Kroger Mergers and Acquisitions Presentation Deck

Financing and Capital Allocation

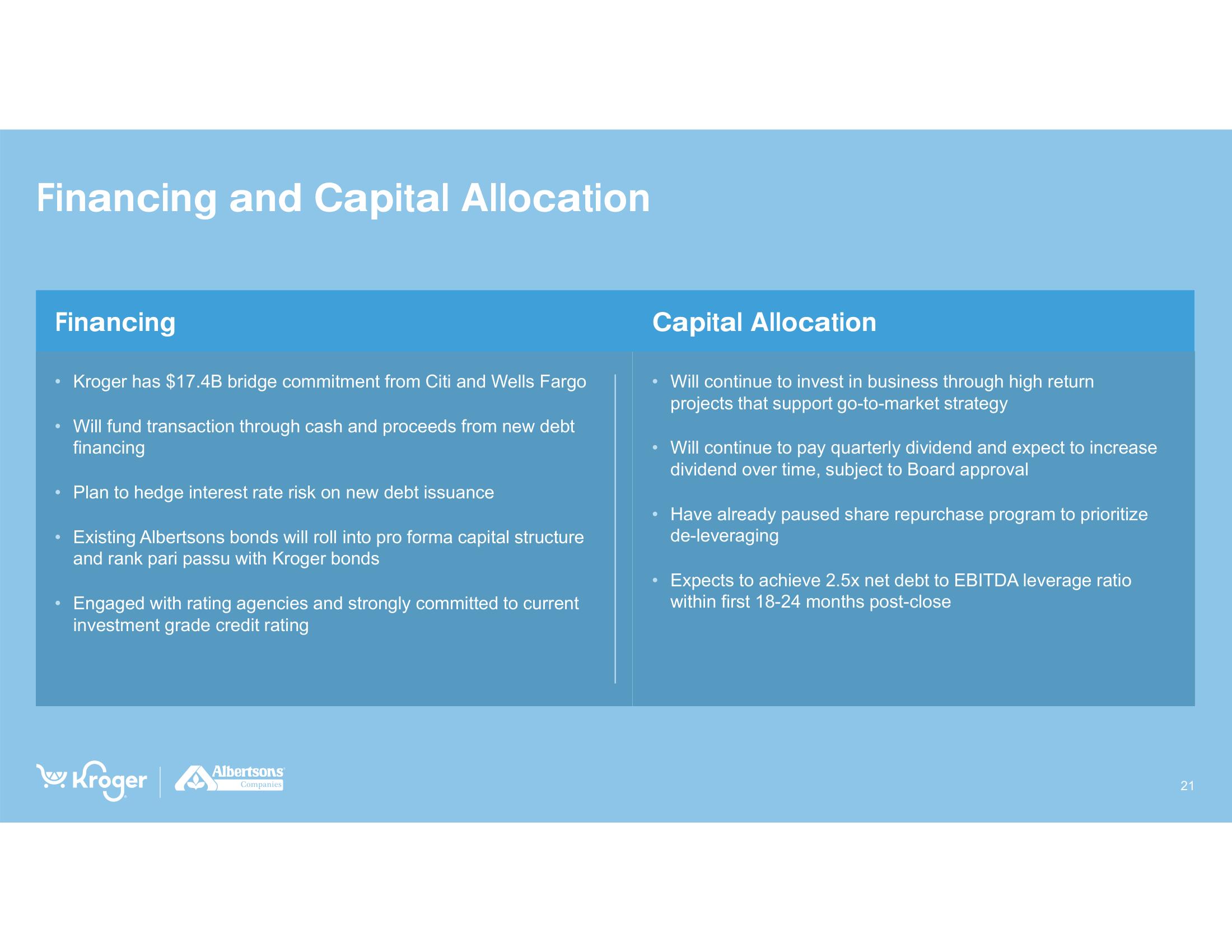

Financing

●

Kroger has $17.4B bridge commitment from Citi and Wells Fargo

Will fund transaction through cash and proceeds from new debt

financing

Plan to hedge interest rate risk on new debt issuance

Existing Albertsons bonds will roll into pro forma capital structure

and rank pari passu with Kroger bonds

Engaged with rating agencies and strongly committed to current

investment grade credit rating

Kroger

Albertsons

Companies

Capital Allocation

Will continue to invest in business through high return

projects that support go-to-market strategy

●

• Will continue to pay quarterly dividend and expect to increase

dividend over time, subject to Board approval

Have already paused share repurchase program to prioritize

de-leveraging

Expects to achieve 2.5x net debt to EBITDA leverage ratio

within first 18-24 months post-close

21View entire presentation