Trian Partners Activist Presentation Deck

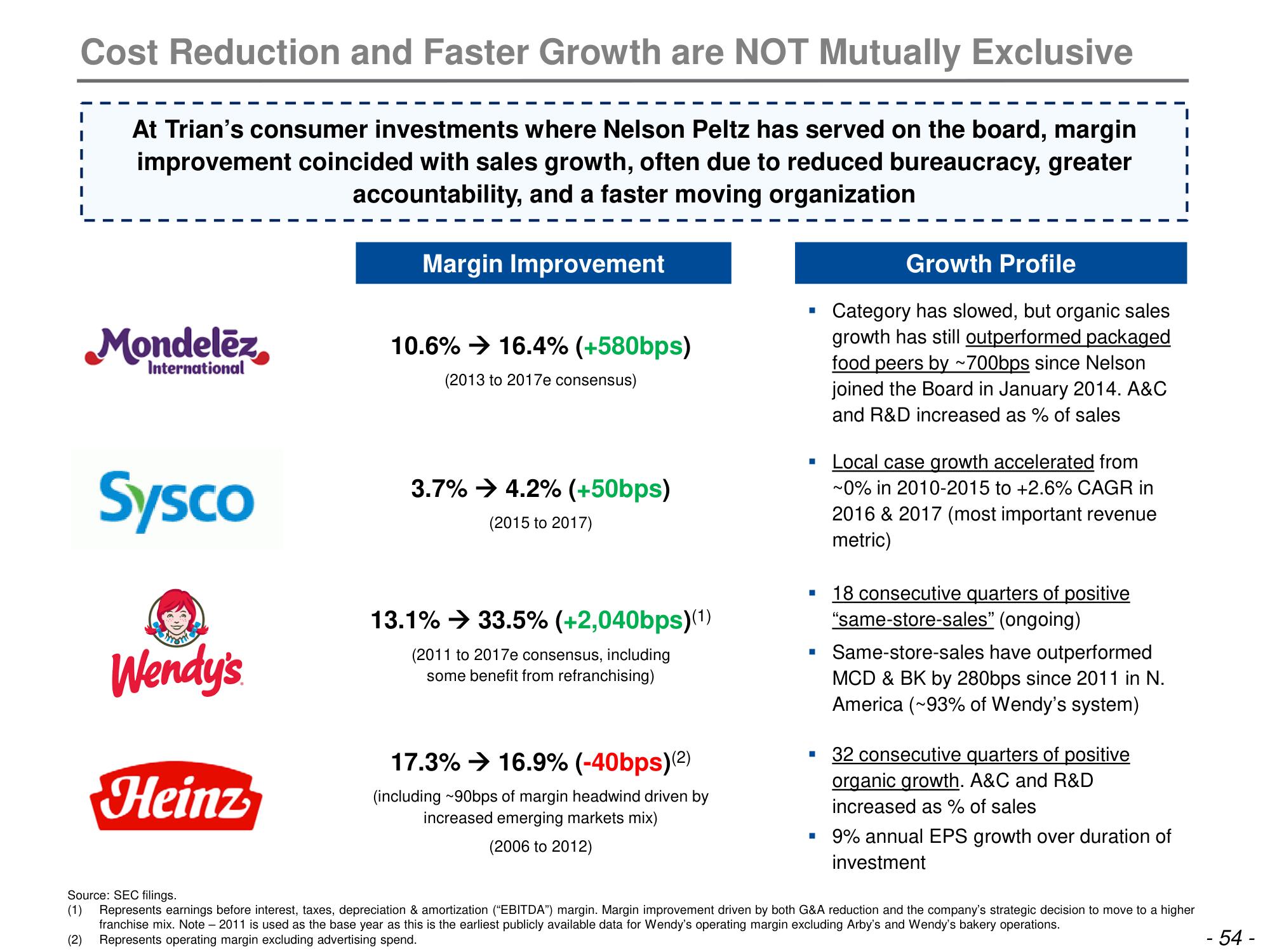

Cost Reduction and Faster Growth are NOT Mutually Exclusive

At Trian's consumer investments where Nelson Peltz has served on the board, margin

improvement coincided with sales growth, often due to reduced bureaucracy, greater

accountability, and a faster moving organization

Mondelez,

International

Sysco

Wendy's

Heinz

Margin Improvement

10.6%→ 16.4% (+580bps)

(2013 to 2017e consensus)

3.7% 4.2% (+50bps)

(2015 to 2017)

13.1% → 33.5% (+2,040bps)(1)

(2011 to 2017e consensus, including

some benefit from refranchising)

17.3%→ 16.9% (-40bps) (2)

(including ~90bps of margin headwind driven by

increased emerging markets mix)

(2006 to 2012)

■

■

■

■

I

Growth Profile

Category has slowed, but organic sales

growth has still outperformed packaged

food peers by ~700bps since Nelson

joined the Board in January 2014. A&C

and R&D increased as % of sales

Local case growth accelerated from

~0% in 2010-2015 to +2.6% CAGR in

2016 & 2017 (most important revenue

metric)

18 consecutive quarters of positive

"same-store-sales" (ongoing)

Same-store-sales have outperformed

MCD & BK by 280bps since 2011 in N.

America (~93% of Wendy's system)

32 consecutive quarters of positive

organic growth. A&C and R&D

increased as % of sales

9% annual EPS growth over duration of

investment

Source: SEC filings.

(1) Represents earnings before interest, taxes, depreciation & amortization ("EBITDA") margin. Margin improvement driven by both G&A reduction and the company's strategic decision to move to a higher

franchise mix. Note - 2011 is used as the base year as this is the earliest publicly available data for Wendy's operating margin excluding Arby's and Wendy's bakery operations.

(2) Represents operating margin excluding advertising spend.

- 54 -View entire presentation