Kinnevik Results Presentation Deck

Intro

Net Asset Value

Note 4 Financial Assets Accounted at

Fair Value Through Profit & Loss

OUR FRAMEWORK AND PRINCIPLES

In assessing the fair value of our unlisted investments, we apply IFRS

13 and the International Private Equity and Venture Capital Valuation

Guidelines, whereunder we make a collective assessment to establish

the valuation methods and points of reference that are suitable and rel-

evant in determining the fair value of each of our unlisted investments.

Valuations in recent transactions are not applied as a valuation method,

but typically provides important points of reference for our valuations.

When applicable, consideration is taken to preferential rights such as

liquidation preferences to proceeds in a sale or listing of a business.

Valuation methods include revenue, GMV, and profit multiples, with

consideration to differences in size, growth, profitability and cost of equity

capital. We also consider the strength of a company's financial position,

cash runway, and the funding environment.

The valuation process is led independently from the investment team.

Accuracy and reliability of financial information is ensured through con-

tinuous contacts with investee management teams and regular reviews

of their financial and operational reporting. Information and opinions on

applicable valuation methods are obtained periodically from investment

managers and well-renowned investment banks and audit firms. The val-

uations are approved by Kinnevik's CFO and CEO after which a proposal

is presented and discussed with the Audit & Sustainability Committee and

Kinnevik's external auditors. After their scrutiny and potential adjustments,

the valuations are approved by the Audit & Sustainability Committee and

included in Kinnevik's financial reports.

When establishing the fair value of other financial instruments, meth-

ods assumed to provide the best estimation of fair value are used. For

assets and liabilities maturing within one year, a nominal value adjusted

for interest payments and premiums is assumed to provide a good

approximation of fair value.

Information in this note is provided per class of financial instruments

that are valued at fair value in the balance sheet, distributed in the levels

stated below:

