Goldman Sachs Investment Banking Pitch Book

Sachs

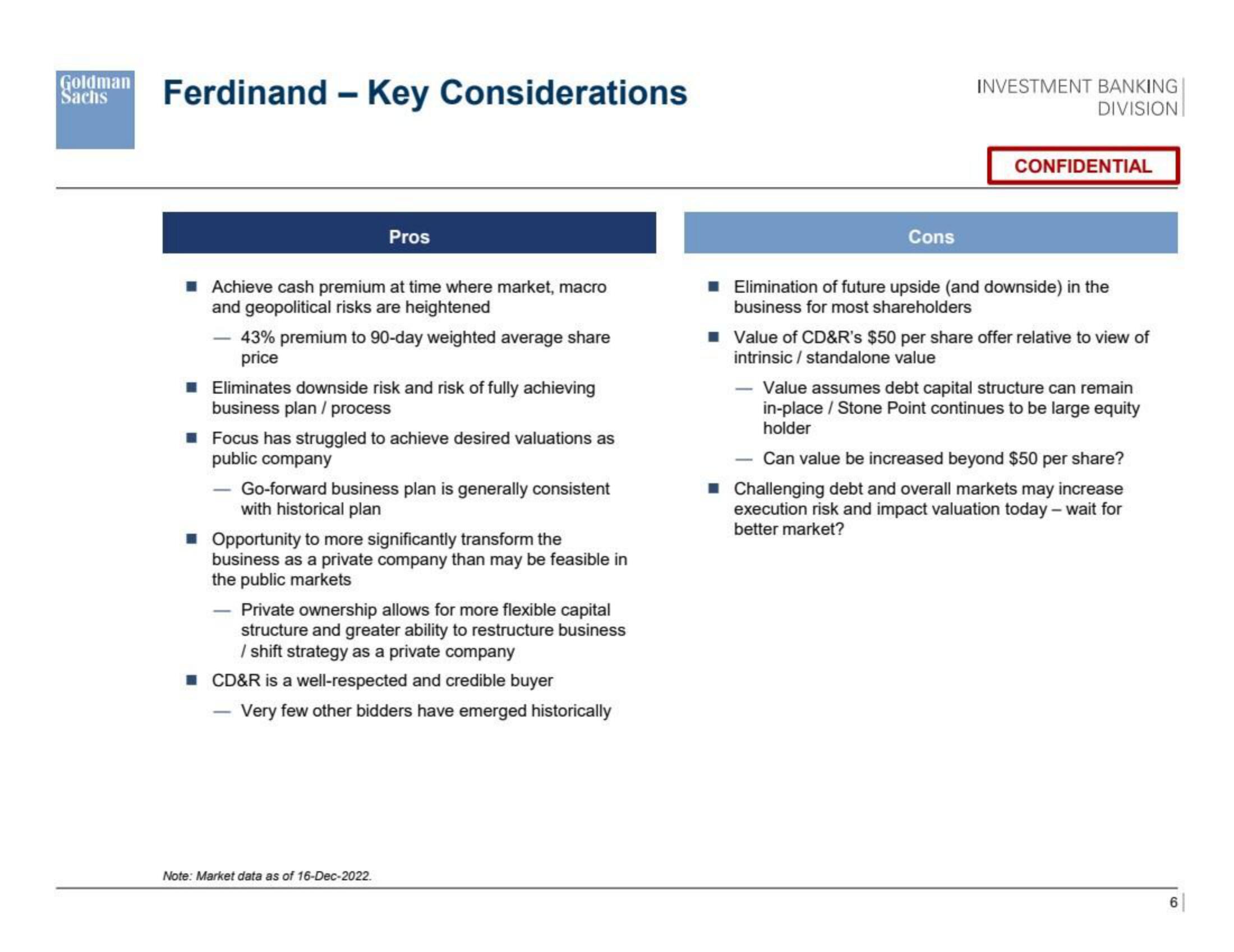

Ferdinand - Key Considerations

Pros

■ Achieve cash premium at time where market, macro

and geopolitical risks are heightened

43% premium to 90-day weighted average share

price

■ Eliminates downside risk and risk of fully achieving

business plan / process

■ Focus has struggled to achieve desired valuations as

public company

Go-forward business plan is generally consistent

with historical plan

Opportunity to more significantly transform the

business as a private company than may be feasible in

the public markets

- Private ownership allows for more flexible capital

structure and greater ability to restructure business

/ shift strategy as a private company

■ CD&R is a well-respected and credible buyer

Very few other bidders have emerged historically

Note: Market data as of 16-Dec-2022.

Cons

INVESTMENT BANKING

DIVISION

CONFIDENTIAL

Elimination of future upside (and downside) in the

business for most shareholders

■ Value of CD&R's $50 per share offer relative to view of

intrinsic / standalone value

- Value assumes debt capital structure can remain

in-place/Stone Point continues to be large equity

holder

Can value be increased beyond $50 per share?

■ Challenging debt and overall markets may increase

execution risk and impact valuation today - wait for

better market?

6View entire presentation