dLocal Results Presentation Deck

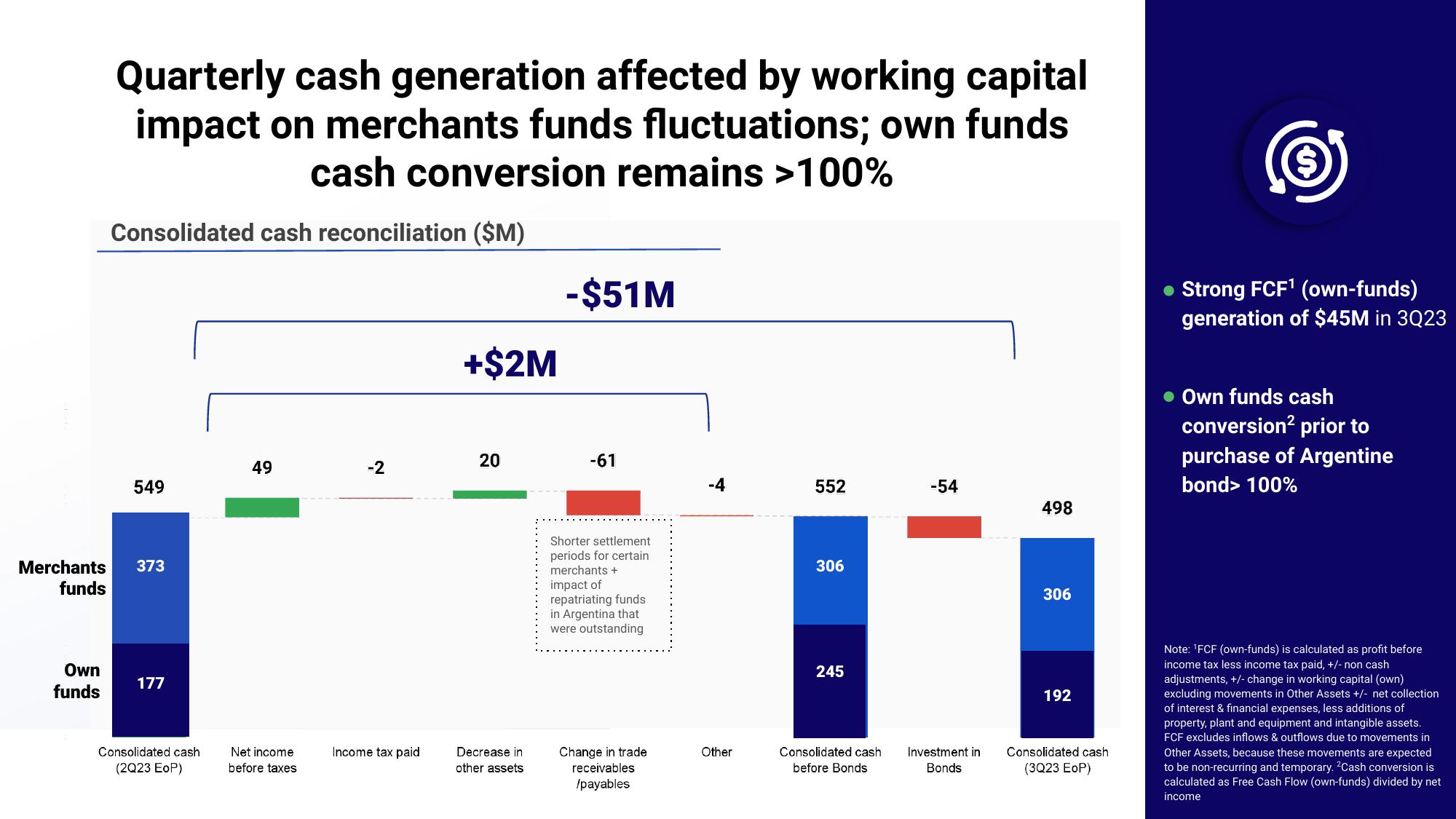

Quarterly cash generation affected by working capital

impact on merchants funds fluctuations; own funds

cash conversion remains >100%

Consolidated cash reconciliation ($M)

Own

funds

549

Merchants 373

funds

177

Consolidated cash

(2Q23 EoP)

49

Net income

before taxes

-2

Income tax paid

+$2M

20

Decrease in

other assets

-$51M

-61

Shorter settlement

periods for certain

merchants +

impact of

repatriating funds

in Argentina that

were outstanding

Change in trade

receivables

/payables

-4

Other

552

306

245

Consolidated cash

before Bonds

-54

Investment in

Bonds

498

306

192

Consolidated cash

(3Q23 EoP)

Ⓒ

• Strong FCF¹ (own-funds)

generation of $45M in 3Q23

• Own funds cash

conversion² prior to

purchase of Argentine

bond> 100%

Note: ¹FCF (own-funds) is calculated as profit before

income tax less income tax paid, +/- non cash

adjustments, +/- change in working capital (own)

excluding movements in Other Assets +/- net collection

of interest & financial expenses, less additions of

property, plant and equipment and intangible assets.

FCF excludes inflows & outflows due to movements in

Other Assets, because these movements are expected

to be non-recurring and temporary. 2Cash conversion is

calculated as Free Cash Flow (own-funds) divided by net

incomeView entire presentation