Waldencast SPAC Presentation Deck

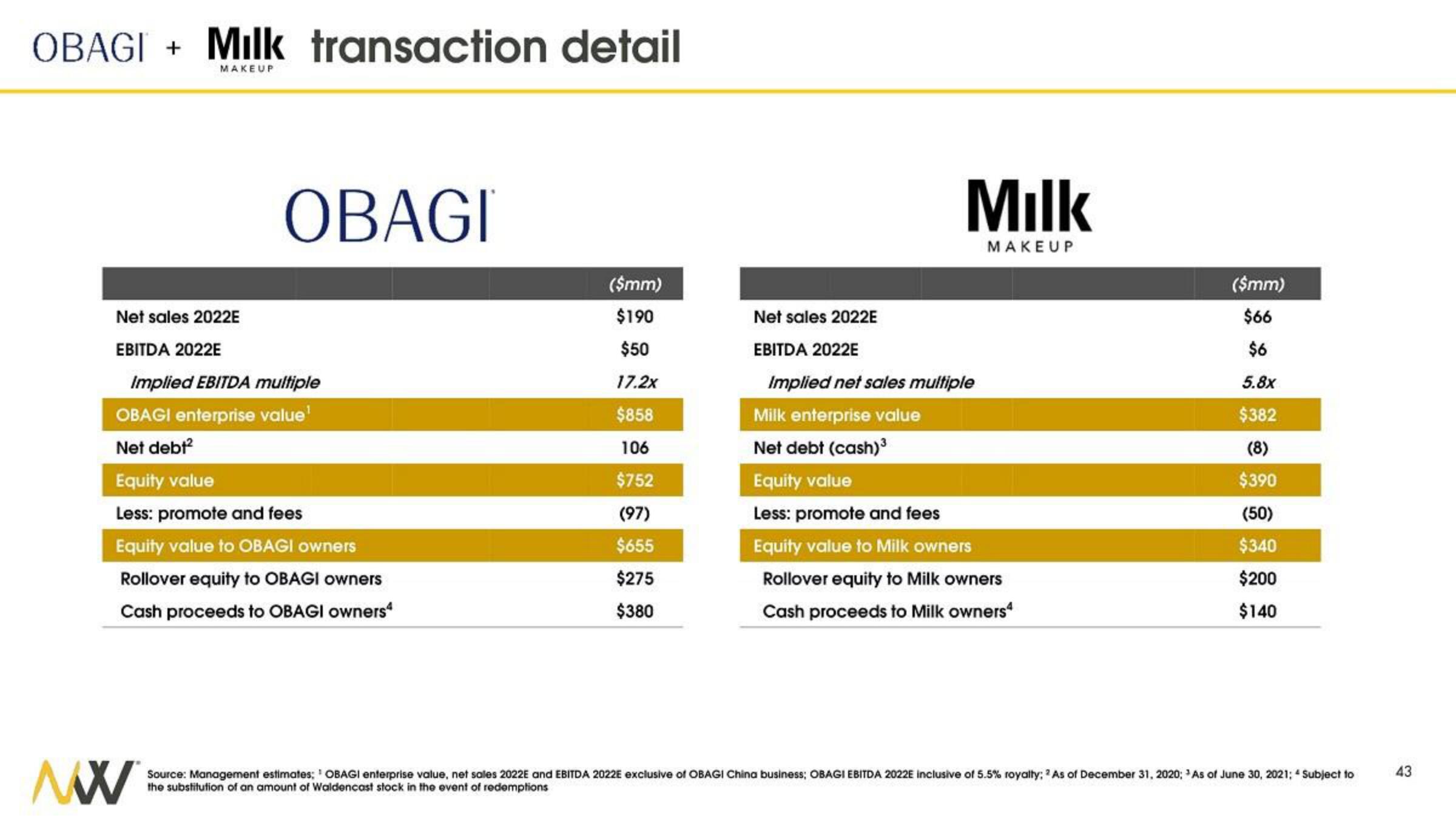

OBAGI + Milk transaction detail

MAKEUP

OBAGI

Net sales 2022E

EBITDA 2022E

Implied EBITDA multiple

OBAGI enterprise value¹

Net debt²

Equity value

Less: promote and fees

Equity value to OBAGI owners

Rollover equity to OBAGI owners

Cash proceeds to OBAGI owners4

MW

($mm)

$190

$50

17.2x

$858

106

$752

(97)

$655

$275

$380

Milk

MAKEUP

Net sales 2022E

EBITDA 2022E

Implied net sales multiple

Milk enterprise value

Net debt (cash)³

Equity value

Less: promote and fees

Equity value to Milk owners

Rollover equity to Milk owners

Cash proceeds to Milk owners4

($mm)

$66

$6

5.8x

$382

(8)

$390

(50)

$340

$200

$140

Source: Management estimates; OBAGI enterprise value, net sales 2022E and EBITDA 2022E exclusive of OBAGI China business; OBAGI EBITDA 2022E inclusive of 5.5% royalty: 2 As of December 31, 2020; As of June 30, 2021; 4 Subject to

the substitution of an amount of Waldencast stock in the event of redemptions

43View entire presentation