jetBlue Mergers and Acquisitions Presentation Deck

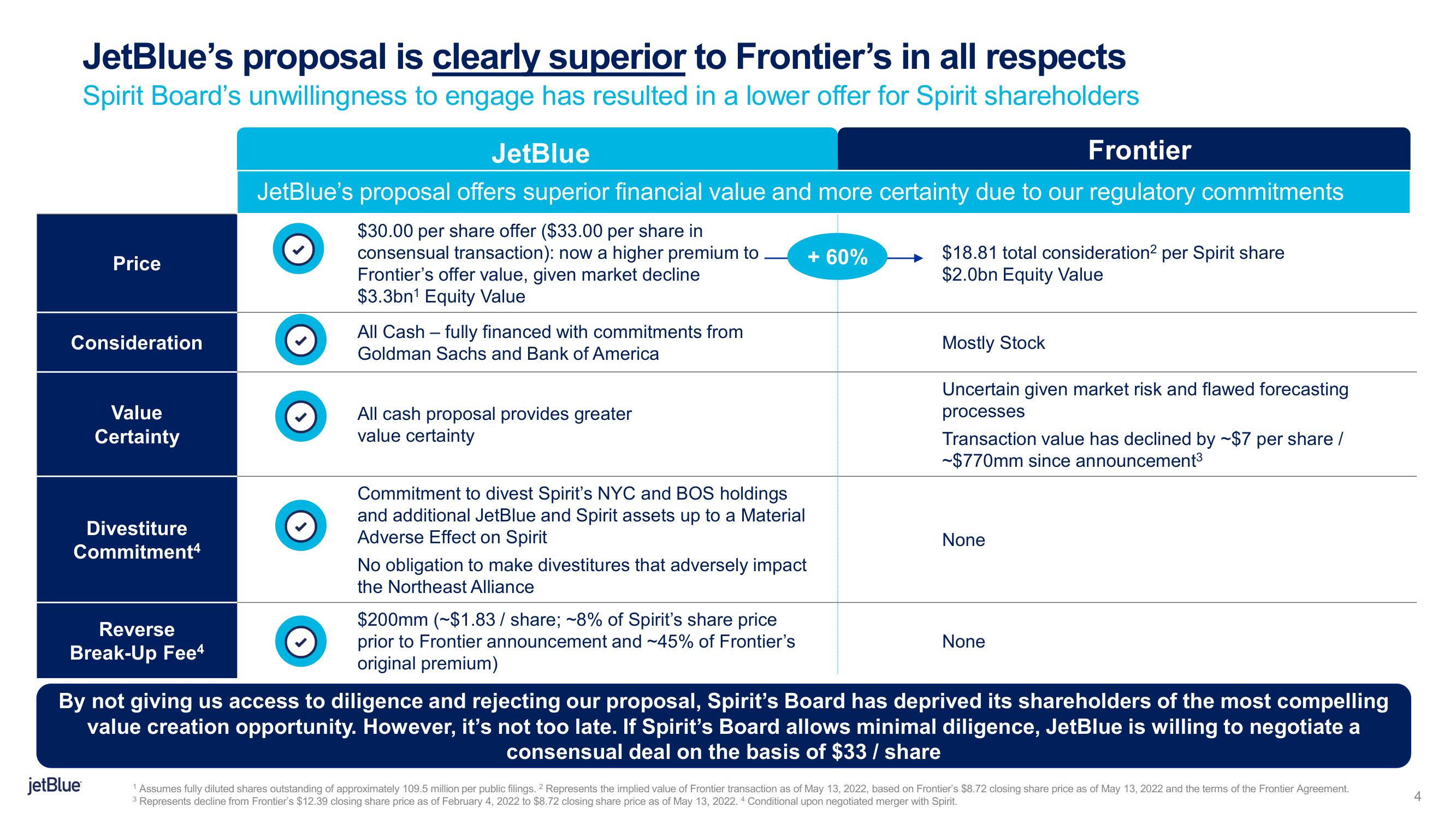

JetBlue's proposal is clearly superior to Frontier's in all respects

Spirit Board's unwillingness to engage has resulted in a lower offer for Spirit shareholders

Price

Consideration

Value

Certainty

Divestiture

Commitment4

jetBlue

Reverse

Break-Up Fee4

JetBlue

Frontier

JetBlue's proposal offers superior financial value and more certainty due to our regulatory commitments

$30.00 per share offer ($33.00 per share in

consensual transaction): now a higher premium to

Frontier's offer value, given market decline

$3.3bn¹ Equity Value

All Cash - fully financed with commitments from

Goldman Sachs and Bank of America

All cash proposal provides greater

value certainty

Commitment to divest Spirit's NYC and BOS holdings

and additional JetBlue and Spirit assets up to a Material

Adverse Effect on Spirit

+ 60%

No obligation to make divestitures that adversely impact

the Northeast Alliance

$200mm (~$1.83/ share; -8% of Spirit's share price

prior to Frontier announcement and ~45% of Frontier's

original premium)

$18.81

$2.0bn Equity Value

consideration² per Spirit shar

Mostly Stock

Uncertain given market risk and flawed forecasting

processes

Transaction value has declined by ~$7 per share /

~$770mm since announcement³

None

None

By not giving us access to diligence and rejecting our proposal, Spirit's Board has deprived its shareholders of the most compelling

value creation opportunity. However, it's not too late. If Spirit's Board allows minimal diligence, JetBlue is willing to negotiate a

consensual deal on the basis of $33 / share

¹ Assumes fully diluted shares outstanding of approximately 109.5 million per public filings. 2 Represents the implied value of Frontier transaction as of May 13, 2022, based on Frontier's $8.72 closing share price as of May 13, 2022 and the terms of the Frontier Agreement.

3 Represents decline from Frontier's $12.39 closing share price as of February 4, 2022 to $8.72 closing share price as of May 13, 2022. 4 Conditional upon negotiated merger with Spirit.

4View entire presentation