Commercial Metals Company Investor Presentation Deck

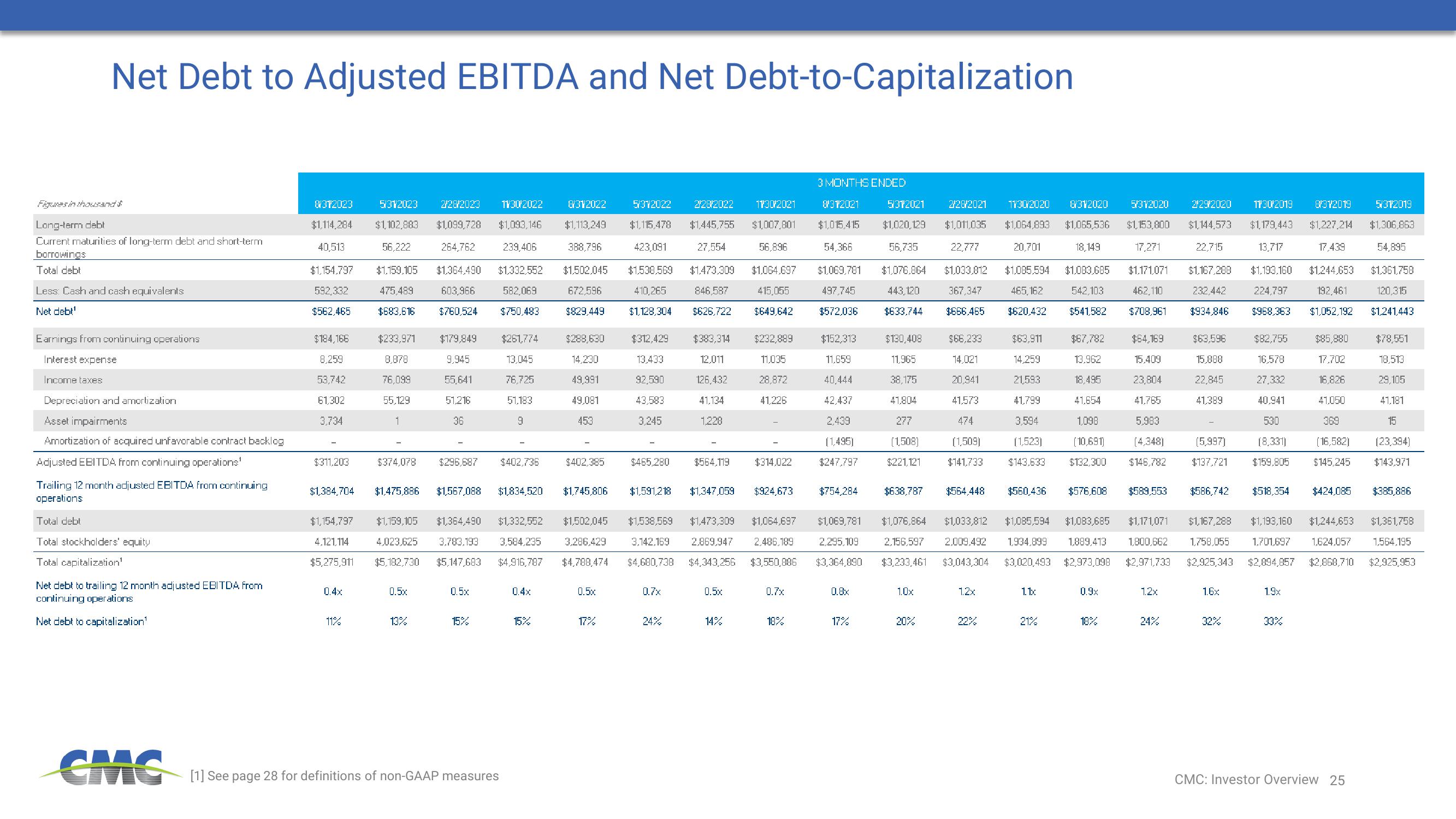

Net Debt to Adjusted EBITDA and Net Debt-to-Capitalization

Figures in thousand

Long-term debt

Current maturities of long-term debt and short-term

borrowings

Total debt

Less: Cash and cash equivalents

Net debt¹

Earnings from continuing operations

Interest expense

Income taxes

Depreciation and amortization

Asset impairments

Amortization of acquired unfavorable contract backlog

Adjusted EBITDA from continuing operations¹

Trailing 12 month adjusted EBITDA from continuing

operations

Total debt

Total stockholders' equity

Total capitalization¹

Net debt to trailing 12 month adjusted EBITDA from

continuing operations

Net debt to capitalization¹

CMC

8312023 5/312023 2/28/2023 1130/2022 8312022

$1,114,284 $1,102,883 $1,099,728 $1,093,146 $1,113,249

40,513

56,222 264,762 239,406 388,796

$1,154.797 $1,159,105 $1,364.490 $1,332,552 $1,502,045

592,332 475,489 603,966 582,069 672,596

$562,465 $683.616 $760,524 $750,483 $829,449

$184,166

8,259

53,742

61,302

3,734

$311,203

$233,971 $179,849 $261,774

8,878

9,945

13,045

76,099

55,641

76,725

51,216

51,183

36

55,129

1

9

$1,384,704 $1,475,886 $1,567,088 $1,834,520

0.4x

$374,078 $296,687 $402,736

11%

$1,154,797 $1,159,105 $1,364,490 $1,332,552 $1,502,045

4.121.114 4,023,625 3.783.193 3,584,235 3.286.429

$5,275,911 $5,182,730 $5.147.683 $4,916,787 $4,788,474

0.5x

13%

0.5x

15%

[1] See page 28 for definitions of non-GAAP measures

0.4x

$288,630

14,230

49,991

49,081

453

15%

$402,385

$1,745,806

0.5x

17%

5/312022 2/28/2022 1130/2021

$1,115,478 $1,445,755 $1,007,801

423,091

27,554

56,896

$1,538.569 $1,473,309 $1.064,697

410,265 846,587 415,055

$1,128,304 $626,722 $649,642

$312,429

13.433

92,590

43.583

3,245

$465,280

$1,591,218

$1,538,569

3,142,169

$4,680,738

0.7x

24%

$383,314

12.011

