WeWork SPAC Presentation Deck

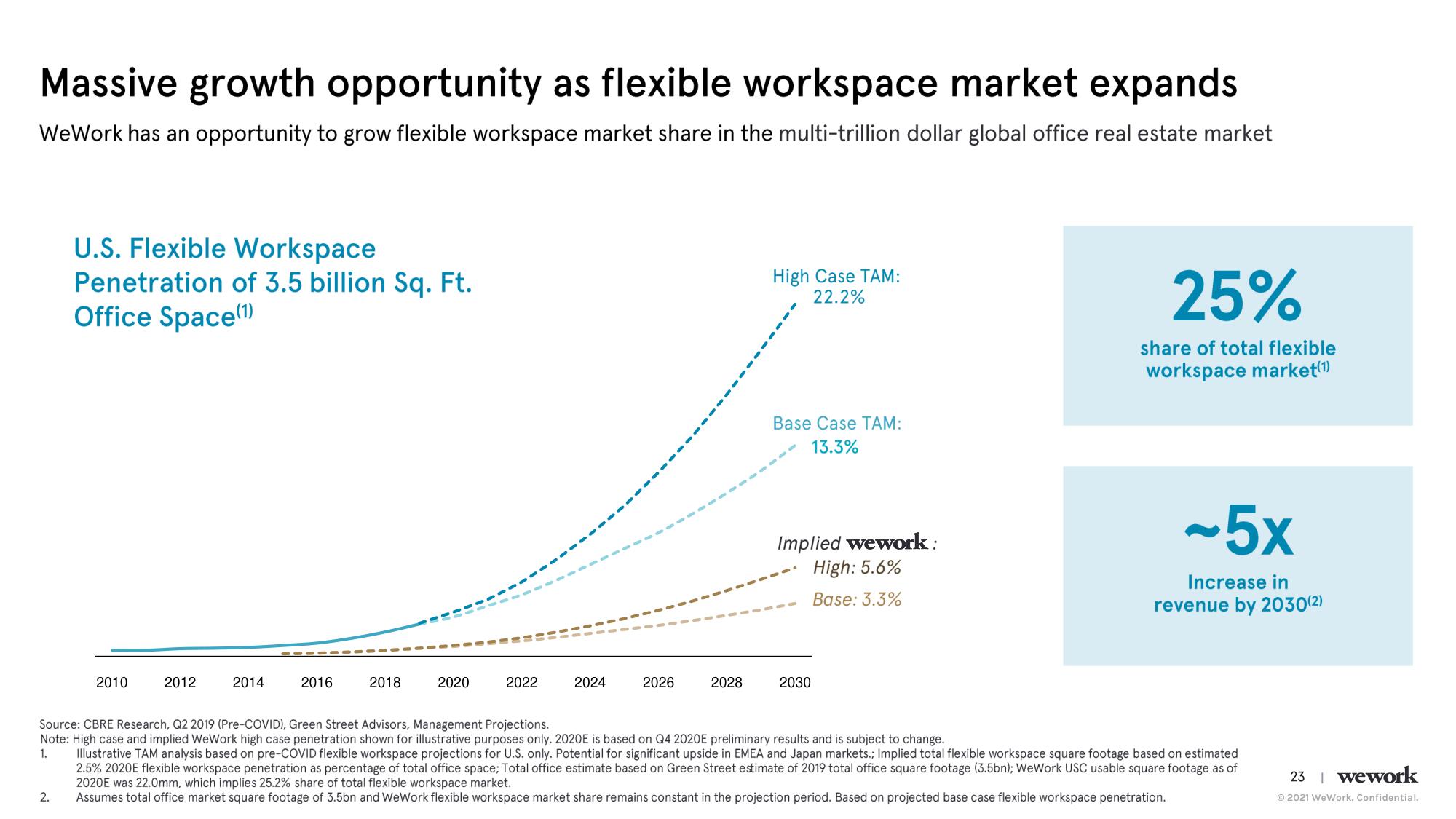

Massive growth opportunity as flexible workspace market expands

WeWork has an opportunity to grow flexible workspace market share in the multi-trillion dollar global office real estate market

U.S. Flexible Workspace

Penetration of 3.5 billion Sq. Ft.

Office Space(1)

2.

2010

2012

2014

2016

2018

2020

2022

2024

2026

2028

High Case TAM:

22.2%

Base Case TAM:

13.3%

Implied wework:

High: 5.6%

Base: 3.3%

2030

25%

share of total flexible

workspace market(1)

~5x

Increase in

revenue by 2030(2)

Source: CBRE Research, Q2 2019 (Pre-COVID), Green Street Advisors, Management Projections.

Note: High case and implied WeWork high case penetration shown for illustrative purposes only. 2020E is based on Q4 2020E preliminary results and is subject to change.

1.

Illustrative TAM analysis based on pre-COVID flexible workspace projections for U.S. only. Potential for significant upside in EMEA and Japan markets.; Implied total flexible workspace square footage based on estimated

2.5% 2020E flexible workspace penetration as percentage of total office space; Total office estimate based on Green Street estimate of 2019 total office square footage (3.5bn); WeWork USC usable square footage as of

2020E was 22.0mm, which implies 25.2% share of total flexible workspace market.

Assumes total office market square footage of 3.5bn and WeWork flexible workspace market share remains constant in the projection period. Based on projected base case flexible workspace penetration.

23 | wework

Ⓒ2021 WeWork. Confidential.View entire presentation