Nexters Results Presentation Deck

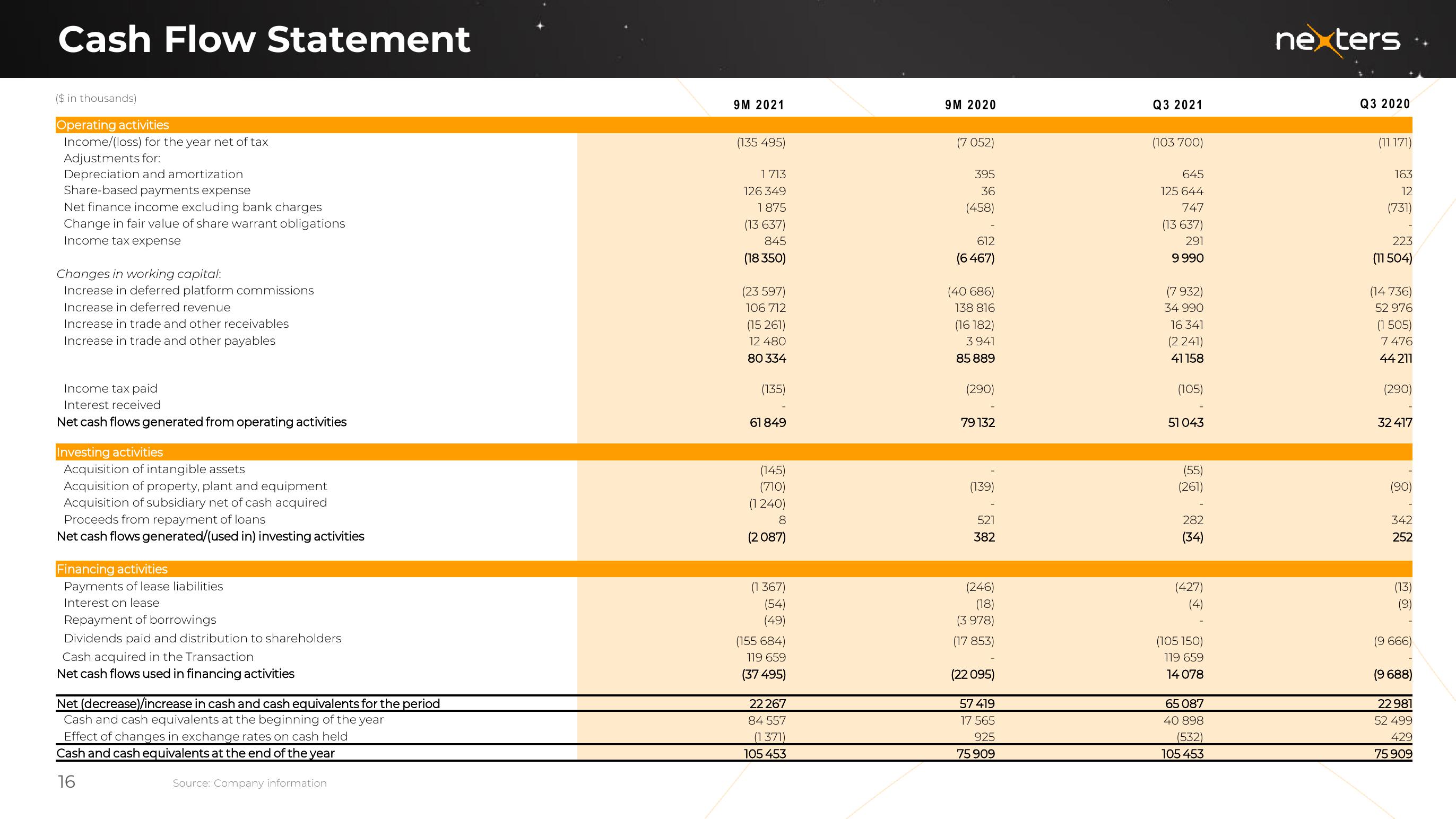

Cash Flow Statement

($ in thousands)

Operating activities

Income/(loss) for the year net of tax

Adjustments for:

Depreciation and amortization

Share-based payments expense

Net finance income excluding bank charges

Change in fair value of share warrant obligations

Income tax expense

Changes in working capital:

Increase in deferred platform commissions

Increase in deferred revenue

Increase in trade and other receivables

Increase in trade and other payables

Income tax paid

Interest received

Net cash flows generated from operating activities

Investing activities

Acquisition of intangible assets

Acquisition of property, plant and equipment

Acquisition of subsidiary net of cash acquired

Proceeds from repayment of loans

Net cash flows generated/(used in) investing activities

Financing activities

Payments of lease liabilities

Interest on lease

Repayment of borrowings

Dividends paid and distribution to shareholders

Cash acquired in the Transaction

Net cash flows used in financing activities

Net (decrease)/increase in cash and cash equivalents for the period

Cash and cash equivalents at the beginning of the year

Effect of changes in exchange rates on cash held

Cash and cash equivalents at the end of the year

16

Source: Company information

9M 2021

(135 495)

1713

126 349

1875

(13 637)

845

(18350)

(23 597)

106 712

(15 261)

12 480

80 334

(135)

61 849

(145)

(710)

(1 240)

8

(2087)

(1367)

(54)

(49)

(155 684)

119 659

(37 495)

22 267

84 557

(1371)

105 453

9M 2020

(7 052)

395

36

(458)

612

(6 467)

(40 686)

138 816

(16 182)

3941

85 889

(290)

79 132

(139)

521

382

(246)

(18)

(3978)

(17 853)

(22 095)

57 419

17 565

925

75 909

Q3 2021

(103 700)

645

125 644

747

(13 637)

291

9 990

(7 932)

34 990

16 341

(2 241)

41158

(105)

51 043

(55)

(261)

282

(34)

(427)

(4)

(105 150)

119 659

14078

65 087

40 898

(532)

105 453

nexters

Q3 2020

(11 171)

163

12

(731)

223

(11 504)

(14 736)

52 976

(1 505)

7 476

44 211

(290)

32 417

(90)

342

252

(13)

@

(9 666)

(9 688)

22 981

52 499

429

75 909View entire presentation