Pathward Financial Results Presentation Deck

SELECTED BALANCE SHEET HIGHLIGHTS

SECOND QUARTER ENDED MARCH 31, 2021

7

BALANCE SHEET

($ in thousands)

Cash and cash equivalents

Loans and leases (HFI)

Allowance for credit losses

Total assets

Noninterest-bearing checking

Total deposits

Total liabilities

Total stockholders' equity

Total liabilities and stockholders equity

Loans / Deposits

Net Interest Margin

Return on Average Assets

Return on Average Equity

$

2Q21

3,724,242

3,657,531

(98,892)

9,790,123

7,928,235

8,642,413

8,954,865

835,258

9,790,123

●

42%

3.07%

2.22%

28.93 %

PERIOD ENDING

1Q21

1,586,451

3,448,675

(72,389)

$ 7,264,515

5,581,597

6,207,791

6,451,305

813,210

7,264,515

$

56%

4.65%

1.73%

13.91%

$

2Q20

108,733

3,618,924

(65,355)

5,843,865

2,900,484

3,962,404

5,038,791

805,074

5,843,865

91%

4.78 %

3.16%

25.15%

AVERAGE

2Q21

4,187,558

4,120,555

(86,591)

$ 10,655,852

8,967,067

9,565,560

9,839,173

816,679

$ 10,655,852

43 %

3.07 %

2.22%

28.93 %

$

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH

$

2Q20

196,754

4,195,772

(41,537)

6,610,899

3,199,148

5,057,293

5,779,060

831,839

6,610,889

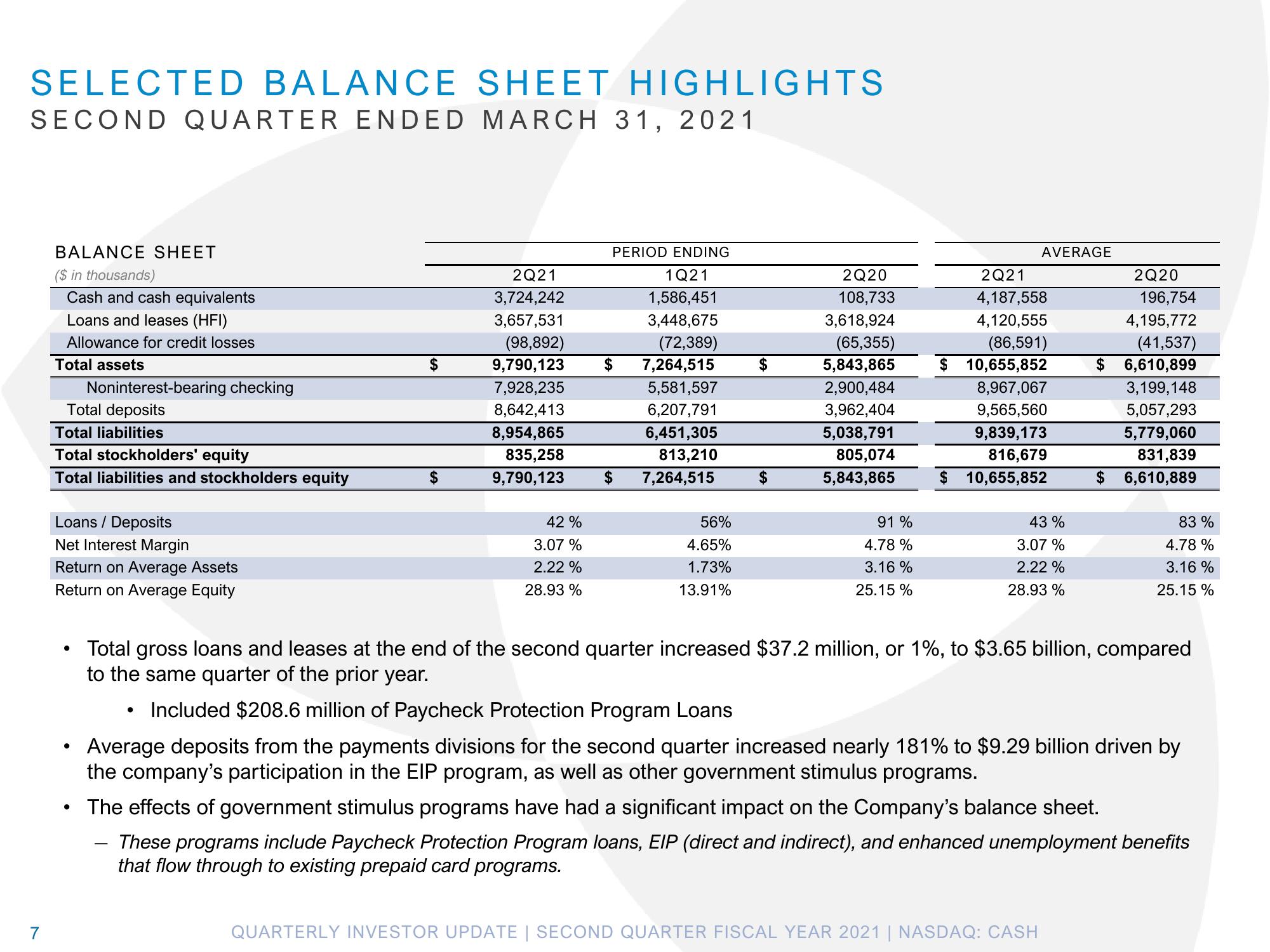

• Total gross loans and leases at the end of the second quarter increased $37.2 million, or 1%, to $3.65 billion, compared

to the same quarter of the prior year.

83%

4.78%

3.16%

25.15 %

Included $208.6 million of Paycheck Protection Program Loans

Average deposits from the payments divisions for the second quarter increased nearly 181% to $9.29 billion driven by

the company's participation in the EIP program, as well as other government stimulus programs.

The effects of government stimulus programs have had a significant impact on the Company's balance sheet.

These programs include Paycheck Protection Program loans, EIP (direct and indirect), and enhanced unemployment benefits

that flow through to existing prepaid card programs.View entire presentation