Plastiq SPAC Presentation Deck

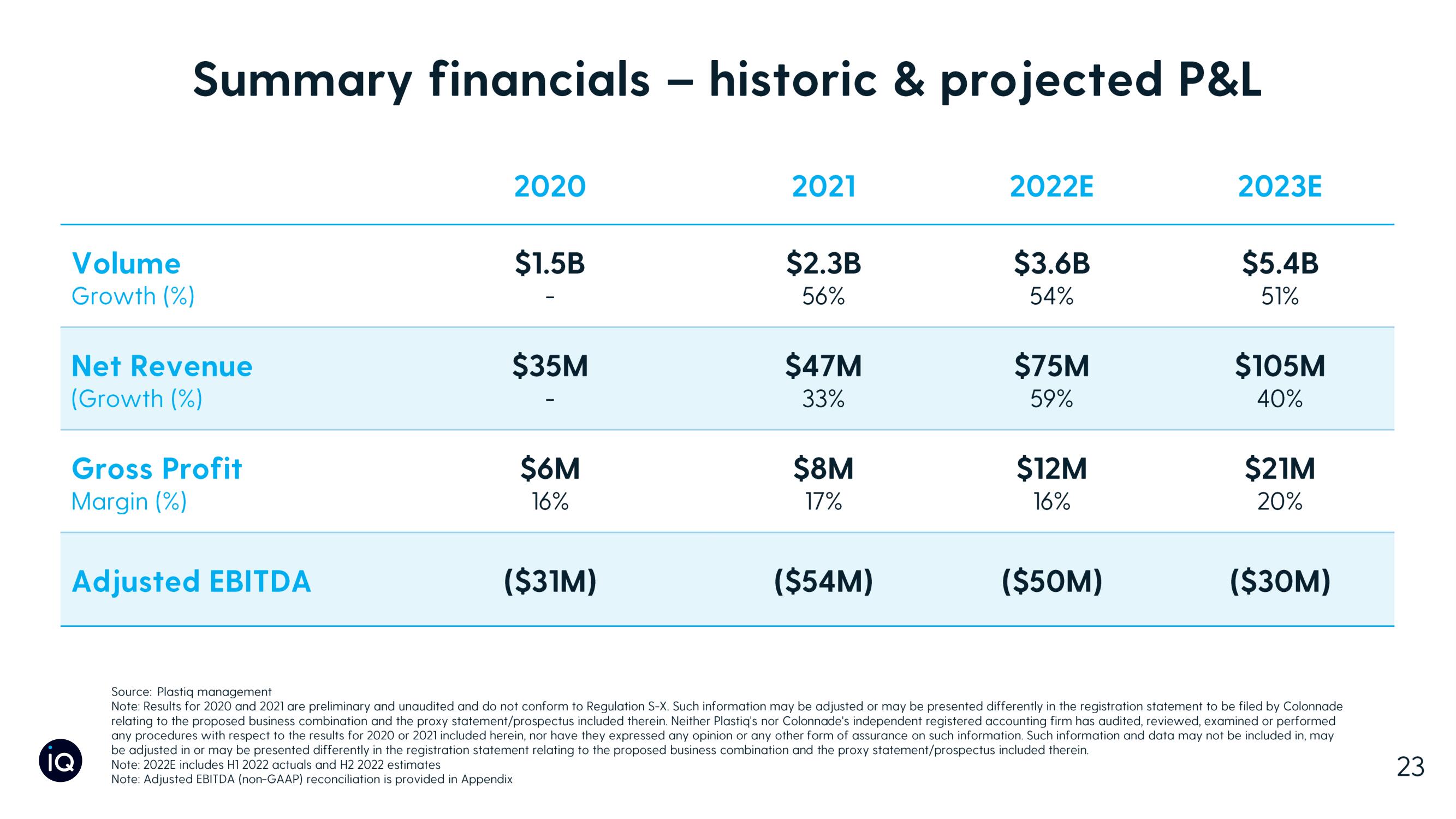

Summary financials - historic & projected P&L

Volume

Growth (%)

Net Revenue

(Growth (%)

Gross Profit

Margin (%)

Adjusted EBITDA

IQ

2020

$1.5B

$35M

$6M

16%

($31M)

2021

$2.3B

56%

$47M

33%

$8M

17%

($54M)

2022E

$3.6B

54%

$75M

59%

$12M

16%

($50M)

2023E

$5.4B

51%

$105M

40%

$21M

20%

($30M)

Source: Plastiq management

Note: Results for 2020 and 2021 are preliminary and unaudited and do not conform to Regulation S-X. Such information may be adjusted or may be presented differently in the registration statement to be filed by Colonnade

relating to the proposed business combination and the proxy statement/prospectus included therein. Neither Plastiq's nor Colonnade's independent registered accounting firm has audited, reviewed, examined or performed

any procedures with respect to the results for 2020 or 2021 included herein, nor have they expressed any opinion or any other form of assurance on such information. Such information and data may not be included in, may

be adjusted in or may be presented differently in the registration statement relating to the proposed business combination and the proxy statement/prospectus included therein.

Note: 2022E includes H1 2022 actuals and H2 2022 estimates

Note: Adjusted EBITDA (non-GAAP) reconciliation is provided in Appendix

23View entire presentation