Ashtead Group Results Presentation Deck

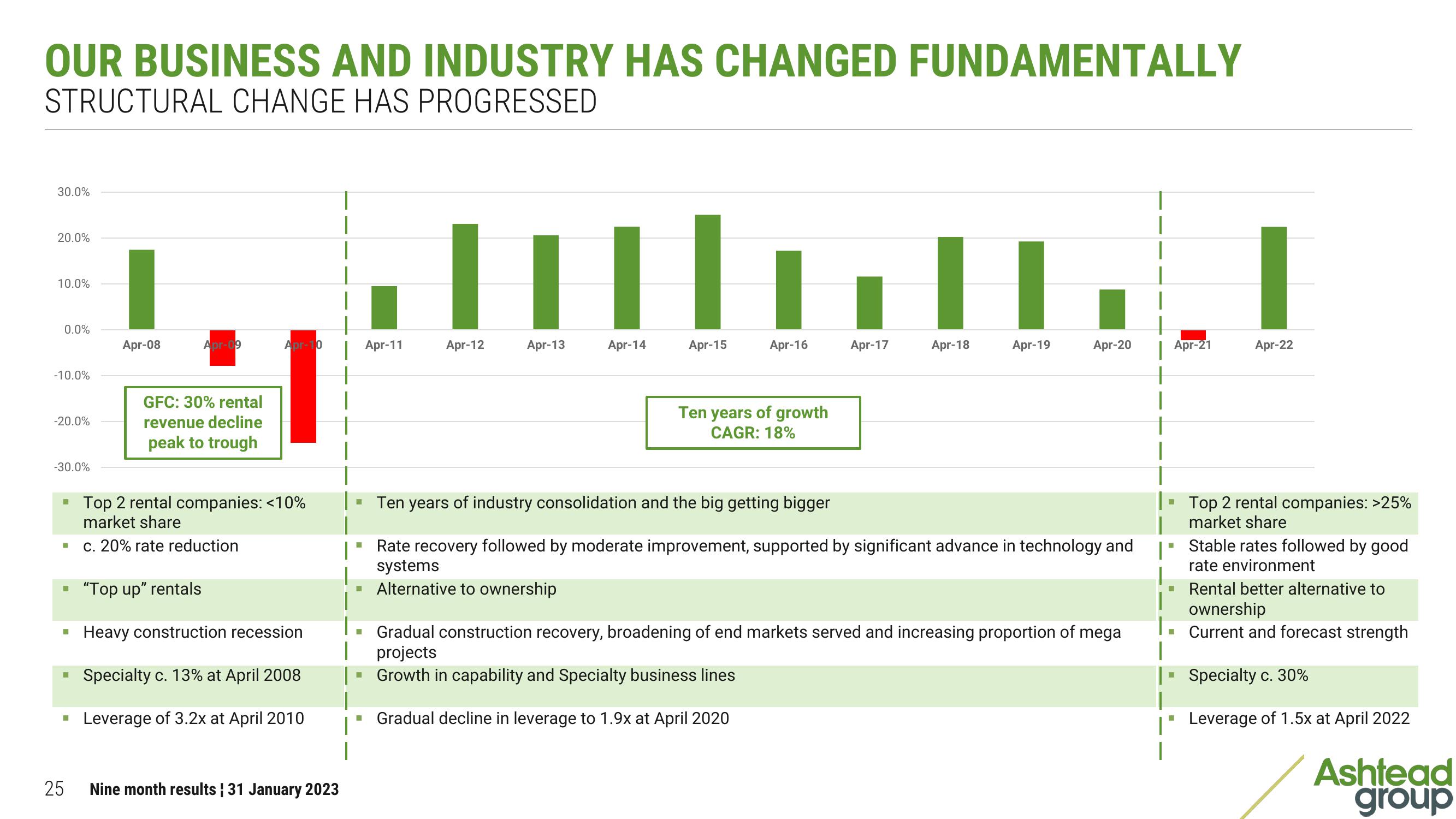

OUR BUSINESS AND INDUSTRY HAS CHANGED FUNDAMENTALLY

STRUCTURAL CHANGE HAS PROGRESSED

30.0%

20.0%

10.0%

0.0%

-10.0%

-20.0%

-30.0%

■

■

■

■

■

25

Apr-08

Apr-09

GFC: 30% rental

revenue decline

peak to trough

Apr-10

Top 2 rental companies: <10%

market share

c. 20% rate reduction

"Top up" rentals

Heavy construction recession

Specialty c. 13% at April 2008

Leverage of 3.2x at April 2010

1

1

Nine month results | 31 January 2023

H

H

■

■

Apr-11

■

THI

Apr-14

Apr-12

Apr-13

Apr-15

Apr-16

Ten years of growth

CAGR: 18%

■ Ten years of industry consolidation and the big getting bigger

Rate recovery followed by moderate improvement, supported by significant advance in technology and

systems

Alternative to ownership

Apr-17

Apr-18

Apr-19

Apr-20

Gradual construction recovery, broadening of end markets served and increasing proportion of mega

projects

Growth in capability and Specialty business lines

Gradual decline in leverage to 1.9x at April 2020

Apr-21

I

T

▪ Top 2 rental companies: >25%

market share

Apr-22

Stable rates followed by good

rate environment

■ Rental better alternative

ownership

Current and forecast strength

Specialty c. 30%

Leverage of 1.5x at April 2022

■

Ashtead

groupView entire presentation