126,432

41.134

1.228

$564.119

$232,889

11.035

28,872

41,226

$1,347,059 $924,673

0.5x

$314.022

$1,473,309 $1,064,697

2,869,947 2,486,189

$4,343,256 $3,550,886

14%

0.7x

18%

3 MONTHS ENDED

8312021 5/312021

$1,015,415 $1,020,129

54,366

56,735

$1,069,781 $1,076.864

497,745 443,120

$572,036 $633,744

$152,313

11.659

40,444

42,437

2,439

(1,495)

$247,797

$754,284

0.8x

$130,408

11,965

38,175

41,804

277

(1,508)

$221,121

17%

$638,787

$1,069,781 $1,076,864 $1,033,812

2,295,109 2,156,597 2,009,492

$3,364,890 $3,233,461 $3,043,304

1.0x

228/2021 1130/2020 8312020

$1,011,035 $1,064,893 $1,065,536

22,777

20,701

18.149

$1,033,812 $1,085,594 $1,083,685

367,347 465,162 542,103

$666.465 $620,432 $541,582

20%

$66,233

14,021

20,941

41.573

474

(1,509)

$141.733

$564,448 $560,436 $576,608

12x

$63,911

14.259

21,593

41,799

3,594

(1,523)

$143.633

22%

$67,782

13.962

18.495

41,654

1.098

(10,691)

$132,300

1.1x

21%

$1,085,594 $1,083,685 $1,171,071

1,934,899 1.889,413 1,800,662

$3,020,493 $2,973,098 $2,971,733

0.9x

5/312020 2292020 1130/2019 8/312019

$1,153,800 $1,144,573 $1,179,443 $1,227,214

17,271

13,717

17.439

$1,171,071 $1,167,288 $1.193.160 $1,244,653

462,110 232,442 224,797 192,461

$708,961 $934.846 $968.363 $1,052,192

18%

$64,169

15,409

23,804

41.765

5,983

(4,348)

$146,782

$589,553

1.2x

24%

22,715

$63,596

15.888

22,845

41,389

$85,880

17.702

$82,755

16,578

27,332

16,826

40,941

41,050

530

369

(8,331) (16,582)

$159.805 $145,245

(5,997)

$137.721

$586,742 $518,354 $424,085

$1,167,288 $1,193,160 $1,244,653

1,758,055 1,701,697 1,624.057

$2,925,343 $2,894,857 $2,868,710

1.6x

32%

1.9x

CMC: Investor Overview 25

5/312019

$1,306,863

54,895

$1,361,758

120,315

$1,241,443

$78,551

18,513

29,105

41.181

15

(23,394)

$143.971

$385,886

$1,361,758

1,564,195

$2,925,953View entire presentation