UBS Fixed Income Presentation Deck

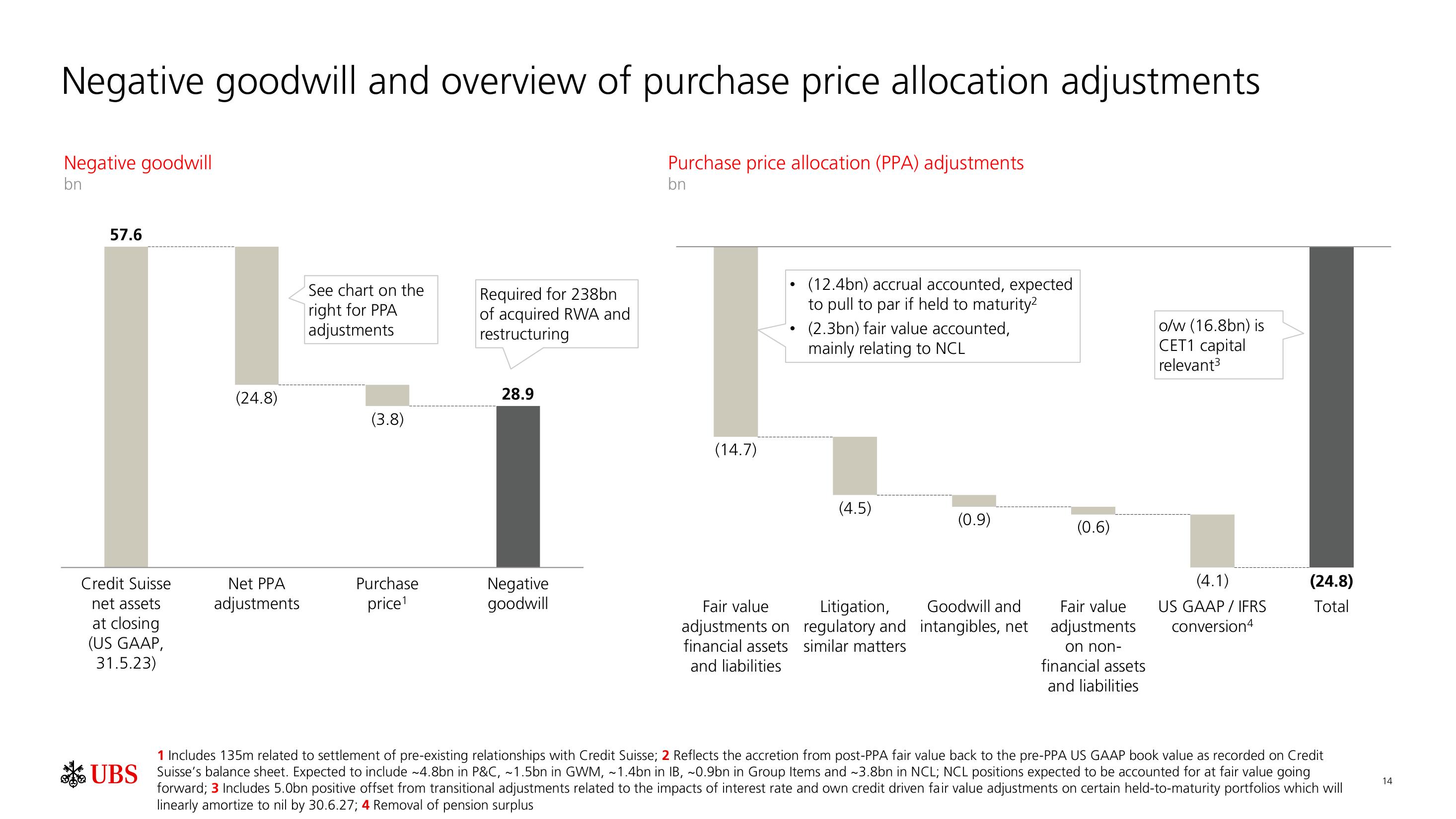

Negative goodwill and overview of purchase price allocation adjustments

Negative goodwill

bn

57.6

Credit Suisse

net assets

at closing

(US GAAP,

31.5.23)

(24.8)

Net PPA

adjustments

See chart on the

right for PPA

adjustments

(3.8)

Purchase

price¹

Required for 238bn

of acquired RWA and

restructuring

28.9

Negative

goodwill

Purchase price allocation (PPA) adjustments

bn

(14.7)

Fair value

adjustments on

financial assets

and liabilities

(12.4bn) accrual accounted, expected

to pull to par if held to maturity²

(2.3bn) fair value accounted,

mainly relating to NCL

(4.5)

(0.9)

Litigation, Goodwill and

regulatory and intangibles, net

similar matters

(0.6)

Fair value

adjustments

on non-

financial assets

and liabilities

o/w (16.8bn) is

CET1 capital

relevant³

(4.1)

US GAAP / IFRS

conversion 4

(24.8)

Total

1 Includes 135m related to settlement of pre-existing relationships with Credit Suisse; 2 Reflects the accretion from post-PPA fair value back to the pre-PPA US GAAP book value as recorded on Credit

UBS Suisse's balance sheet. Expected to include ~4.8bn in P&C, ~1.5bn in GWM, ~1.4bn in IB, ~0.9bn in Group Items and ~3.8bn in NCL; NCL positions expected to be accounted for at fair value going

forward; 3 Includes 5.0bn positive offset from transitional adjustments related to the impacts of interest rate and own credit driven fair value adjustments on certain held-to-maturity portfolios which will

linearly amortize to nil by 30.6.27; 4 Removal of pension surplus

14View entire presentation