Snap Inc Investor Presentation Deck

Snap Inc.

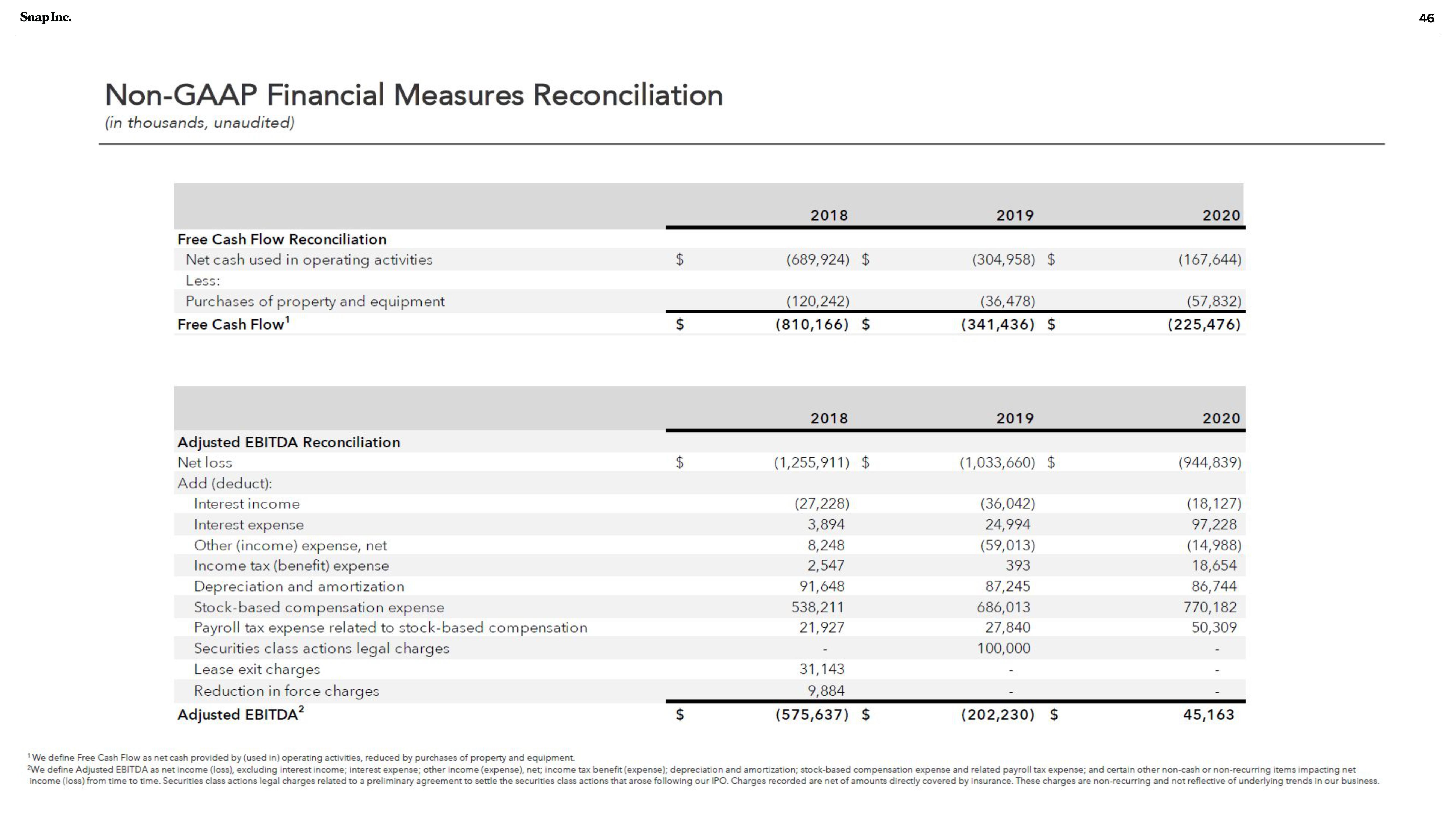

Non-GAAP Financial Measures Reconciliation

(in thousands, unaudited)

Free Cash Flow Reconciliation

Net cash used in operating activities

Less:

Purchases of property and equipment

Free Cash Flow¹

Adjusted EBITDA Reconciliation

Net loss

Add (deduct):

Interest income

Interest expense

Other (income) expense, net

Income tax (benefit) expense

Depreciation and amortization

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Securities class actions legal charges

Lease exit charges

Reduction in force charges

Adjusted EBITDA²

$

$

$

$

2018

(689,924) $

(120,242)

(810,166) $

2018

(1,255,911) $

(27,228)

3,894

8,248

2,547

91,648

538,211

21,927

31,143

9,884

(575,637) $

2019

(304,958) $

(36,478)

(341,436) $

2019

(1,033,660) $

(36,042)

24,994

(59,013)

393

87,245

686,013

27,840

100,000

(202,230) $

2020

(167,644)

(57,832)

(225,476)

2020

(944,839)

(18,127)

97,228

(14,988)

18,654

86,744

770,182

50,309

45,163

¹We define Free Cash Flow as net cash provided by (used in) operating activities, reduced by purchases of property and equipment.

We define Adjusted EBITDA as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense and related payroll tax expense; and certain other non-cash or non-recurring items impacting net

income (loss) from time to time. Securities class actions legal charges related to a preliminary agreement to settle the securities class actions that arose following our IPO. Charges recorded are net of amounts directly covered by insurance. These charges are non-recurring and not reflective of underlying trends in our business.

46View entire presentation