KINNEVIK

Interim Report Q2 2022

Portfolio Overview

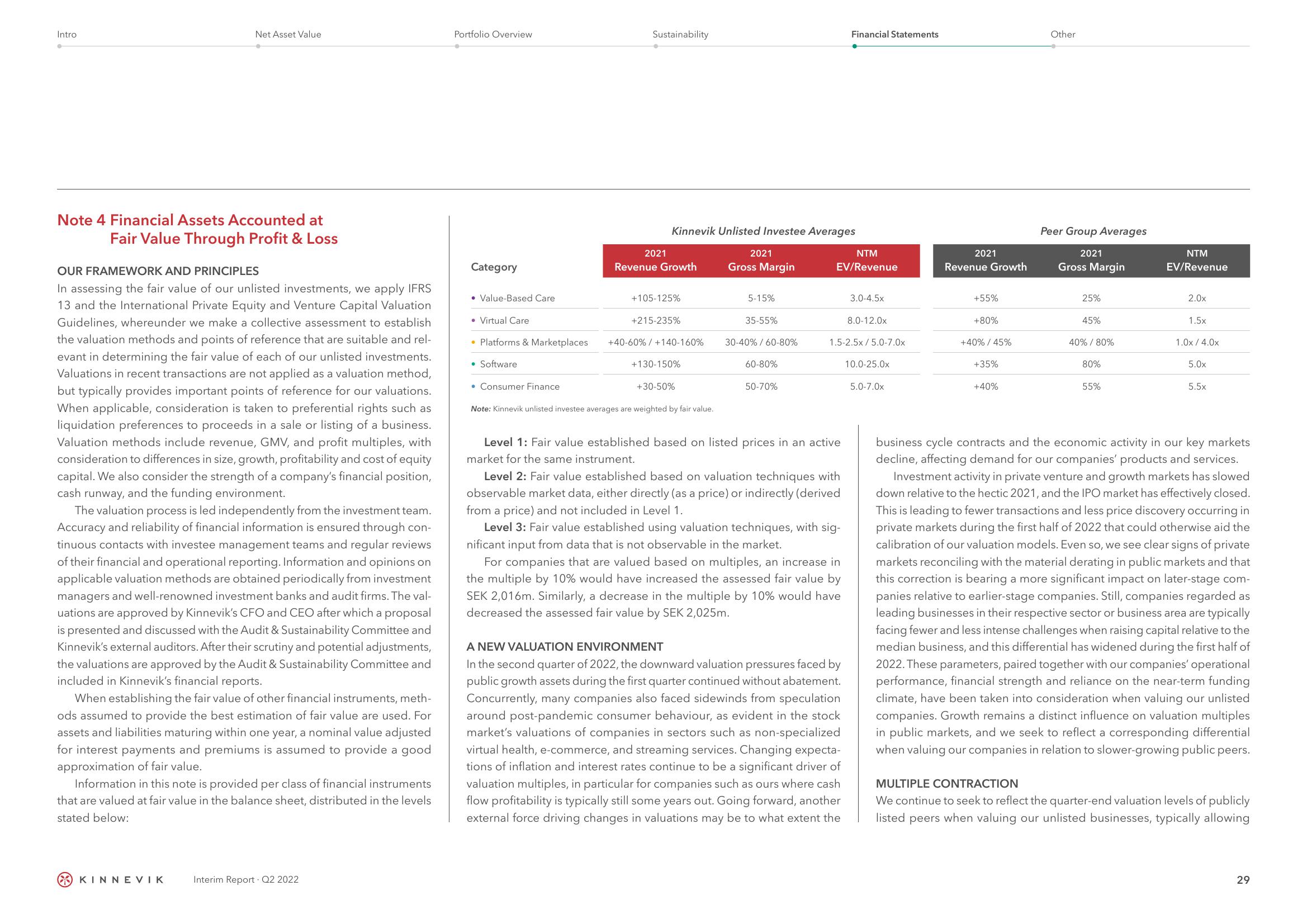

Category

• Value-Based Care

• Virtual Care

• Platforms & Marketplaces

• Software

• Consumer Finance

Sustainability

2021

Kinnevik Unlisted Investee Averages

Revenue Growth

+105-125%

+215-235%

+40-60% / +140-160%

+130-150%

+30-50%

Note: Kinnevik unlisted investee averages are weighted by fair value.

2021

Gross Margin

5-15%

35-55%

30-40% / 60-80%

60-80%

50-70%

Financial Statements

NTM

EV/Revenue

Level 1: Fair value established based on listed prices in an active

market for the same instrument.

Level 2: Fair value established based on valuation techniques with

observable market data, either directly (as a price) or indirectly (derived

from a price) and not included in Level 1.

Level 3: Fair value established using valuation techniques, with sig-

nificant input from data that is not observable in the market.

For companies that are valued based on multiples, an increase in

the multiple by 10% would have increased the assessed fair value by

SEK 2,016m. Similarly, a decrease in the multiple by 10% would have

decreased the assessed fair value by SEK 2,025m.

A NEW VALUATION ENVIRONMENT

In the second quarter of 2022, the downward valuation pressures faced by

public growth assets during the first quarter continued without abatement.

Concurrently, many companies also faced sidewinds from speculation

around post-pandemic consumer behaviour, as evident in the stock

market's valuations of companies in sectors such as non-specialized

virtual health, e-commerce, and streaming services. Changing expecta-

tions of inflation and interest rates continue to be a significant driver of

valuation multiples, in particular for companies such as ours where cash

flow profitability is typically still some years out. Going forward, another

external force driving changes in valuations may be to what extent the

3.0-4.5x

1.5-2.5x/5.0-7.0x

8.0-12.0x

10.0-25.0x

5.0-7.0x

2021

Revenue Growth

+55%

+80%

+40% / 45%

+35%

+40%

Other

Peer Group Averages

2021

Gross Margin

25%

45%

40% / 80%

80%

55%

NTM

EV/Revenue

2.0x

1.5x

1.0x / 4.0x

5.0x

5.5x

business cycle contracts and the economic activity in our key markets

decline, affecting demand for our companies' products and services.

Investment activity in private venture and growth markets has slowed

down relative to the hectic 2021, and the IPO market has effectively closed.

This is leading to fewer transactions and less price discovery occurring in

private markets during the first half of 2022 that could otherwise aid the

calibration of our valuation models. Even so, we see clear signs of private

markets reconciling with the material derating in public markets and that

this correction is bearing a more significant impact on later-stage com-

panies relative to earlier-stage companies. Still, companies regarded as

leading businesses in their respective sector or business area are typically

facing fewer and less intense challenges when raising capital relative to the

median business, and this differential has widened during the first half of

2022. These parameters, paired together with our companies' operational

performance, financial strength and reliance on the near-term funding

climate, have been taken into consideration when valuing our unlisted

companies. Growth remains a distinct influence on valuation multiples

in public markets, and we seek to reflect a corresponding differential

when valuing our companies in relation to slower-growing public peers.

MULTIPLE CONTRACTION

We continue to seek to reflect the quarter-end valuation levels of publicly

listed peers when valuing our unlisted businesses, typically allowing

29View entire presentation