AMC Investor Presentation Deck

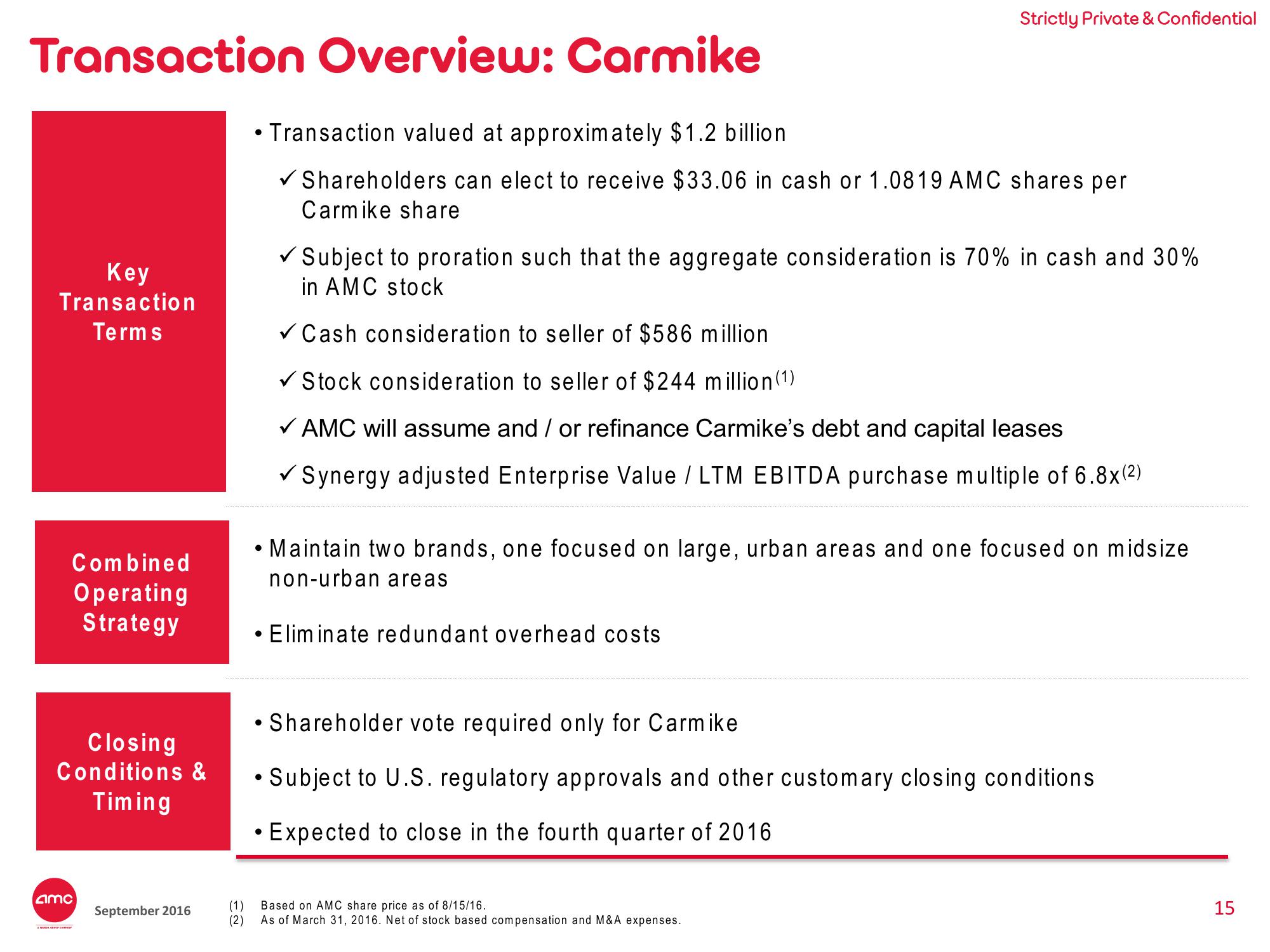

Transaction Overview: Carmike

Key

Transaction

Terms

Combined

Operating

Strategy

Closing

Conditions &

Timing

amc

September 2016

(1)

(2)

●

• Transaction valued at approximately $1.2 billion

Strictly Private & Confidential

✓ Shareholders can elect to receive $33.06 in cash or 1.0819 AMC shares per

Carmike share

●

✓ Subject to proration such that the aggregate consideration is 70% in cash and 30%

in AMC stock

✓ Cash consideration to seller of $586 million

✓ Stock consideration to seller of $244 million (1)

✓ AMC will assume and / or refinance Carmike's debt and capital leases

✓ Synergy adjusted Enterprise Value / LTM EBITDA purchase multiple of 6.8x(²)

●

• Maintain two brands, one focused on large, urban areas and one focused on midsize

non-urban areas

• Eliminate redundant overhead costs

Shareholder vote required only for Carmike

• Subject to U.S. regulatory approvals and other customary closing conditions

●

• Expected to close in the fourth quarter of 2016

Based on AMC share price as of 8/15/16.

As of March 31, 2016. Net of stock based compensation and M&A expenses.

15View entire presentation