Evercore Investment Banking Pitch Book

McMoRan Situation Analysis

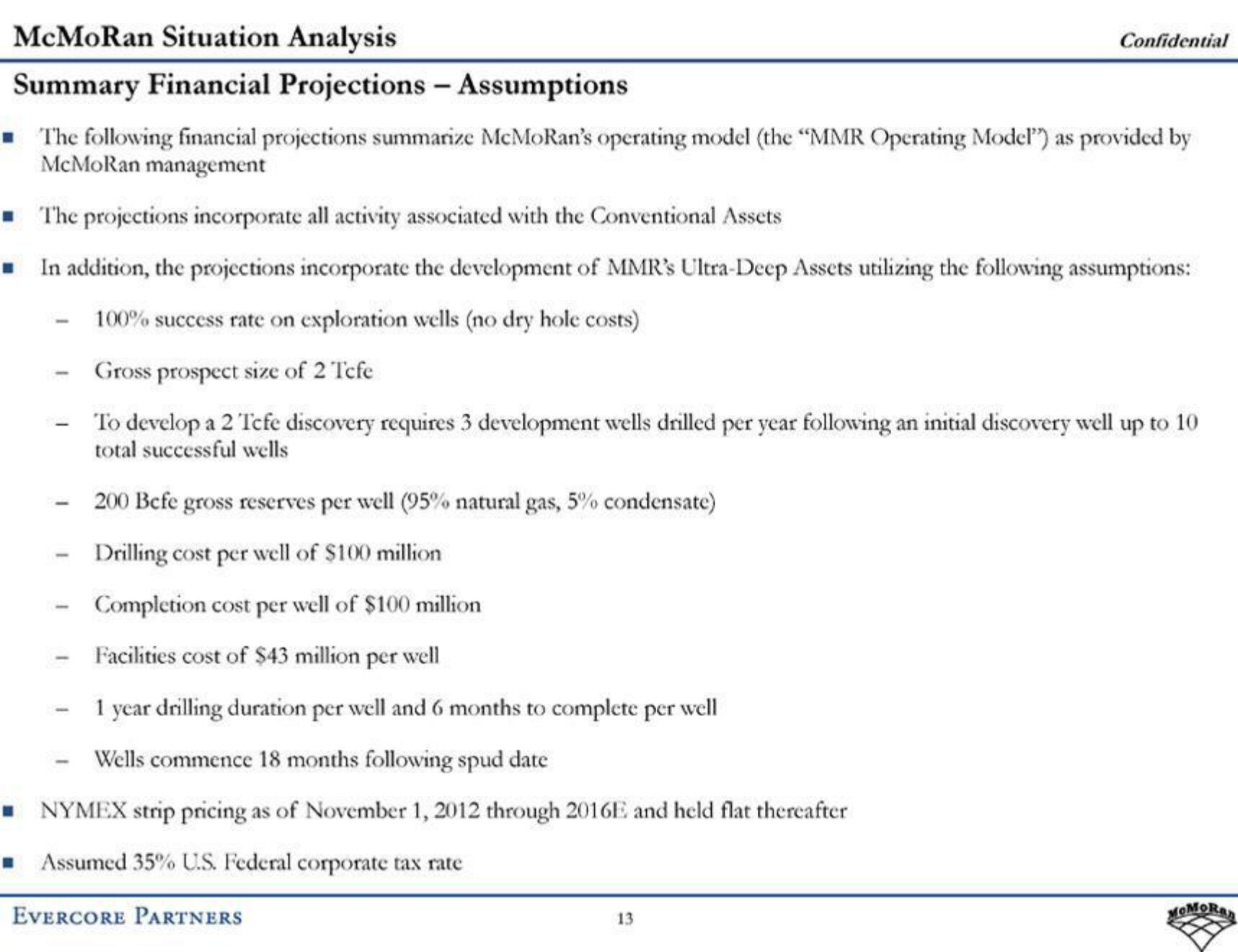

Summary Financial Projections - Assumptions

■ The following financial projections summarize McMoRan's operating model (the "MMR Operating Model) as provided by

McMoRan management

■

The projections incorporate all activity associated with the Conventional Assets

■ In addition, the projections incorporate the development of MMR's Ultra-Deep Assets utilizing the following assumptions:

100% success rate on exploration wells (no dry hole costs)

Gross prospect size of 2 Tcfe

1

Confidential

To develop a 2 Tcfe discovery requires 3 development wells drilled per year following an initial discovery well up to 10

total successful wells

200 Befe gross reserves per well (95% natural gas, 5% condensate)

Drilling cost per well of $100 million

Completion cost per well of $100 million

- Facilities cost of $43 million per well

1 year drilling duration per well and 6 months to complete per well

Wells commence 18 months following spud date

■

NYMEX strip pricing as of November 1, 2012 through 2016E and held flat thereafter

■ Assumed 35% U.S. Federal corporate tax rate

EVERCORE PARTNERS

13

MOMORANView entire presentation