Q4 2020 Investor Presentation

2020 Financial Highlights

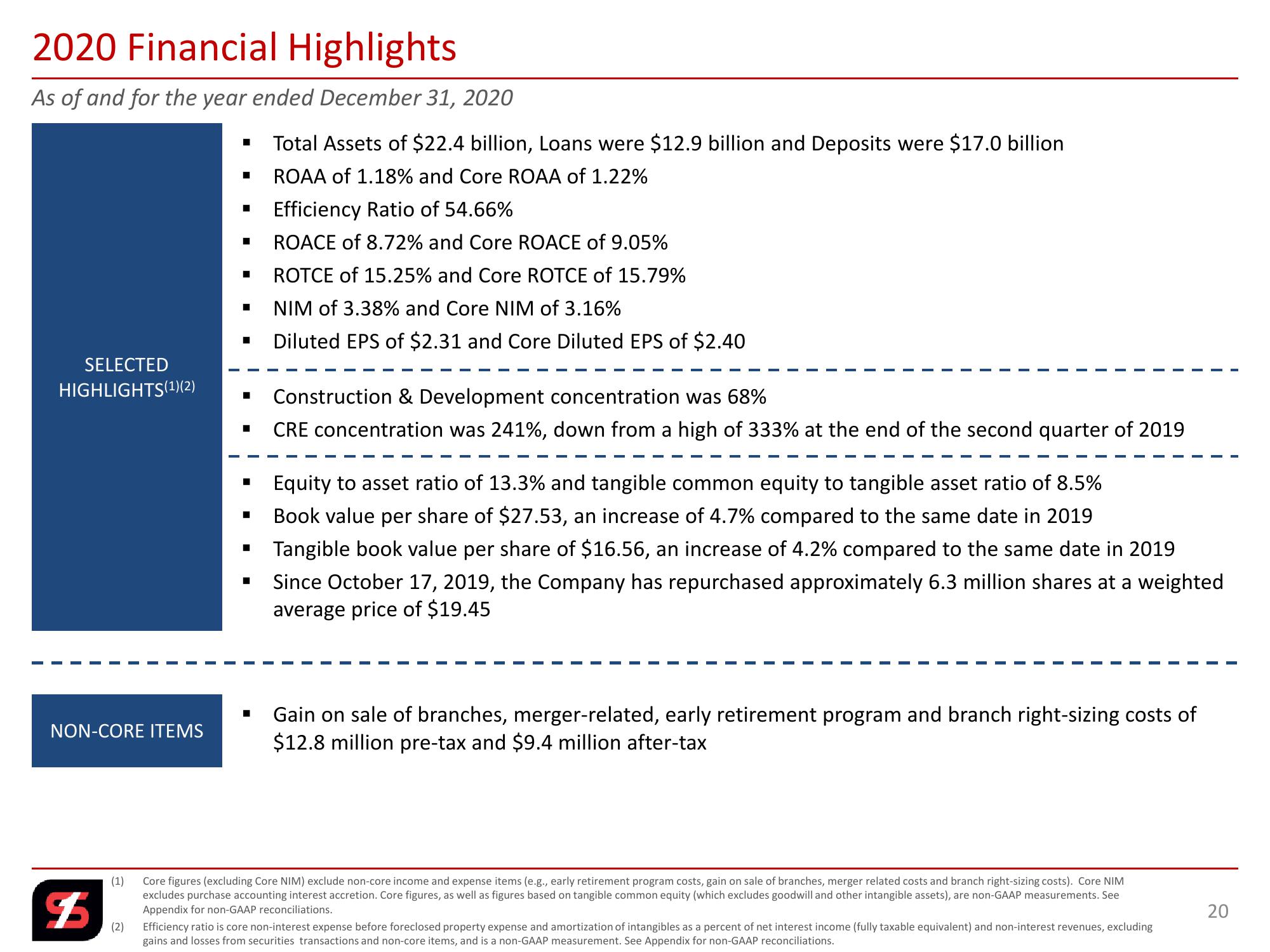

As of and for the year ended December 31, 2020

SELECTED

HIGHLIGHTS(1)(2)

NON-CORE ITEMS

■

Total Assets of $22.4 billion, Loans were $12.9 billion and Deposits were $17.0 billion

■ ROAA of 1.18% and Core ROAA of 1.22%

Efficiency Ratio of 54.66%

■

ROACE of 8.72% and Core ROACE of 9.05%

☐

ROTCE of 15.25% and Core ROTCE of 15.79%

■

NIM of 3.38% and Core NIM of 3.16%

■

Diluted EPS of $2.31 and Core Diluted EPS of $2.40

◉

■

Construction & Development concentration was 68%

CRE concentration was 241%, down from a high of 333% at the end of the second quarter of 2019

◉

Equity to asset ratio of 13.3% and tangible common equity to tangible asset ratio of 8.5%

■

Book value per share of $27.53, an increase of 4.7% compared to the same date in 2019

◉

■

Tangible book value per share of $16.56, an increase of 4.2% compared to the same date in 2019

Since October 17, 2019, the Company has repurchased approximately 6.3 million shares at a weighted

average price of $19.45

■

Gain on sale of branches, merger-related, early retirement program and branch right-sizing costs of

$12.8 million pre-tax and $9.4 million after-tax

$

(1)

(2)

Core figures (excluding Core NIM) exclude non-core income and expense items (e.g., early retirement program costs, gain on sale of branches, merger related costs and branch right-sizing costs). Core NIM

excludes purchase accounting interest accretion. Core figures, as well as figures based on tangible common equity (which excludes goodwill and other intangible assets), are non-GAAP measurements. See

Appendix for non-GAAP reconciliations.

Efficiency ratio is core non-interest expense before foreclosed property expense and amortization of intangibles as a percent of net interest income (fully taxable equivalent) and non-interest revenues, excluding

gains and losses from securities transactions and non-core items, and is a non-GAAP measurement. See Appendix for non-GAAP reconciliations.

20View entire presentation