Opendoor Investor Presentation Deck

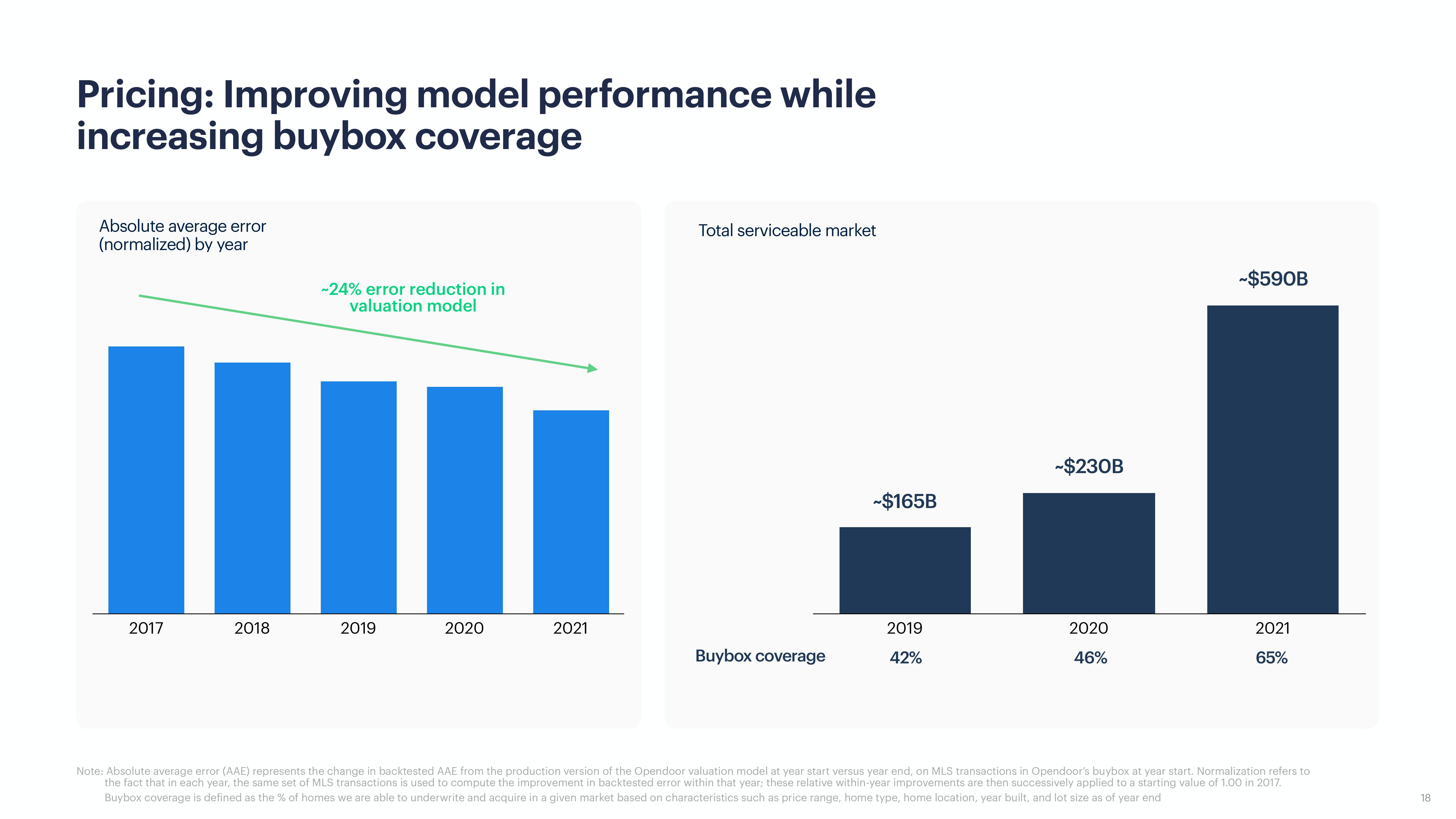

Pricing: Improving model performance while

increasing buybox coverage

Absolute average error

(normalized) by year

2017

2018

-24% error reduction in

valuation model

2019

2020

2021

Total serviceable market

Buybox coverage

~$165B

2019

42%

-$230B

2020

46%

~$590B

2021

65%

Note: Absolute average error (AAE) represents the change in backtested AAE from the production version of the Opendoor valuation model at year start versus year end, on MLS transactions in Opendoor's buybox at year start. Normalization refers to

the fact that in each year, the same set of MLS transactions is used to compute the improvement in backtested error within that year; these relative within-year improvements are then successively applied to a starting value of 1.00 in 2017.

Buybox coverage is defined as the % of homes we are able to underwrite and acquire in a given market based on characteristics such as price range, home type, home location, year built, and lot size as of year end

18View entire presentation