Credit Suisse Investment Banking Pitch Book

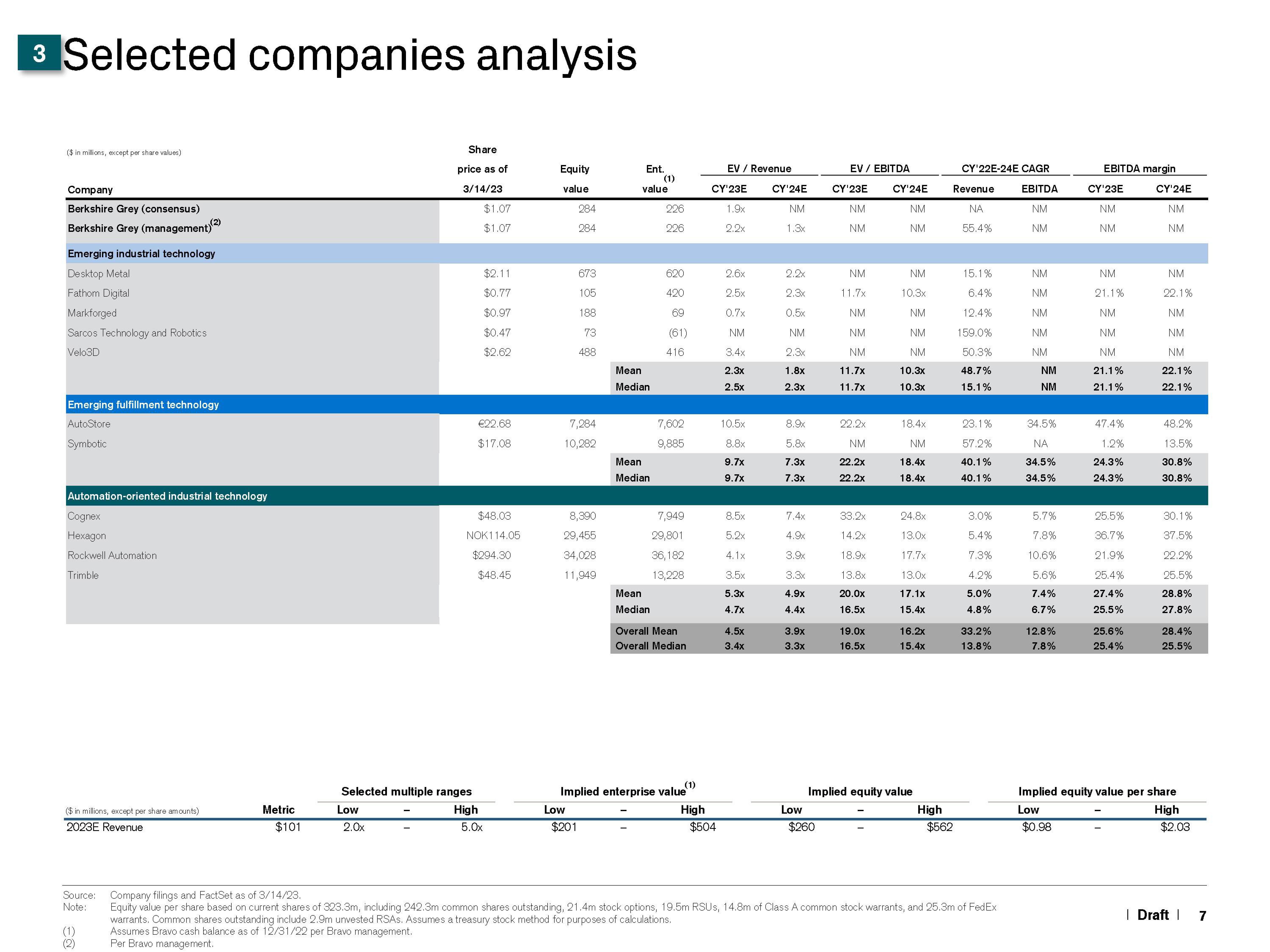

3 Selected companies analysis

($ in millions, except per share values)

