NuStar Energy Investor Conference Presentation Deck

NuStar

Reconciliation of Non-GAAP Financial

Information (continued)

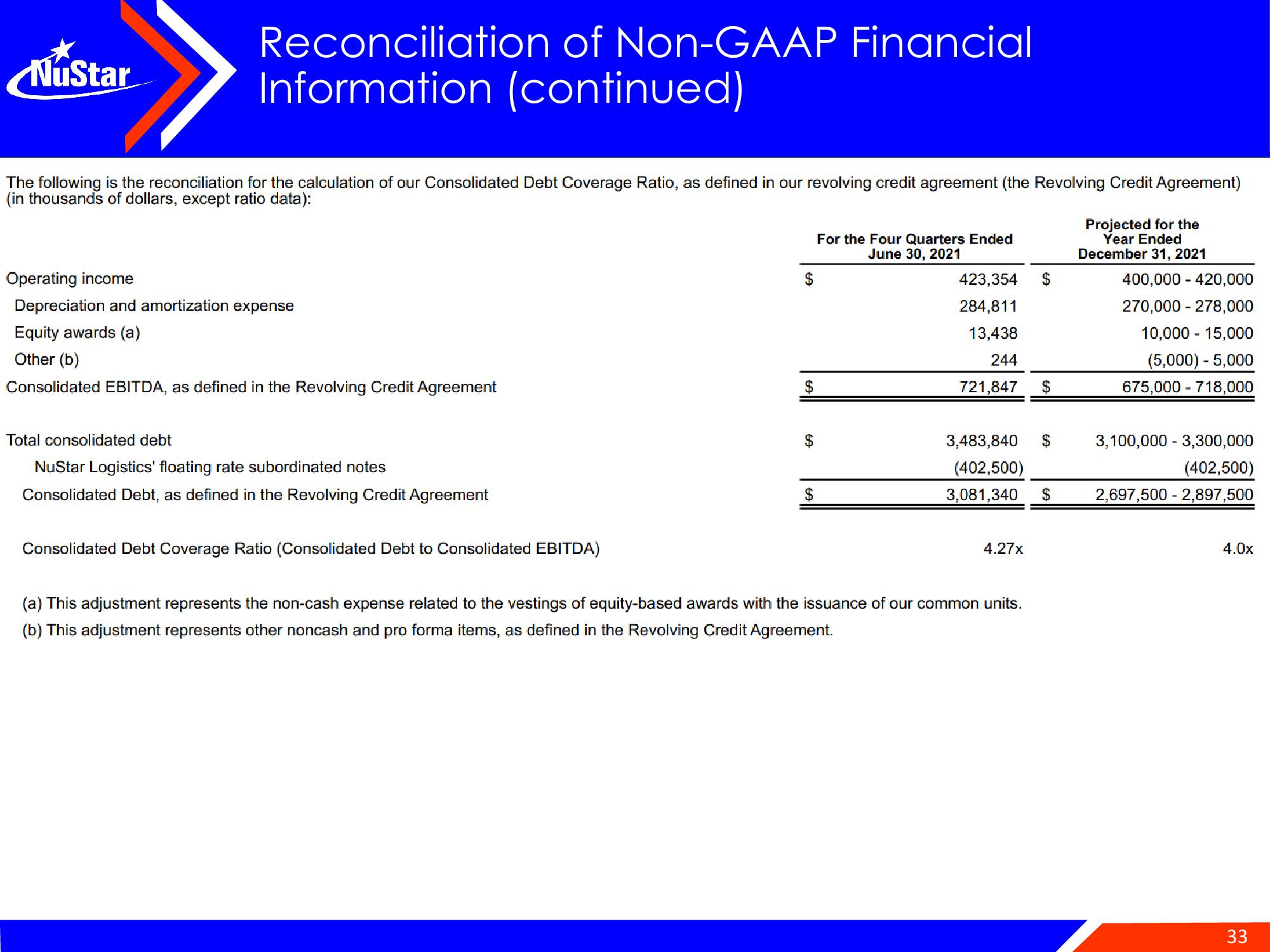

The following is the reconciliation for the calculation of our Consolidated Debt Coverage Ratio, as defined in our revolving credit agreement (the Revolving Credit Agreement)

(in thousands of dollars, except ratio data):

Operating income

Depreciation and amortization expense

Equity awards (a)

Other (b)

Consolidated EBITDA, as defined in the Revolving Credit Agreement

Total consolidated debt

NuStar Logistics' floating rate subordinated notes

Consolidated Debt, as defined in the Revolving Credit Agreement

Consolidated Debt Coverage Ratio (Consolidated Debt to Consolidated EBITDA)

$

$

EA

$

$

For the Four Quarters Ended

June 30, 2021

423,354

284,811

13,438

244

721,847

3,483,840 $

(402,500)

3,081,340 $

4.27x

$

(a) This adjustment represents the non-cash expense related to the vestings of equity-based awards with the issuance of our common units.

(b) This adjustment represents other noncash and pro forma items, as defined in the Revolving Credit Agreement.

Projected for the

Year Ended

December 31, 2021

400,000 - 420,000

270,000 -278,000

10,000 15,000

(5,000) - 5,000

675,000 - 718,000

3,100,000 3,300,000

(402,500)

2,697,500 2,897,500

4.0x

33View entire presentation