Baird Investment Banking Pitch Book

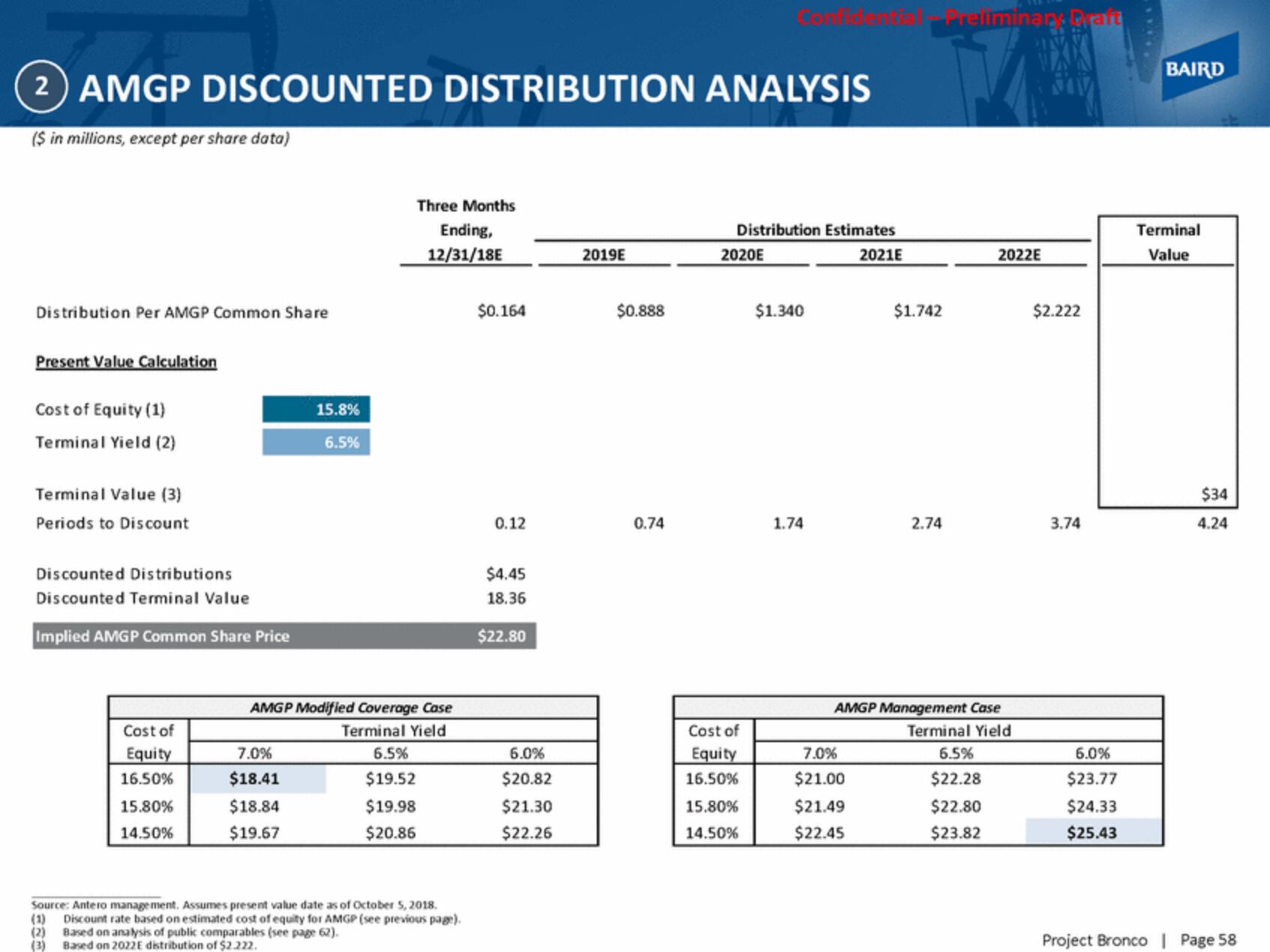

2 AMGP DISCOUNTED DISTRIBUTION ANALYSIS

($ in millions, except per share data)

Distribution Per AMGP Common Share

Present Value Calculation

Cost of Equity (1)

Terminal Yield (2)

Terminal Value (3)

Periods to Discount

Discounted Distributions

Discounted Terminal Value

Implied AMGP Common Share Price

Cost of

Equity

16.50%

(1)

(2)

(3)

15.80%

14.50%

15.8%

6.5%

7.0%

$18.41

$18.84

$19.67

AMGP Modified Coverage Case

Terminal Yield

Three Months

Ending,

12/31/18E

Source: Antero management. Assumes present value date as of October 5, 2018.

Discount rate based on estimated cost of equity for AMGP (see previous page).

Based on analysis of public comparables (see page 62).

Based on 2022E distribution of $2.222.

6.5%

$19.52

$19.98

$20.86

$0.164

0.12

$4.45

18.36

$22.80

6.0%

$20.82

$21.30

$22.26

2019E

$0.888

0.74

Distribution Estimates

2021E

2020E

Cost of

Equity

16.50%

15.80%

14.50%

$1.340

1.74

Preliminary Draft

7.0%

$21.00

$21.49

$22.45

$1.742

2.74

AMGP Management Case

Terminal Yield

6.5%

$22.28

2022E

$22.80

$23.82

$2.222

3.74

6.0%

$23.77

$24.33

$25.43

BAIRD

Terminal

Value

$34

4.24

Project Bronco | Page 58View entire presentation