TPG Results Presentation Deck

Fourth Quarter and Full Year 2021 Highlights

Actual

Non-GAAP

Financial

Measures

($M)

Pro Forma

Non-GAAP

Financial

Measures

($M)

Operating

Metrics

($B)

=

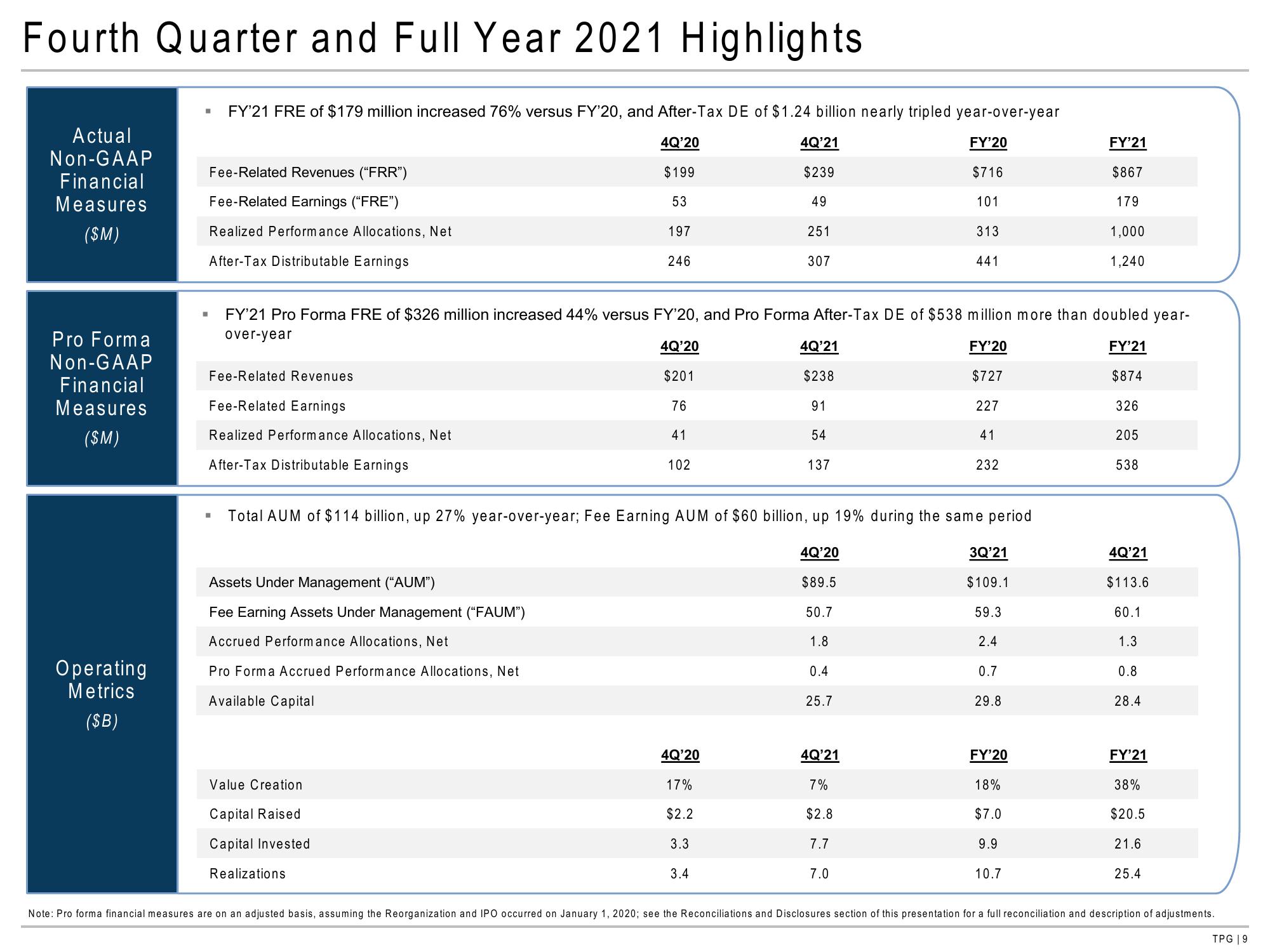

FY'21 FRE of $179 million increased 76% versus FY'20, and After-Tax DE of $1.24 billion nearly tripled year-over-year

4Q'20

$199

53

197

Fee-Related Revenues ("FRR")

Fee-Related Earnings ("FRE")

Realized Performance Allocations, Net

After-Tax Distributable Earnings

I

Fee-Related Revenues.

Fee-Related Earnings

Realized Performance Allocations, Net

After-Tax Distributable Earnings

Assets Under Management ("AUM")

Fee Earning Assets Under Management ("FAUM")

Accrued Performance Allocations, Net

Pro Forma Accrued Performance Allocations, Net

Available Capital

246

Value Creation

Capital Raised

Capital Invested

Realizations

4Q'21

$239

49

251

307

FY'21 Pro Forma FRE of $326 million increased 44% versus FY'20, and Pro Forma After-Tax DE of $538 million more than doubled year-

over-year

4Q'20

FY'20

FY'21

$201

$727

$874

76

227

326

41

41

205

102

538

4Q'20

17%

$2.2

3.3

3.4

4Q'21

$238

91

54

137

Total AUM of $114 billion, up 27% year-over-year; Fee Earning AUM of $60 billion, up 19% during the same period

4Q'20

$89.5

50.7

1.8

0.4

25.7

4Q'21

7%

FY'20

$716

$2.8

7.7

101

7.0

313

441

232

3Q'21

$109.1

59.3

2.4

0.7

29.8

FY'20

18%

$7.0

9.9

FY'21

$867

179

1,000

1,240

10.7

4Q'21

$113.6

60.1

1.3

0.8

28.4

FY'21

38%

$20.5

21.6

25.4

Note: Pro forma financial measures are on an adjusted basis, assuming the Reorganization and IPO occurred on January 1, 2020; see the Reconciliations and Disclosures section of this presentation for a full reconciliation and description of adjustments.

TPG 9View entire presentation