Bank of America Investment Banking Pitch Book

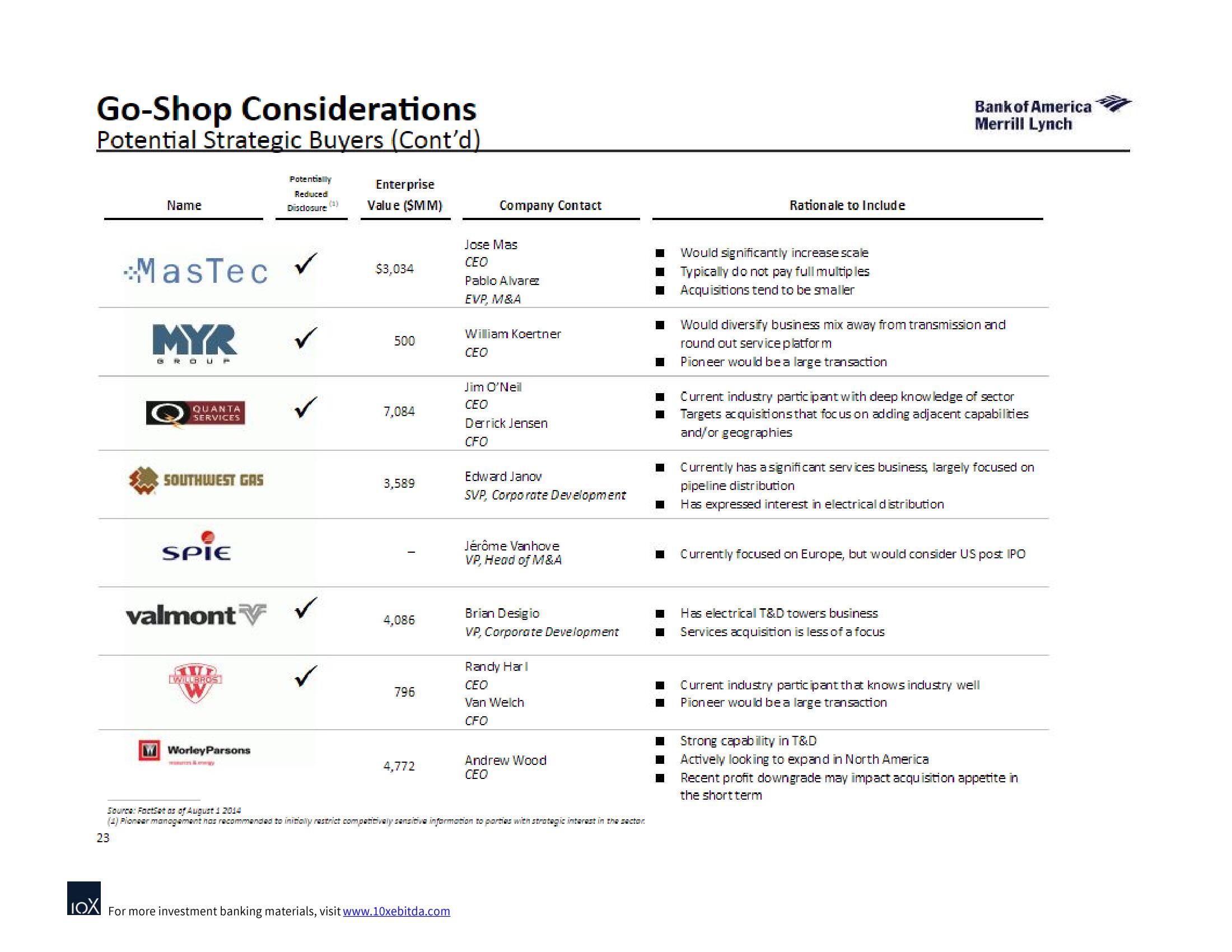

Go-Shop Considerations

Potential Strategic Buyers (Cont'd)

Potentially

Reduced

Disclosure

MasTec V

MYR

GROUP

Name

QUANTA

SERVICES

SOUTHWEST GAS

SPIE

valmont

WILLBROS

Worley Parsons

✓

(4)

✓

Enterprise

Value ($MM)

$3,034

500

7,084

3,589

4,086

796

4,772

Company Contact

IOX For more investment banking materials, visit www.10xebitda.com

Jose Mas

CEO

Pablo Alvarez

EVP, M&A

William Koertner

CEO

Jim O'Neil

CEO

Derrick Jensen

CFO

Edward Janov

SVP, Corporate Development

Jérôme Vanhove

VP, Head of M&A

Brian Desigio

VP, Corporate Development

Randy Harl

CEO

Van Welch

CFO

Andrew Wood

CEO

Source: FactSet as of August 1 2014

(4) Pioneer management has recommended to initially restrict competitivaly sensitive information to parties with strategic interest in the sector.

23

Would significantly increase scale

Typically do not pay full multiples

2 Acquisitions tend to be smaller

2

Rationale to Include

■

Bank of America

Merrill Lynch

Would diversify business mix away from transmission and

round out service platform

Pioneer would be a large transaction

Current industry participant with deep knowledge of sector

Targets acquisitions that focus on adding adjacent capabilities

and/or geographies

Currently has a significant services business, largely focused on

pipeline distribution

Has expressed interest in electrical distribution

Currently focused on Europe, but would consider US post: IPO

Has electrical T&D towers business

■ Services acquisition is less of a focus

Current industry participant that knows industry well

Pioneer would be a large transaction

7

Strong capability in T&D

1 Actively looking to expand in North America

Recent profit downgrade may impact acquisition appetite in

the short termView entire presentation