Barclays Global Financial Services Conference

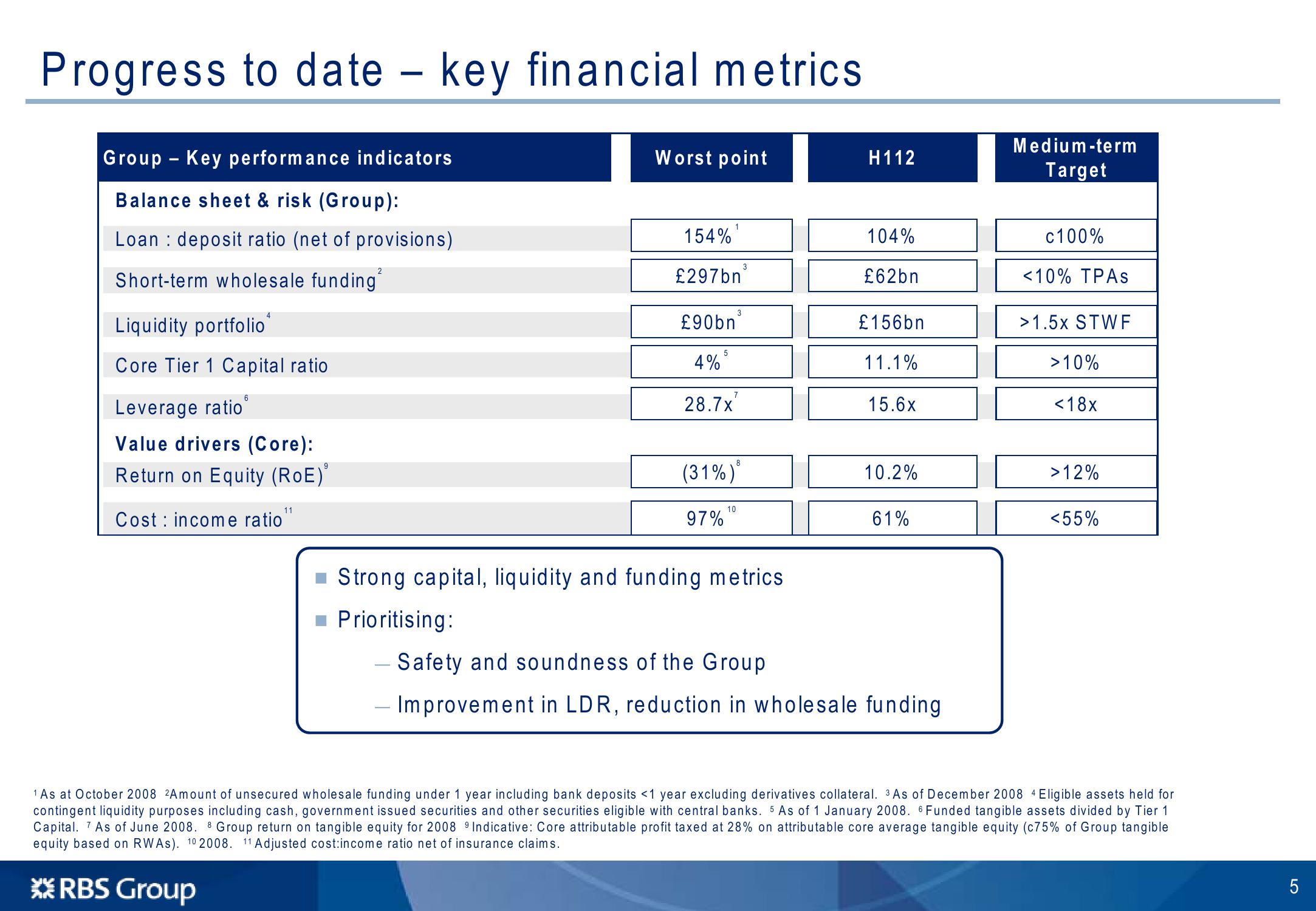

Progress to date key financial metrics.

-

-

Group Key performance indicators

Balance sheet & risk (Group):

Loan deposit ratio (net of provisions)

Worst point

H112

Medium-term

Target

Short-term wholesale funding

Liquidity portfolio*

Core Tier 1 Capital ratio

Leverage ratio

6

Value drivers (Core):

Return on Equity (ROE)'

11

Cost income ratio

1

154%

104%

c100%

3

£297bn

£62bn

<10% TPAS

3

£90bn

£156bn

>1.5x STWF

5

4%

11.1%

>10%

7

28.7x

15.6x

<18x

8

(31%)

10.2%

>12%

10

97%

61%

<55%

■Strong capital, liquidity and funding metrics.

■ Prioritising:

- Safety and soundness of the Group

- Improvement in LDR, reduction in wholesale funding

1 As at October 2008 2Amount of unsecured wholesale funding under 1 year including bank deposits <1 year excluding derivatives collateral. 3 As of December 2008 4 Eligible assets held for

contingent liquidity purposes including cash, government issued securities and other securities eligible with central banks. 5 As of 1 January 2008. 6 Funded tangible assets divided by Tier 1

Capital. As of June 2008. 8 Group return on tangible equity for 2008 9 Indicative: Core attributable profit taxed at 28% on attributable core average tangible equity (c75% of Group tangible

equity based on RWAs). 10 2008. 11 Adjusted cost:income ratio net of insurance claims.

**RBS Group

5View entire presentation