Owens&Minor Investor Day Presentation Deck

93

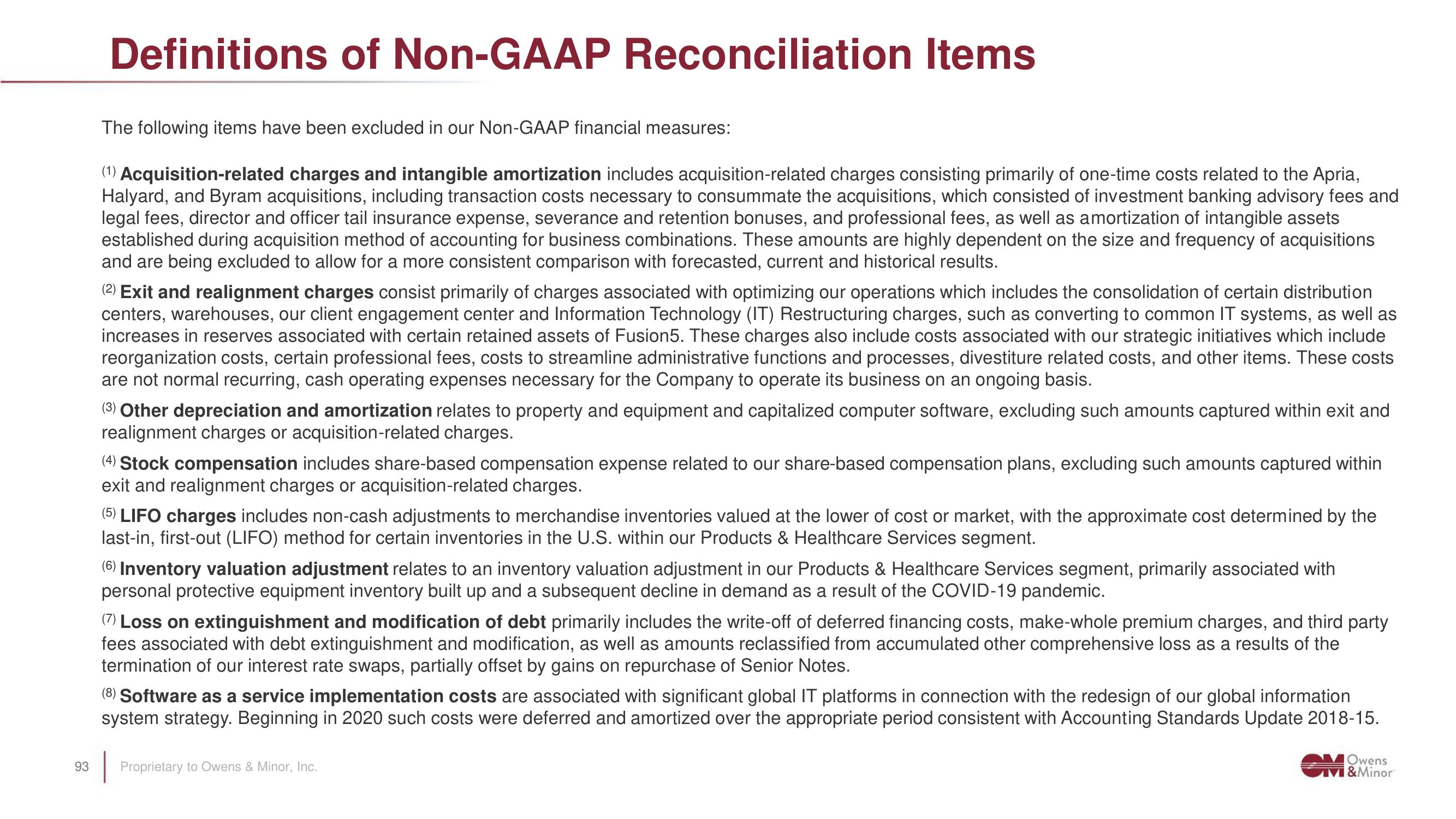

Definitions of Non-GAAP Reconciliation Items

The following items have been excluded in our Non-GAAP financial measures:

(1) Acquisition-related charges and intangible amortization includes acquisition-related charges consisting primarily of one-time costs related to the Apria,

Halyard, and Byram acquisitions, including transaction costs necessary to consummate the acquisitions, which consisted of investment banking advisory fees and

legal fees, director and officer tail insurance expense, severance and retention bonuses, and professional fees, as well as amortization of intangible assets

established during acquisition method of accounting for business combinations. These amounts are highly dependent on the size and frequency of acquisitions

and are being excluded to allow for a more consistent comparison with forecasted, current and historical results.

(2) Exit and realignment charges consist primarily of charges associated with optimizing our operations which includes the consolidation of certain distribution

centers, warehouses, our client engagement center and Information Technology (IT) Restructuring charges, such as converting to common IT systems, as well as

increases in reserves associated with certain retained assets of Fusion5. These charges also include costs associated with our strategic initiatives which include

reorganization costs, certain professional fees, costs to streamline administrative functions and processes, divestiture related costs, and other items. These costs

are not normal recurring, cash operating expenses necessary for the Company to operate its business on an ongoing basis.

(3) Other depreciation and amortization relates to property and equipment and capitalized computer software, excluding such amounts captured within exit and

realignment charges or acquisition-related charges.

(4) Stock compensation includes share-based compensation expense related to our share-based compensation plans, excluding such amounts captured within

exit and realignment charges or acquisition-related charges.

(5) LIFO charges includes non-cash adjustments to merchandise inventories valued at the lower of cost or market, with the approximate cost determined by the

last-in, first-out (LIFO) method for certain inventories in the U.S. within our Products & Healthcare Services segment.

(6) Inventory valuation adjustment relates to an inventory valuation adjustment in our Products & Healthcare Services segment, primarily associated with

personal protective equipment inventory built up and a subsequent decline in demand as a result of the COVID-19 pandemic.

(7) Loss on extinguishment and modification of debt primarily includes the write-off of deferred financing costs, make-whole premium charges, and third party

fees associated with debt extinguishment and modification, as well as amounts reclassified from accumulated other comprehensive loss as a results of the

termination of our interest rate swaps, partially offset by gains on repurchase of Senior Notes.

(8) Software as a service implementation costs are associated with significant global IT platforms in connection with the redesign of our global information

system strategy. Beginning in 2020 such costs were deferred and amortized over the appropriate period consistent with Accounting Standards Update 2018-15.

Proprietary to Owens & Minor, Inc.

Owens

M&MinorView entire presentation