OppFi Results Presentation Deck

8

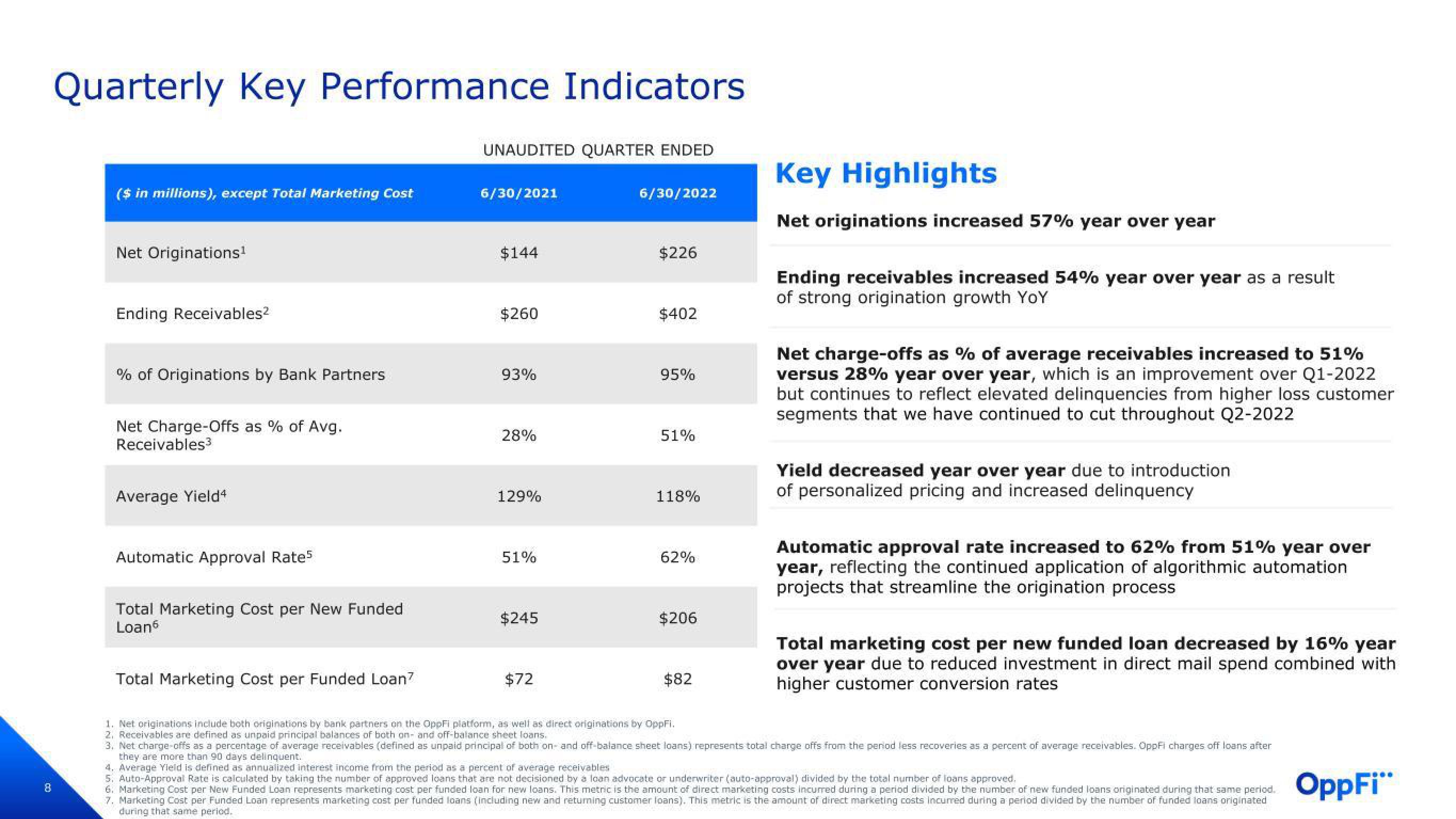

Quarterly Key Performance Indicators

($ in millions), except Total Marketing Cost

Net Originations¹

Ending Receivables²

% of Originations by Bank Partners

Net Charge-Offs as % of Avg.

Receivables3

Average Yield4

Automatic Approval Rate5

Total Marketing Cost per New Funded

Loan6

Total Marketing Cost per Funded Loan?

UNAUDITED QUARTER ENDED

6/30/2021

$144

$260

93%

28%

129%

51%

$245

$72

6/30/2022

$226

$402

95%

51%

118%

62%

$206

$82

Key Highlights

Net originations increased 57% year over year

Ending receivables increased 54% year over year as a result

of strong origination growth YoY

Net charge-offs as % of average receivables increased to 51%

versus 28% year over year, which is an improvement over Q1-2022

but continues to reflect elevated delinquencies from higher loss customer

segments that we have continued to cut throughout Q2-2022

Yield decreased year over year due to introduction

of personalized pricing and increased delinquency

Automatic approval rate increased to 62% from 51% year over

year, reflecting the continued application of algorithmic automation

projects that streamline the origination process

Total marketing cost per new funded loan decreased by 16% year

over year due to reduced investment in direct mail spend combined with

higher customer conversion rates

1. Net originations include both originations by bank partners on the OppFi platform, as well as direct originations by OppFi.

2. Receivables are defined as unpaid principal balances of both on- and off-balance sheet loans.

3. Net charge-offs as a percentage of average receivables (defined as unpaid principal of both on- and off-balance sheet loans) represents total charge offs from the period less recoveries as a percent of average receivables. OppFi charges off loans after

they are more than 90 days delinquent.

4. Average Yield is defined as annualized interest income from the period as a percent of average receivables

5. Auto-Approval Rate is calculated by taking the number of approved loans that are not decisioned by a loan advocate or underwriter (auto-approval) divided by the total number of loans approved.

6. Marketing Cost per New Funded Loan represents marketing cost per funded loan for new loans. This metric is the amount of direct marketing costs incurred during a period divided by the number of new funded loans originated during that same period.

7. Marketing Cost per Funded Loan represents marketing cost per funded loans (including new and returning customer loans). This metric is the amount of direct marketing costs incurred during a period divided by the number of funded loans originated

during that same period.

OppFi"*View entire presentation