Deutsche Bank Fixed Income Presentation Deck

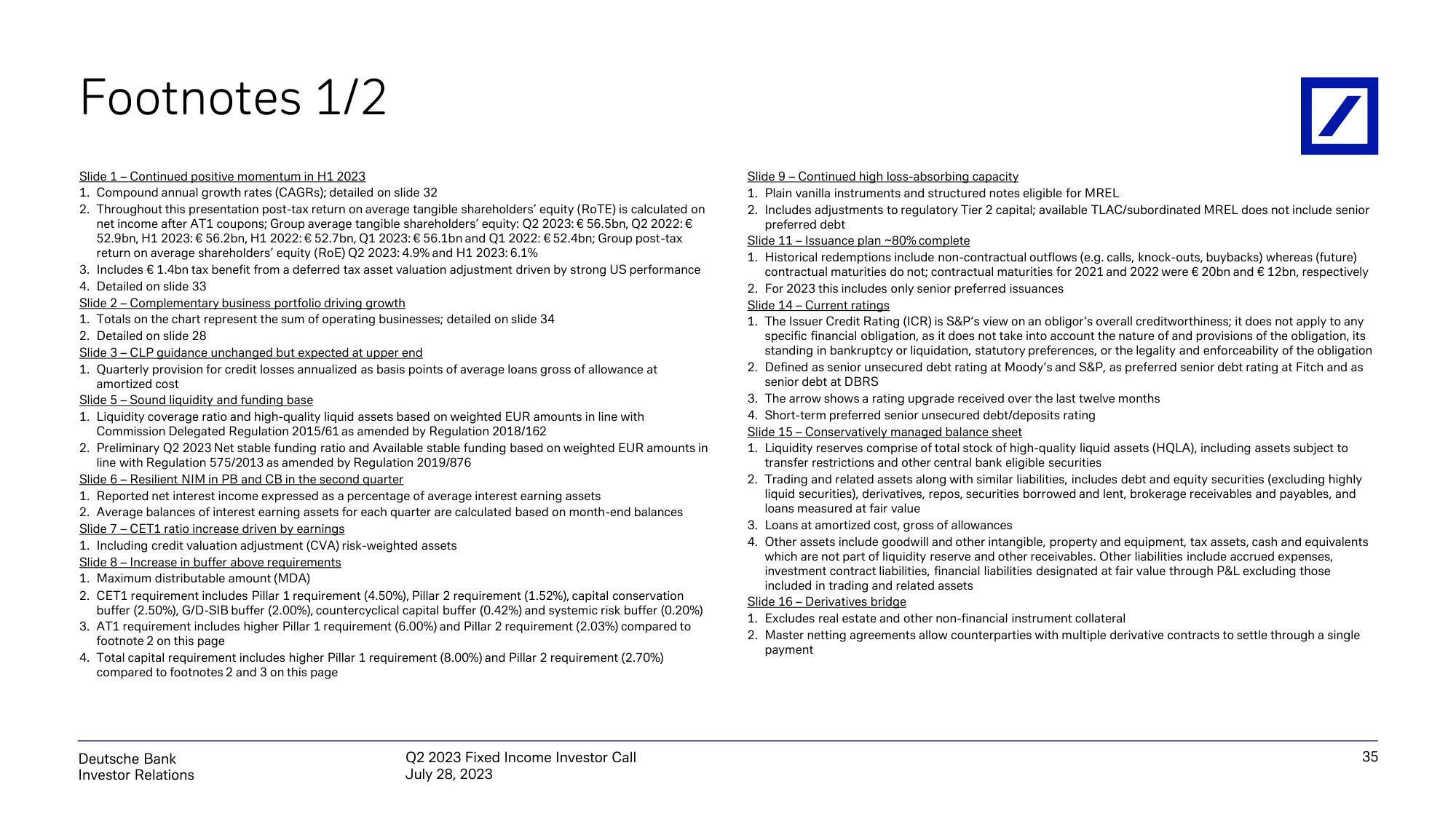

Footnotes 1/2

Slide 1 Continued positive momentum in H1 2023

1. Compound annual growth rates (CAGRS); detailed on slide 32

2. Throughout this presentation post-tax return on average tangible shareholders' equity (RoTE) is calculated on

net income after AT1 coupons; Group average tangible shareholders' equity: Q2 2023: € 56.5bn, Q2 2022: €

