BMO Capital Markets Investment Banking Pitch Book

BMO Capital Markets

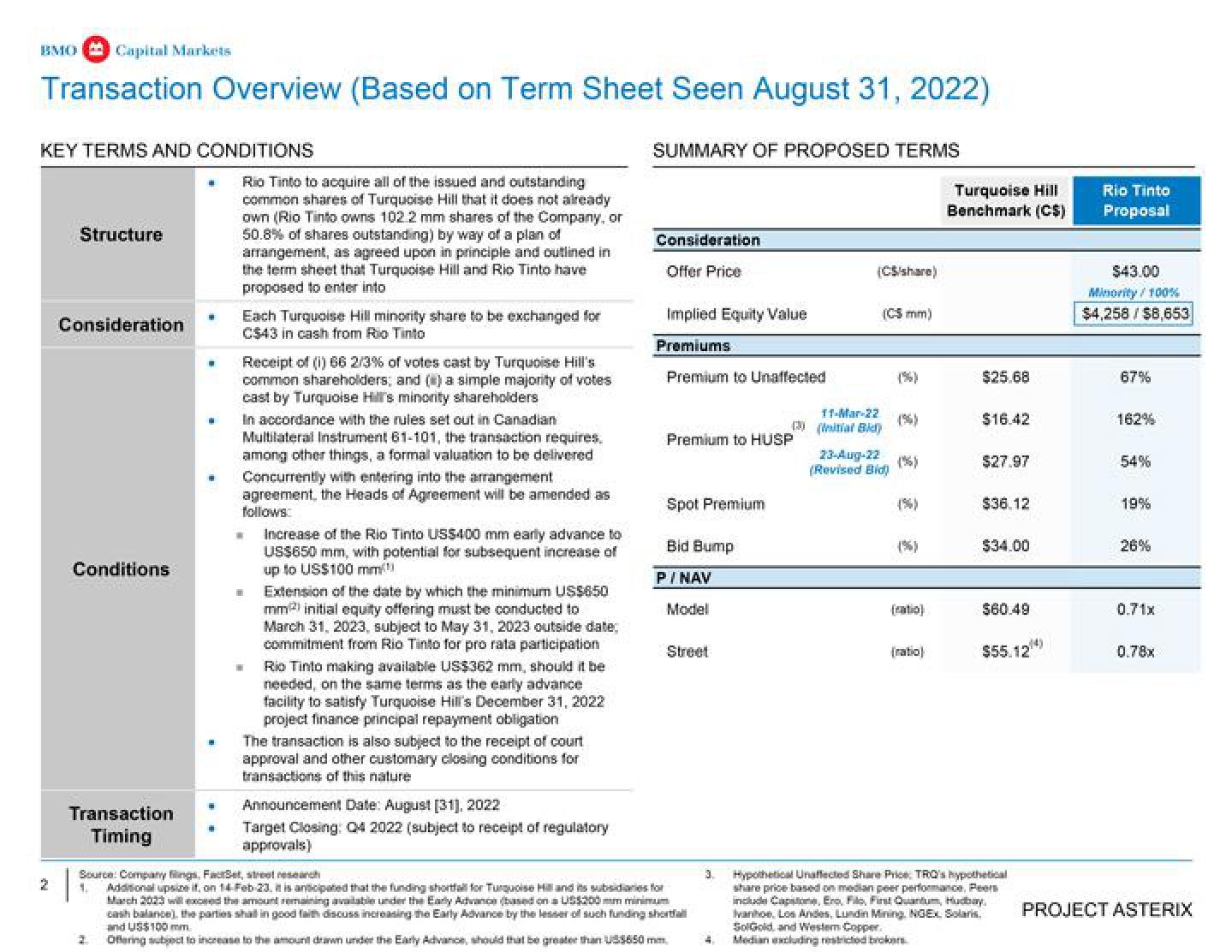

Transaction Overview (Based on Term Sheet Seen August 31, 2022)

KEY TERMS AND CONDITIONS

Structure

Consideration

Conditions

Transaction

Timing

Rio Tinto to acquire all of the issued and outstanding

common shares of Turquoise Hill that it does not already

own (Rio Tinto owns 102.2 mm shares of the Company, or

50.8% of shares outstanding) by way of a plan of

arrangement, as agreed upon in principle and outlined in

the term sheet that Turquoise Hill and Rio Tinto have

proposed to enter into

Each Turquoise Hill minority share to be exchanged for

C$43 in cash from Rio Tinto

Receipt of (1) 66 2/3% of votes cast by Turquoise Hill's

common shareholders; and () a simple majority of votes

cast by Turquoise Hill's minority shareholders

In accordance with the rules set out in Canadian

Multilateral Instrument 61-101, the transaction requires

among other things, a formal valuation to be delivered

Concurrently with entering into the arrangement

agreement, the Heads of Agreement will be amended as

follows:

H Increase of the Rio Tinto US$400 mm early advance to

US$650 mm, with potential for subsequent increase of

up to US$100 mm

图

Extension of the date by which the minimum US$650

mm² initial equity offering must be conducted to

March 31, 2023, subject to May 31, 2023 outside date;

commitment from Rio Tinto for pro rata participation

Rio Tinto making available US$362 mm, should it be

needed, on the same terms as the early advance

facility to satisfy Turquoise Hill's December 31, 2022

project finance principal repayment obligation

The transaction is also subject to the receipt of court

approval and other customary closing conditions for

transactions of this nature

Announcement Date: August [31], 2022

Target Closing: Q4 2022 (subject to receipt of regulatory

approvals)

SUMMARY OF PROPOSED TERMS

Consideration

Offer Price

Implied Equity Value

Premiums

Premium to Unaffected

Premium to HUSP

Spot Premium

Bid Bump

P/NAV

Model

Street

(3)

Source: Company Rings, FactSet, stretch

1. Additional upsie it, on 14-Feb-23, it is anticipated that the funding shortfall for Turquoise Hill and its subsidiaries for

March 2023 will exosed the amount remaining available under the Early Advance (based on a US$200 mm minimum

cash balance), the parties shall in good faith discuss increasing the Early Advance by the lesser of such funding shortfall

and US$100 mm.

2 Offering subject to increase to the amount drawn under the Early Advance, should that be greater than US$650 mm.

(CS/share)

11-Mar-22

(Initial Bid

(C5 mm)

23-Aug-22 (%)

(Revised Bid)

*

(ratio)

(ratio)

Turquoise Hill

Benchmark (C$)

$25.68

$16.42

$27.97

$36.12

$34.00

$60.49

2441

$55.12

3. Hypothetical Unaffected Share Prics, TRO's hypothetical

share price based on median peer performance, Peers

include Capstone, Ero, Filo, First Quantum, Hudbay.

Ivanhoe, Los Andes, Lundin Mining, NGEL Solaris.

SolGold, and Western Copper.

Median excluding restricted brokers

Rio Tinto

Proposal

$43.00

Minority/ 100%

$4,258 / $8,653

67%

162%

54%

19%

26%

0.71x

0.78x

PROJECT ASTERIXView entire presentation