Investor Presentation

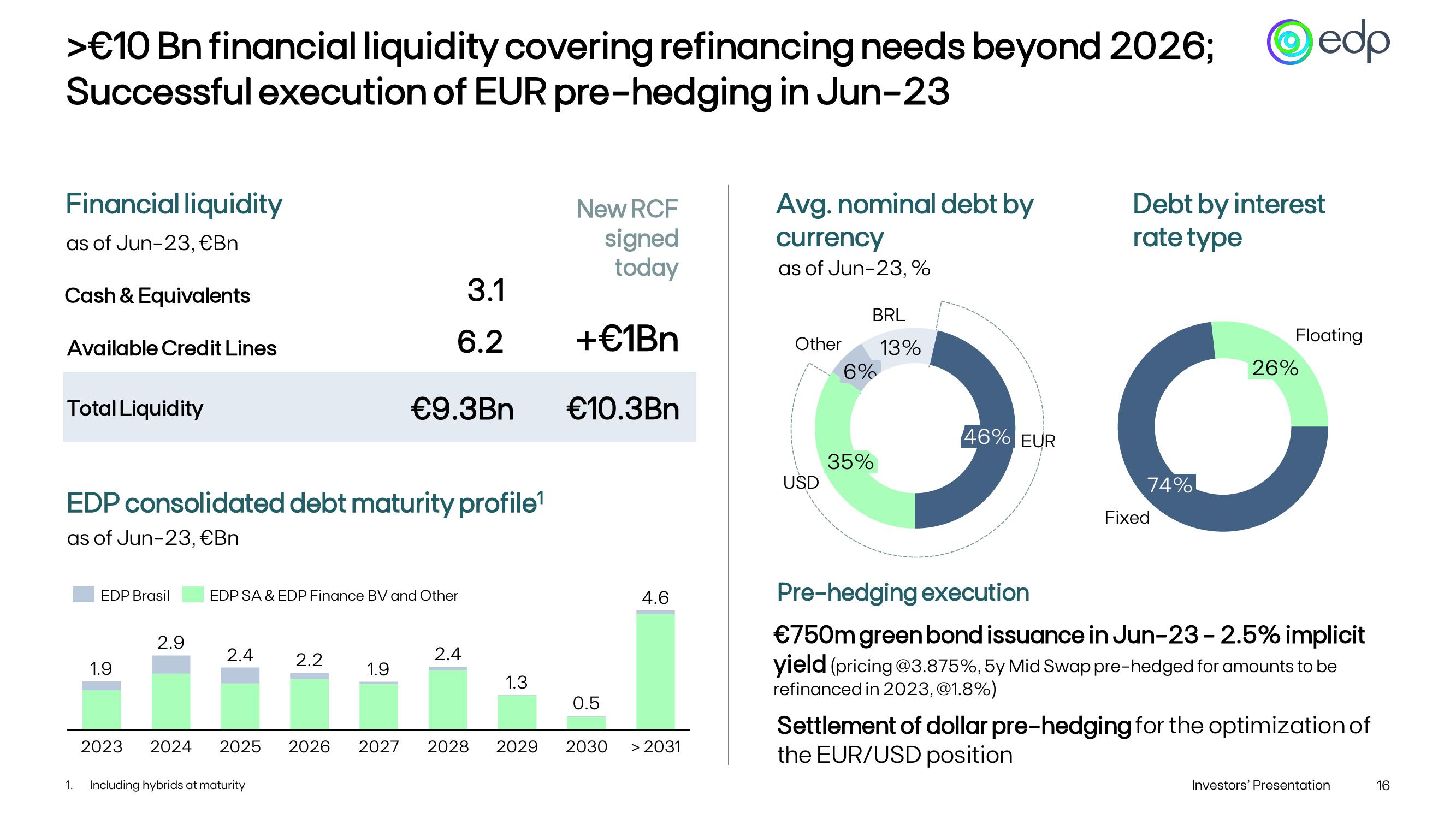

>€10 Bn financial liquidity covering refinancing needs beyond 2026; ①edp

Successful execution of EUR pre-hedging in Jun-23

Financial liquidity

as of Jun-23, €Bn

Cash & Equivalents

New RCF

signed

today

Avg. nominal debt by

currency

Debt by interest

rate type

as of Jun-23, %

3.1

BRL

Available Credit Lines

6.2

+€1Bn

Other 13%

6%

Total Liquidity

€9.3Bn

€10.3Bn

46% EUR

35%

USD

EDP consolidated debt maturity profile¹

as of Jun-23, €Bn

Floating

74%

O

26%

Fixed

EDP Brasil

EDP SA & EDP Finance BV and Other

4.6

2.9

2.4

2.4

2.2

1.9

1.9

1.3

0.5

2023

2024 2025

2026

2027

2028 2029

2030

> 2031

1. Including hybrids at maturity

Pre-hedging execution

€750m green bond issuance in Jun-23 - 2.5% implicit

yield (pricing @3.875%, 5y Mid Swap pre-hedged for amounts to be

refinanced in 2023, @1.8%)

Settlement of dollar pre-hedging for the optimization of

the EUR/USD position

Investors' Presentation

16View entire presentation