52.9bn, H1 2023: € 56.2bn, H1 2022: € 52.7bn, Q1 2023: € 56.1bn and Q1 2022: €52.4bn; Group post-tax

return on average shareholders' equity (RoE) Q2 2023: 4.9% and H1 2023: 6.1%

3. Includes € 1.4bn tax benefit from a deferred tax asset valuation adjustment driven by strong US performance

4. Detailed on slide 33.

Slide 2 Complementary business portfolio driving growth

1. Totals on the chart represent the sum of operating businesses; detailed on slide 34

2. Detailed on slide 28

Slide 3 CLP guidance unchanged but expected at upper end

1. Quarterly provision for credit losses annualized as basis points of average loans gross of allowance at

amortized cost

Slide 5- Sound liquidity and funding base

1. Liquidity coverage ratio and high-quality liquid assets based on weighted EUR amounts in line with

Commission Delegated Regulation 2015/61 as amended by Regulation 2018/162

2. Preliminary Q2 2023 Net stable funding ratio and Available stable funding based on weighted EUR amounts in

line with Regulation 575/2013 as amended by Regulation 2019/876

Slide 6 Resilient NIM in PB and CB in the second quarter

1. Reported net interest income expressed as a percentage of average interest earning assets

2. Average balances of interest earning assets for each quarter are calculated based on month-end balances

Slide 7 - CET1 ratio increase driven by earnings

1. Including credit valuation adjustment (CVA) risk-weighted assets

Slide 8 Increase in buffer above requirements

1. Maximum distributable amount (MDA)

2. CET1 requirement includes Pillar 1 requirement (4.50% ), Pillar 2 requirement (1.52%), capital conservation

buffer (2.50%), G/D-SIB buffer (2.00%), countercyclical capital buffer (0.42%) and systemic risk buffer (0.20%)

3. AT1 requirement includes higher Pillar 1 requirement (6.00%) and Pillar 2 requirement (2.03%) compared to

footnote 2 on this page

4. Total capital requirement includes higher Pillar 1 requirement (8.00%) and Pillar 2 requirement (2.70%)

compared to footnotes 2 and 3 on this page

Deutsche Bank

Investor Relations

Q2 2023 Fixed Income Investor Call

July 28, 2023

Slide 9 Continued high loss-absorbing capacity

1. Plain vanilla instruments and structured notes eligible for MREL

2. Includes adjustments to regulatory Tier 2 capital; available TLAC/subordinated MREL does not include senior

preferred debt

Slide 11- Issuance plan ~80% complete

1. Historical redemptions include non-contractual outflows (e.g. calls, knock-outs, buybacks) whereas (future)

contractual maturities do not; contractual maturities for 2021 and 2022 were € 20bn and € 12bn, respectively

2. For 2023 this includes only senior preferred issuances

Slide 14-Current ratings

1. The Issuer Credit Rating (ICR) is S&P's view on an obligor's overall creditworthiness; it does not apply to any

specific financial obligation, as it does not take into account the nature of and provisions of the obligation, its

standing in bankruptcy or liquidation, statutory preferences, or the legality and enforceability of the obligation

2. Defined as senior unsecured debt rating at Moody's and S&P, as preferred senior debt rating at Fitch and as

senior debt at DBRS

3. The arrow shows a rating upgrade received over the last twelve months

4. Short-term preferred senior unsecured debt/deposits rating

Slide 15 - Conservatively managed balance sheet

1. Liquidity reserves comprise of total stock of high-quality liquid assets (HQLA), including assets subject to

transfer restrictions and other central bank eligible securities

2. Trading and related assets along with similar liabilities, includes debt and equity securities (excluding highly

liquid securities), derivatives, repos, securities borrowed and lent, brokerage receivables and payables, and

loans measured at fair value

3. Loans at amortized cost, gross of allowances

4. Other assets include goodwill and other intangible, property and equipment, tax assets, cash and equivalents

which are not part of liquidity reserve and other receivables. Other liabilities include accrued expenses,

investment contract liabilities, financial liabilities designated at fair value through P&L excluding those

included in trading and related assets

Slide 16-Derivatives bridge

1. Excludes real estate and other non-financial instrument collateral

2. Master netting agreements allow counterparties with multiple derivative contracts to settle through a single

payment

35View entire presentation