First Busey Results Presentation Deck

1

4Q23 Earnings Investor Presentation

■

As of 12/31/23

■

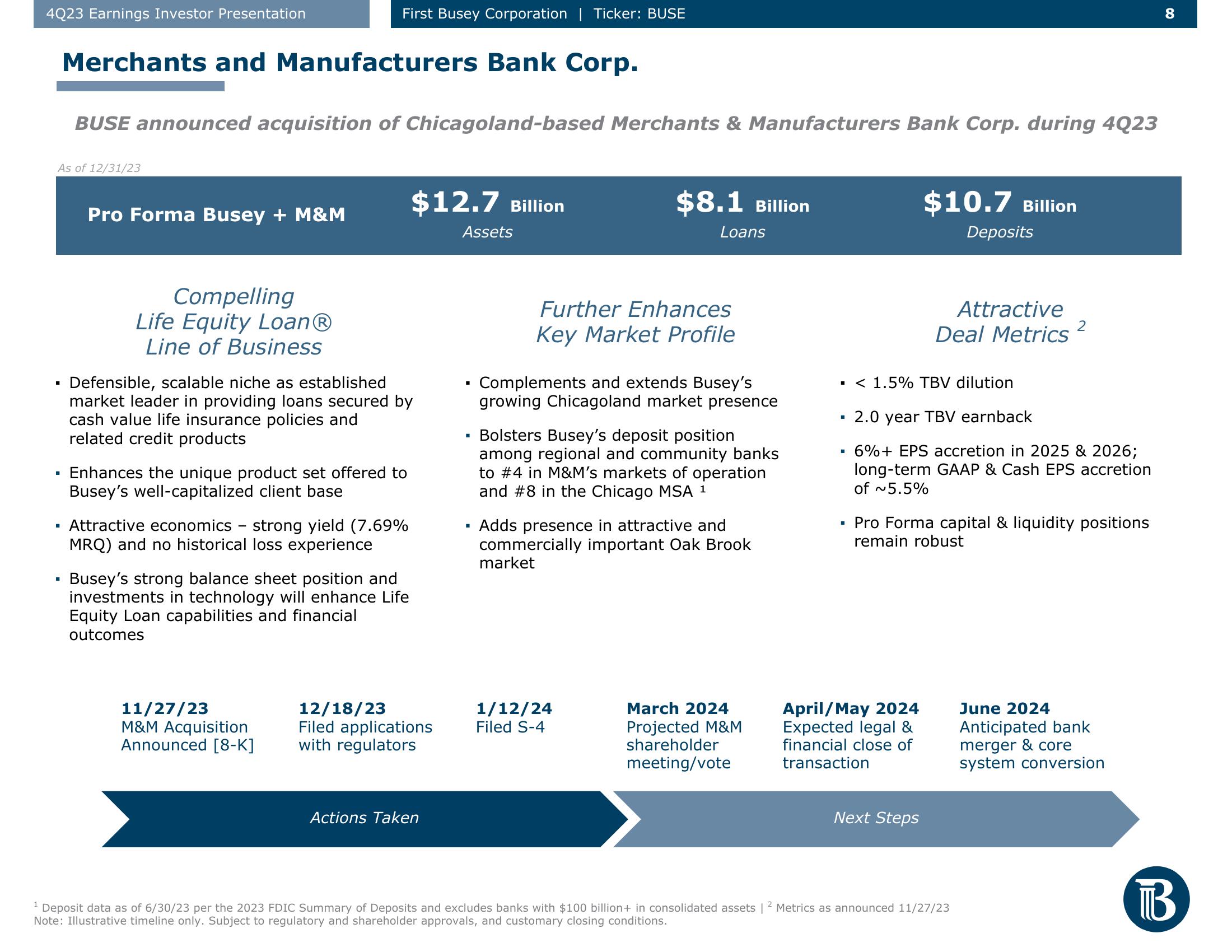

Merchants and Manufacturers Bank Corp.

BUSE announced acquisition of Chicagoland-based Merchants & Manufacturers Bank Corp. during 4Q23

Pro Forma Busey + M&M

First Busey Corporation | Ticker: BUSE

Compelling

Life Equity Loan Ⓡ

Line of Business

Defensible, scalable niche as established

market leader in providing loans secured by

cash value life insurance policies and

related credit products

Enhances the unique product set offered to

Busey's well-capitalized client base

Attractive economics - strong yield (7.69%

MRQ) and no historical loss experience

Busey's strong balance sheet position and

investments in technology will enhance Life

Equity Loan capabilities and financial

outcomes

11/27/23

M&M Acquisition

Announced [8-K]

$12.7 Billion

12/18/23

Filed applications

with regulators

Actions Taken

Assets

B

$8.1 Billion

Loans

Further Enhances

Key Market Profile

Complements and extends Busey's

growing Chicagoland market presence

Bolsters Busey's deposit position

among regional and community banks

to #4 in M&M's markets of operation

and #8 in the Chicago MSA ¹

1/12/24

Filed S-4

Adds presence in attractive and

commercially important Oak Brook

market

March 2024

Projected M&M

shareholder

meeting/vote

■

▪ < 1.5% TBV dilution

2.0 year TBV earnback

■

$10.7 Billion

Deposits

Attractive

Deal Metrics

April/May 2024

Expected legal &

financial close of

transaction

6%+ EPS accretion in 2025 & 2026;

long-term GAAP & Cash EPS accretion

of ~5.5%

Next Steps

▪ Pro Forma capital & liquidity positions

remain robust

2

Deposit data as of 6/30/23 per the 2023 FDIC Summary of Deposits and excludes banks with $100 billion+ in consolidated assets | 2 Metrics as announced 11/27/23

Note: Illustrative timeline only. Subject to regulatory and shareholder approvals, and customary closing conditions.

June 2024

Anticipated bank

merger & core

system conversion

8

BView entire presentation