Cyxtera SPAC Presentation Deck

Transaction Summary & Timing

Capital

Structure

Governance

Equity

Alignment

Other

Timing

Cyxtera

●

●

●

●

●

●

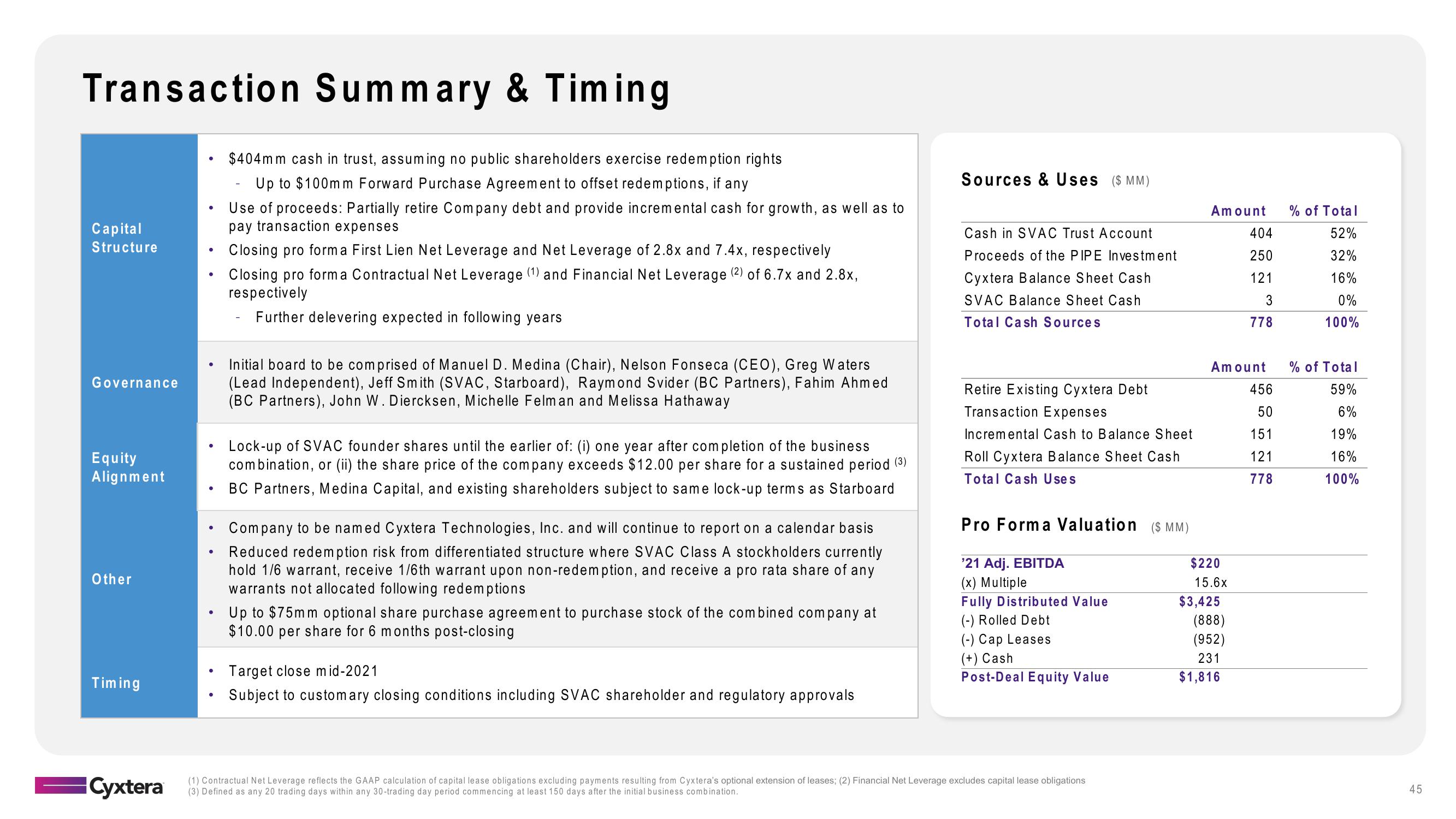

$404mm cash in trust, assuming no public shareholders exercise redemption rights

Up to $100mm Forward Purchase Agreement to offset redemptions, if any

Use of proceeds: Partially retire Company debt and provide incremental cash for growth, as well as to

pay transaction expenses

Closing pro form a First Lien Net Leverage and Net Leverage of 2.8x and 7.4x, respectively

Closing pro forma Contractual Net Leverage (1) and Financial Net Leverage (2) of 6.7x and 2.8x,

respectively

Further delevering expected in following years

Initial board to be comprised of Manuel D. Medina (Chair), Nelson Fonseca (CEO), Greg Waters

(Lead Independent), Jeff Smith (SVAC, Starboard), Raymond Svider (BC Partners), Fahim Ahmed

(BC Partners), John W. Diercksen, Michelle Felman and Melissa Hathaway

Lock-up of SVAC founder shares until the earlier of: (i) one year after completion of the business

combination, or (ii) the share price of the company exceeds $12.00 per share for a sustained period (³)

BC Partners, Medina Capital, and existing shareholders subject to same lock-up terms as Starboard

Company to be named Cyxtera Technologies, Inc. and will continue to report on a calendar basis

Reduced redemption risk from differentiated structure where SVAC Class A stockholders currently

hold 1/6 warrant, receive 1/6th warrant upon non-redemption, and receive a pro rata share of any

warrants not allocated following redemptions

Up to $75mm optional share purchase agreement to purchase stock of the combined company at

$10.00 per share for 6 months post-closing

• Target close mid-2021

Subject to customary closing conditions including SVAC shareholder and regulatory approvals

Sources & Uses ($ MM)

Cash in SVAC Trust Account

Proceeds of the PIPE Investment

Cyxtera Balance Sheet Cash

SVAC Balance Sheet Cash

Total Cash Sources

Retire Existing Cyxtera Debt

Transaction Expenses

Incremental Cash to Balance Sheet

Roll Cyxtera Balance Sheet Cash

Total Cash Uses

Pro Forma Valuation ($ MM)

'21 Adj. EBITDA

(x) Multiple

Fully Distributed Value

(-) Rolled Debt

(-) Cap Leases

(+) Cash

Post-Deal Equity Value

(1) Contractual Net Leverage reflects the GAAP calculation of capital lease obligations excluding payments resulting from Cyxtera's optional extension of leases; (2) Financial Net Leverage excludes capital lease obligations

(3) Defined as any 20 trading days within any 30-trading day period commencing at least 150 days after the initial business combination.

Amount

Amount

$220

15.6x

$3,425

404

250

121

3

778

(888)

(952)

231

$1,816

456

50

151

121

778

% of Total

52%

32%

16%

0%

100%

% of Total

59%

6%

19%

16%

100%

45View entire presentation