Endeavour Mining Investor Presentation Deck

Q1-2022 vs Q4-2021 INSIGHTS

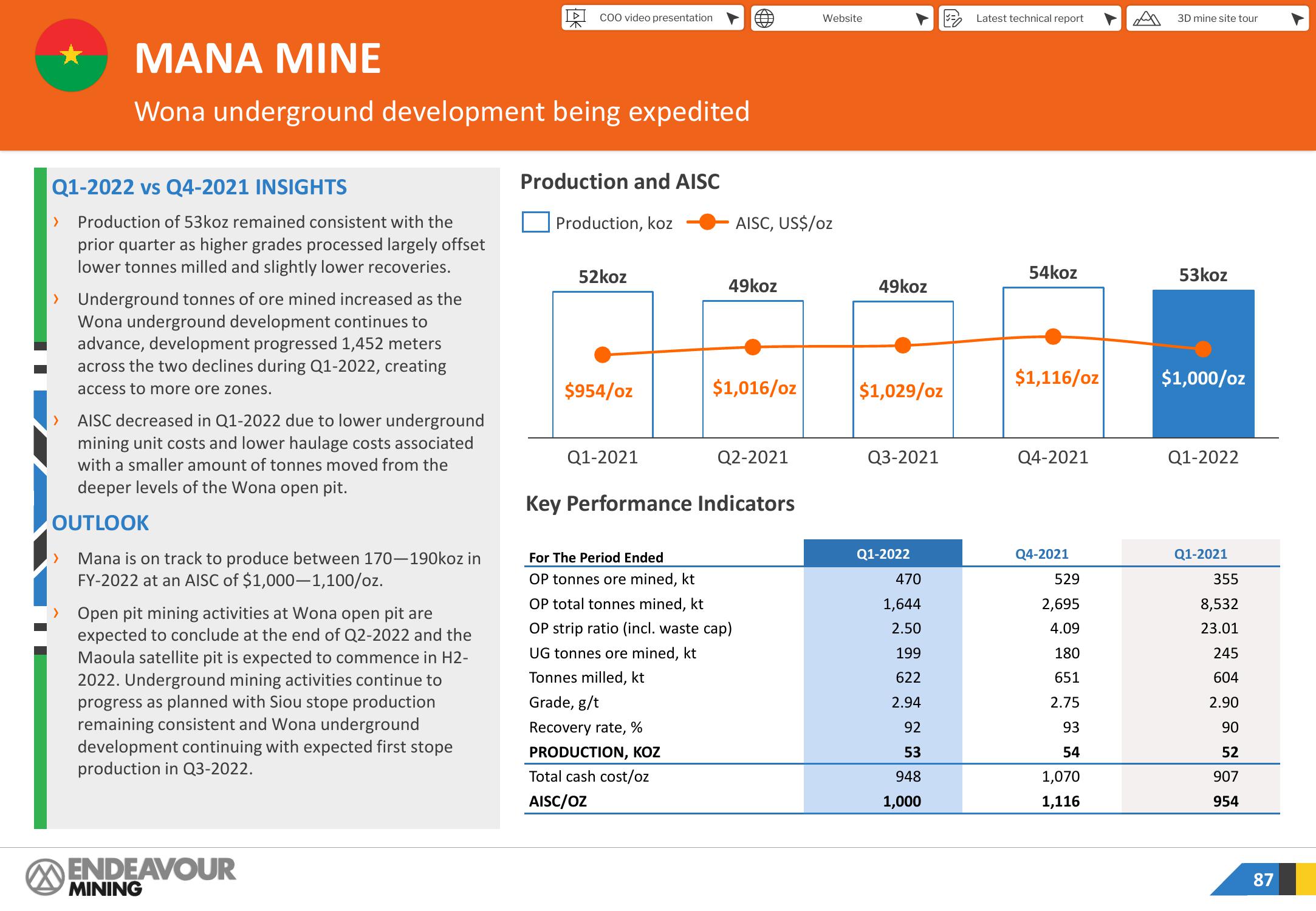

> Production of 53koz remained consistent with the

prior quarter as higher grades processed largely offset

lower tonnes milled and slightly lower recoveries.

MANA MINE

Wona underground development being expedited

Underground tonnes of ore mined increased as the

Wona underground development continues to

advance, development progressed 1,452 meters

across the two declines during Q1-2022, creating

access to more ore zones.

AISC decreased in Q1-2022 due to lower underground

mining unit costs and lower haulage costs associated

with a smaller amount of tonnes moved from the

deeper levels of the Wona open pit.

OUTLOOK

Mana is on track to produce between 170-190koz in

FY-2022 at an AISC of $1,000-1,100/oz.

Open pit mining activities at Wona open pit are

expected to conclude at the end of Q2-2022 and the

Maoula satellite pit is expected to commence in H2-

2022. Underground mining activities continue to

progress as planned with Siou stope production

remaining consistent and Wona underground

development continuing with expected first stope

production in Q3-2022.

ENDEAVOUR

AN

MINING

COO video presentation

Production and AISC

Production, koz

52koz

$954/oz

Q1-2021

For The Period Ended

OP tonnes ore mined, kt

O

PRODUCTION, KOZ

Total cash cost/oz

AISC/OZ

49koz

AISC, US$/oz

$1,016/oz

Key Performance Indicators

OP total tonnes mined, kt

OP strip ratio (incl. waste cap)

UG tonnes ore mined, kt

Tonnes milled, kt

Grade, g/t

Recovery rate, %

Q2-2021

Website

49koz

$1,029/oz

Q3-2021

Q1-2022

470

1,644

2.50

199

622

2.94

92

53

948

1,000

Latest technical report

54koz

$1,116/oz

Q4-2021

Q4-2021

529

2,695

4.09

180

651

2.75

93

54

1,070

1,116

8

3D mine site tour

53koz

$1,000/oz

Q1-2022

Q1-2021

355

8,532

23.01

245

604

2.90

90

52

907

954

87View entire presentation