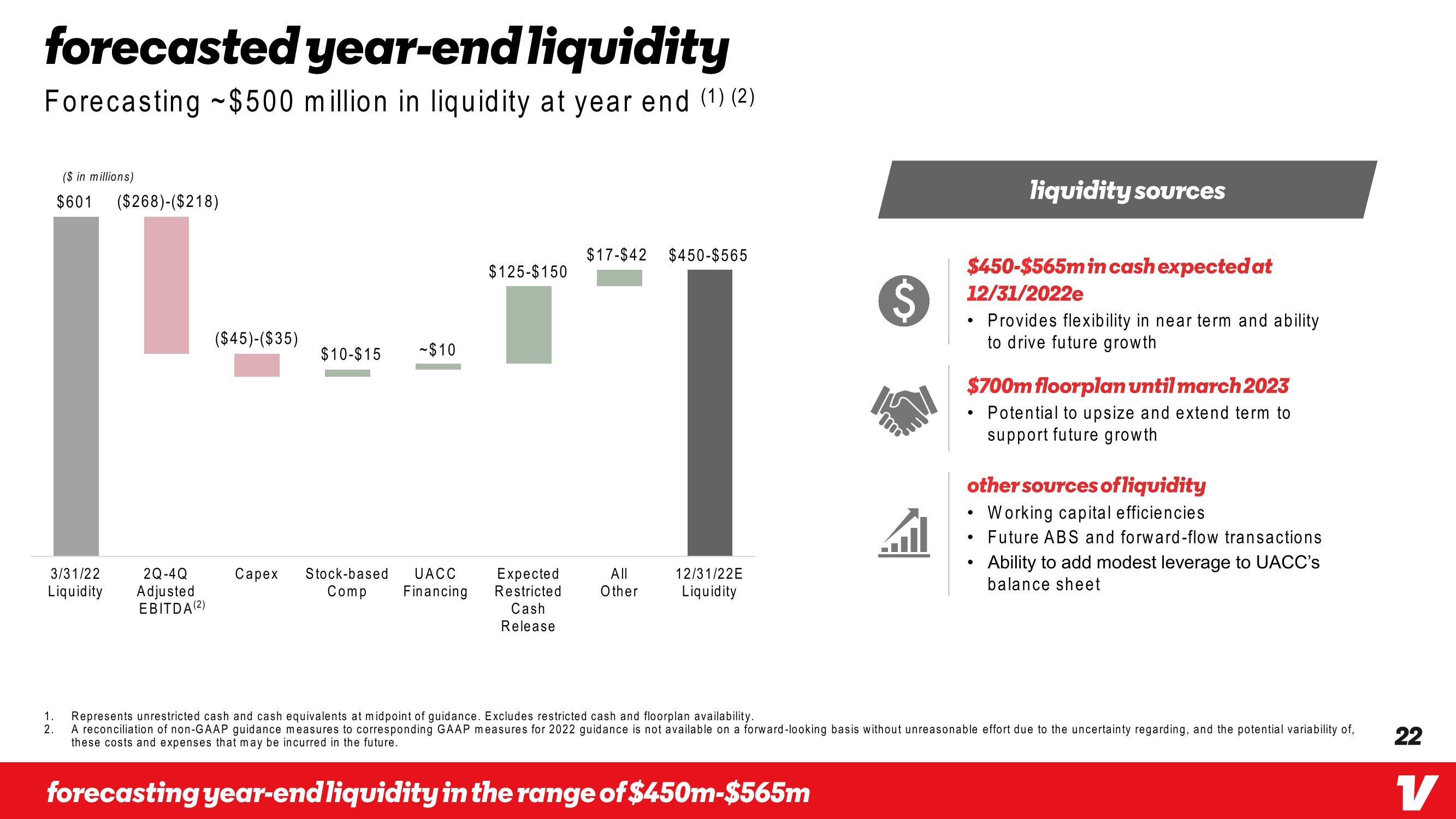

Forecasting -$500 million in liquidity at year end (1) (2)

($ in millions)

$601 ($268)-($218)

3/31/22

Liquidity

2Q-4Q

Adjusted

EBITDA (2)

($45)-($35)

$10-$15 -$10

Capex Stock-based UACC

Comp Financing

$125-$150

Expected

Restricted

Cash

Release

$17-$42 $450-$565

All

Other

12/31/22E

Liquidity

$

m

liquidity sources

$450-$565m in cash expected at

12/31/2022e

●

Provides flexibility in near term and ability

to drive future growth

$700m floorplan until march 2023

Potential to upsize and extend term to

support future growth

other sources of liquidity

Working capital efficiencies

Future ABS and forward-flow transactions

Ability to add modest leverage to UACC's

balance sheet

1. Represents unrestricted cash and cash equivalents at midpoint of guidance. Excludes restricted cash and floorplan availability.

2.

A reconciliation of non-GAAP guidance measures to corresponding GAAP measures for 2022 guidance is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of,

these costs and expenses that may be incurred in the future.

forecasting year-end liquidity in the range of $450m-$565m

22

VView entire presentation