Investor Presentation

2-STRATEGY AND OPERATIONAL TARGETS - STORAGE CAPEX

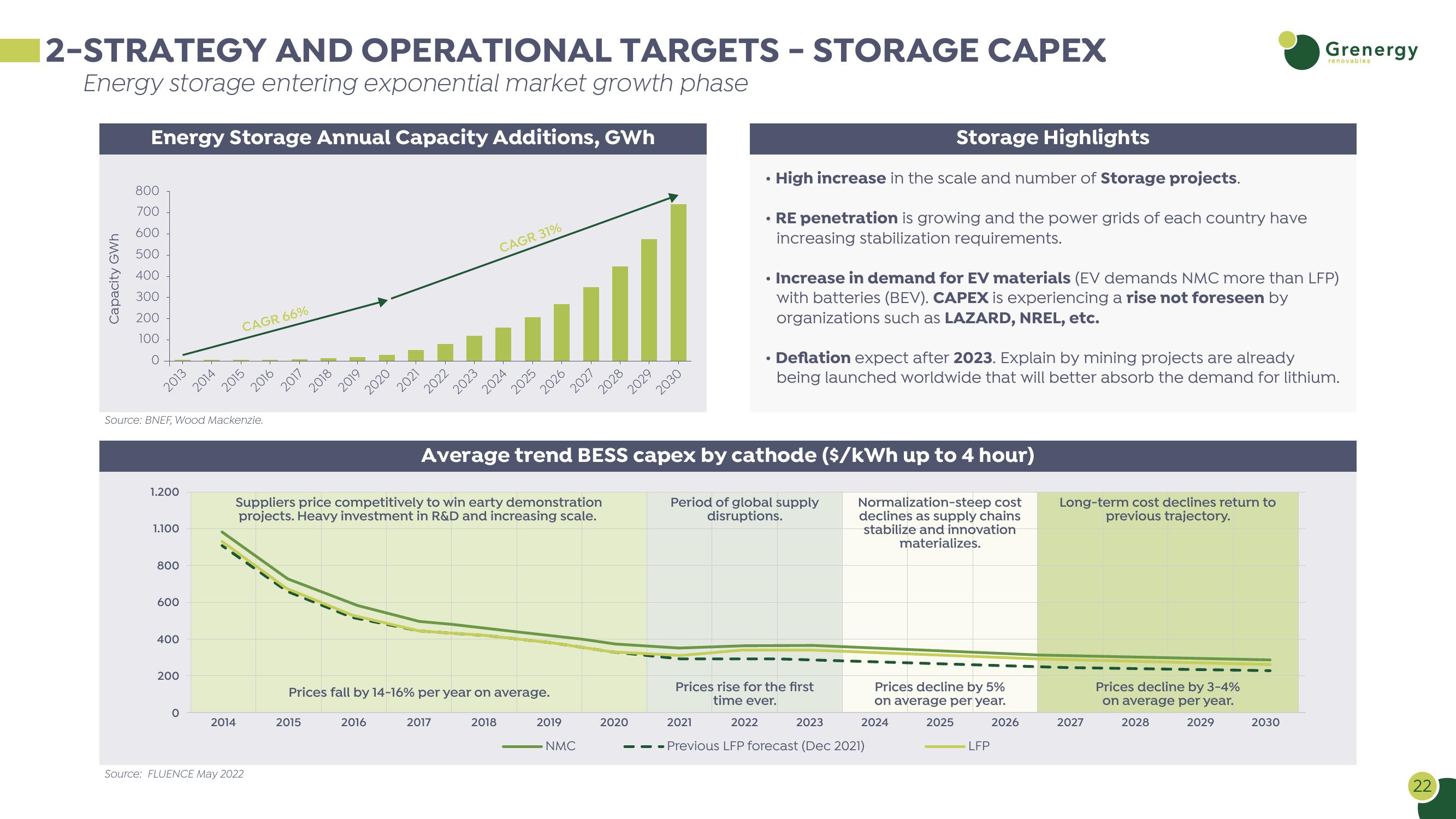

Energy storage entering exponential market growth phase

Energy Storage Annual Capacity Additions, GWh

800

700

Capacity GWh

600

500

400

300

200

100

O

Source: BNEF, Wood Mackenzie.

2013

CAGR 66%

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

CAGR 31%

2025

2026

2027

2028

2029

2030

Grenergy

renovables

•

.

•

•

Storage Highlights

High increase in the scale and number of Storage projects.

RE penetration is growing and the power grids of each country have

increasing stabilization requirements.

Increase in demand for EV materials (EV demands NMC more than LFP)

with batteries (BEV). CAPEX is experiencing a rise not foreseen by

organizations such as LAZARD, NREL, etc.

Deflation expect after 2023. Explain by mining projects are already

being launched worldwide that will better absorb the demand for lithium.

Average trend BESS capex by cathode ($/kWh up to 4 hour)

1.200

Suppliers price competitively to win earty demonstration

projects. Heavy investment in R&D and increasing scale.

Period of global supply

disruptions.

1.100

Normalization-steep cost

declines as supply chains

stabilize and innovation

materializes.

Long-term cost declines return to

previous trajectory.

800

600

400

200

Prices fall by 14-16% per year on average.

0

2014

2015

2016

Source: FLUENCE May 2022

2017

2018

2019

2020

2021

NMC

Prices rise for the first

time ever.

2022

2023

Prices decline by 5%

on average per year.

2024

2025

2026

2027

-Previous LFP forecast (Dec 2021)

LFP

Prices decline by 3-4%

on average per year.

2028

2029

2030

22View entire presentation