Company

Berkshire Grey (consensus)

Berkshire Grey (management) (2)

Emerging industrial technology

Desktop Metal

Fathom gital

Markforged

Sarcos Technology and Robotics

Velo3D

Emerging fulfillment technology

AutoStore

Symbotic

Automation-oriented industrial technology

Cognex

Hexagon

Rockwell Automatic

Trimble

($ in millions, except per share amounts)

2023E Revenue

Metric

(1)

(2)

$101

Low

Share

price as of

3/14/23

2.0x

Selected multiple ranges

High

$1.07

$1.07

$2.11

$0.77

$0.97

$0.47

$2.62

€22.68

$17.08

$48.03

NOK 114.05

$294.30

$48.45

5.0x

Equity

value

284

284

673

105

188

73

488

7,284

10,282

8,390

29,455

34,028

11,949

Low

$201

Ent.

value

Mean

Median

Mean

Median

(1)

Mean

Median

226

226

620

420

69

(61)

416

7,602

9,885

7,949

29,801

36,182

13,228

Overall Mean

Overall Median

(1)

Implied enterprise value

EV / Revenue

CY¹23E

1.9x

2.2x

High

$504

2.6x

2.5x

0.7x

NM

3.4x

2.3x

2.5x

10.5×

8.8x

9.7x

9.7x

8.5x

5,2x

4.1x

3.5x

5.3x

4.7x

4.5x

3.4x

CY'24E

NM

1.3x

2.2x

2.3x

0.5x

NM

2.3x

1.8x

2.3x

8.9x

5.8x

7.3x

7.3x

7.4x

4.9x

3.9x

3.3x

4.9x

4.4x

3.9x

3.3x

Low

EV / EBITDA

$260

CY'23E

NM

NM

NM

11.7x

NM

NM

NM

11.7x

11.7x

22.2x

NM

22.2x

22.2x

33.2x

14,2x

18.9x

13.8x

20.0x

16.5x

19.0x

16.5x

CY'24E

NM

NM

NM

10.3x

NM

NM

NM

10.3x

10.3x

18.4x

NM

18.4x

18.4x

24.8x

13.0x

17.7x

13.0x

17.1x

15.4x

16.2x

15.4x

Implied equity value

High

CY'22E-24E CAGR

EBITDA

NM

NM

Revenue

ΝΑ

55.4%

$562

15.1%

6.4%

12.4%

159.0%

50.3%

48.7%

15.1%

23.1%

57.2%

40.1%

40.1%

3.0%

5.4%

7.3%

4.2%

5.0%

4.8%

33.2%

13.8%

Source: Company filings and FactSet as of 3/14/23.

Note:

Equity value per share based on current shares of 323.3m, including 242.3m common shares outstanding, 21.4m stock options, 19.5m RSUS, 14.8m of Class A common stock warrants, and 25.3m of FedEx

warrants. Common shares outstanding include 2.9m unvested RSAS. Assumes a treasury stock method for purposes of calculations.

Assumes Bravo cash balance as of 12/31/22 per Bravo management.

Per Bravo management.

NM

NM

NM

NM

NM

NM

NM

34.5%

NA

34.5%

34.5%

5.7%

7.8%

10.6%

5.6%

7.4%

6.7%

12.8%

7.8%

EBITDA margin

CY'23E

NM

NM

NM

21.1%

NM

NM

NM

21.1%

21.1%

47.4%

1.2%

24.3%

24.3%

25.5%

36.7%

21.9%

25.4%

27.4%

25.5%

25.6%

25.4%

CY'24E

NM

NM

NM

22.1%

NM

NM

NM

22.1%

22.1%

48.2%

13.5%

30.8%

30.8%

30.1%

37.5%

22.2%

25.5%

28.8%

27.8%

28.4%

25.5%

Implied equity value per share

Low

High

$2.03

$0.98

| Draft |

7View entire presentation