Bausch+Lomb Results Presentation Deck

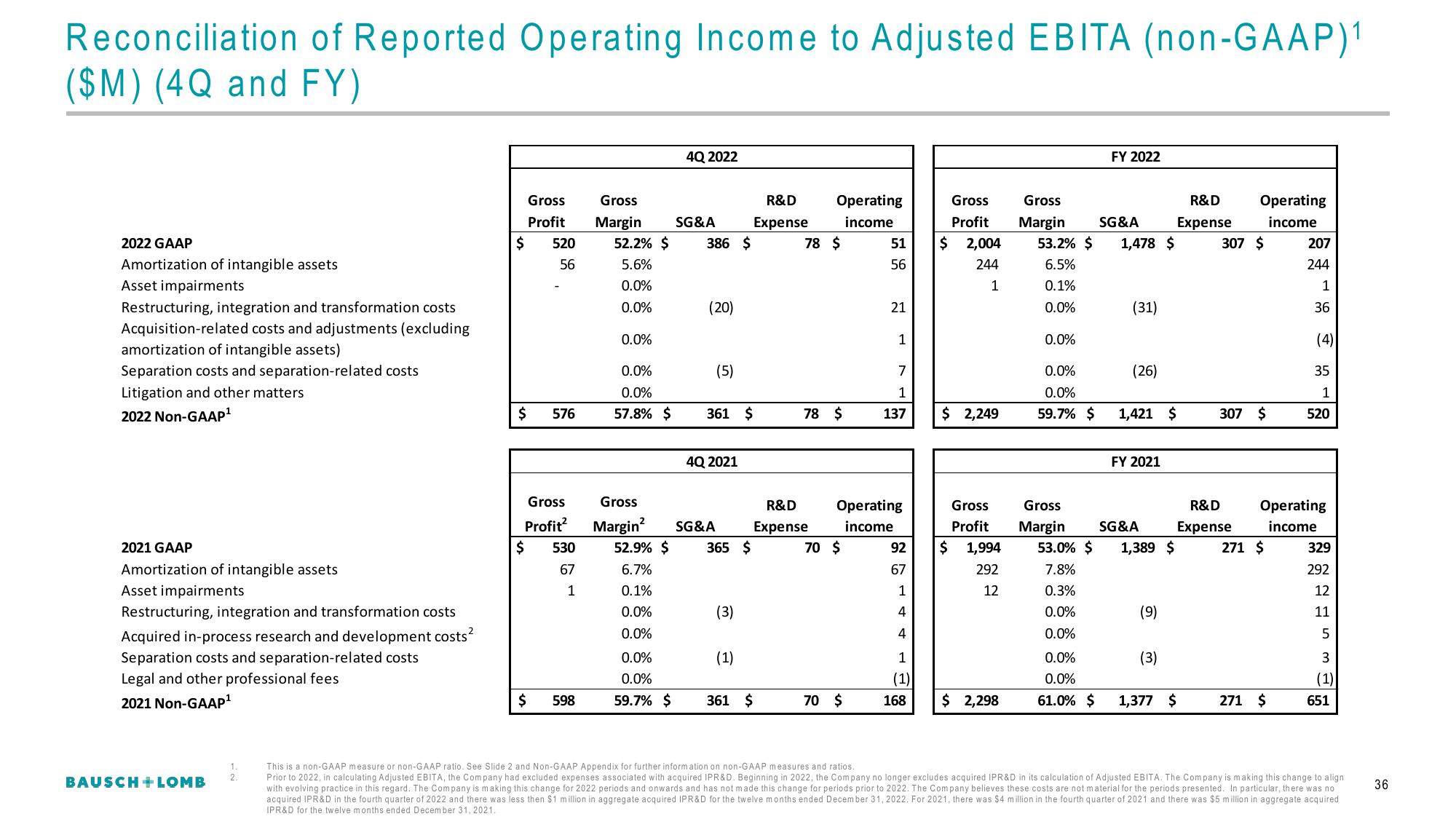

Reconciliation of Reported Operating Income to Adjusted EBITA (non-GAAP)¹

($M) (4Q and FY)

2022 GAAP

Amortization of intangible assets

Asset impairments

Restructuring, integration and transformation costs

Acquisition-related costs and adjustments (excluding

amortization of intangible assets)

Separation costs and separation-related costs

Litigation and other matters

2022 Non-GAAP¹

2021 GAAP

Amortization of intangible assets

Asset impairments

Restructuring, integration and transformation costs

Acquired in-process research and development costs²

Separation costs and separation-related costs

Legal and other professional fees

2021 Non-GAAP¹

BAUSCH + LOMB

2.

$

$ 576

Gross

Profit

520

56

Gross

Profit²

530

67

1

$

$

598

Gross

Margin SG&A

52.2% $ 386 $

5.6%

0.0%

0.0%

0.0%

0.0%

0.0%

57.8% $

4Q 2022

0.0%

0.0%

59.7% $

(20)

(5)

361 $

4Q 2021

Gross

Margin² SG&A

52.9% $ 365 $

6.7%

0.1%

0.0%

0.0%

(3)

(1)

361 $

R&D

Expense

Operating

income

78 $

78 $

R&D

Expense

70 $

51

56

70 $

21

1

Operating

income

7

1

137

92

67

1

4

4

1

(1)

168

Gross

Profit

$ 2,004

244

1

$ 2,249

Gross

Profit

$ 1,994

292

12

$ 2,298

Gross

Margin SG&A

53.2% $ 1,478 $

6.5%

0.1%

0.0%

0.0%

0.0%

0.0%

59.7% $

Gross

Margin

FY 2022

53.0% $

7.8%

0.3%

0.0%

0.0%

0.0%

0.0%

61.0% $

(31)

(26)

1,421 $

FY 2021

SG&A

1,389 $

(9)

(3)

1,377 $

R&D

Expense

Operating

income

307 $

307 $

R&D

Expense

271 $

207

244

271 $

1

36

Operating

income

35

1

520

329

292

12

11

5

3

(1)

651

This is a non-GAAP measure or non-GAAP ratio. See Slide 2 and Non-GAAP Appendix for further information on non-GAAP measures and ratios.

Prior to 2022, in calculating Adjusted EBITA, the Company had excluded expenses associated with acquired IPR&D. Beginning in 2022, the Company no longer excludes acquired IPR&D in its calculation of Adjusted EBITA. The Company is making this change to alignt

with evolving practice in this regard. The Company is making this change for 2022 periods and onwards and has not made this change for periods prior to 2022. The Company believes these costs are not material for the periods presented. In particular, there was no

acquired IPR&D in the fourth quarter of 2022 and there was less then $1 million in aggregate acquired IPR&D for the twelve months ended December 31, 2022. For 2021, there was $4 million in the fourth quarter of 2021 and there was $5 million in aggregate acquired

IPR&D for the twelve months ended December 31, 2021.

36View entire presentation