Antero Midstream Partners Mergers and Acquisitions Presentation Deck

Wall Street Perspectives

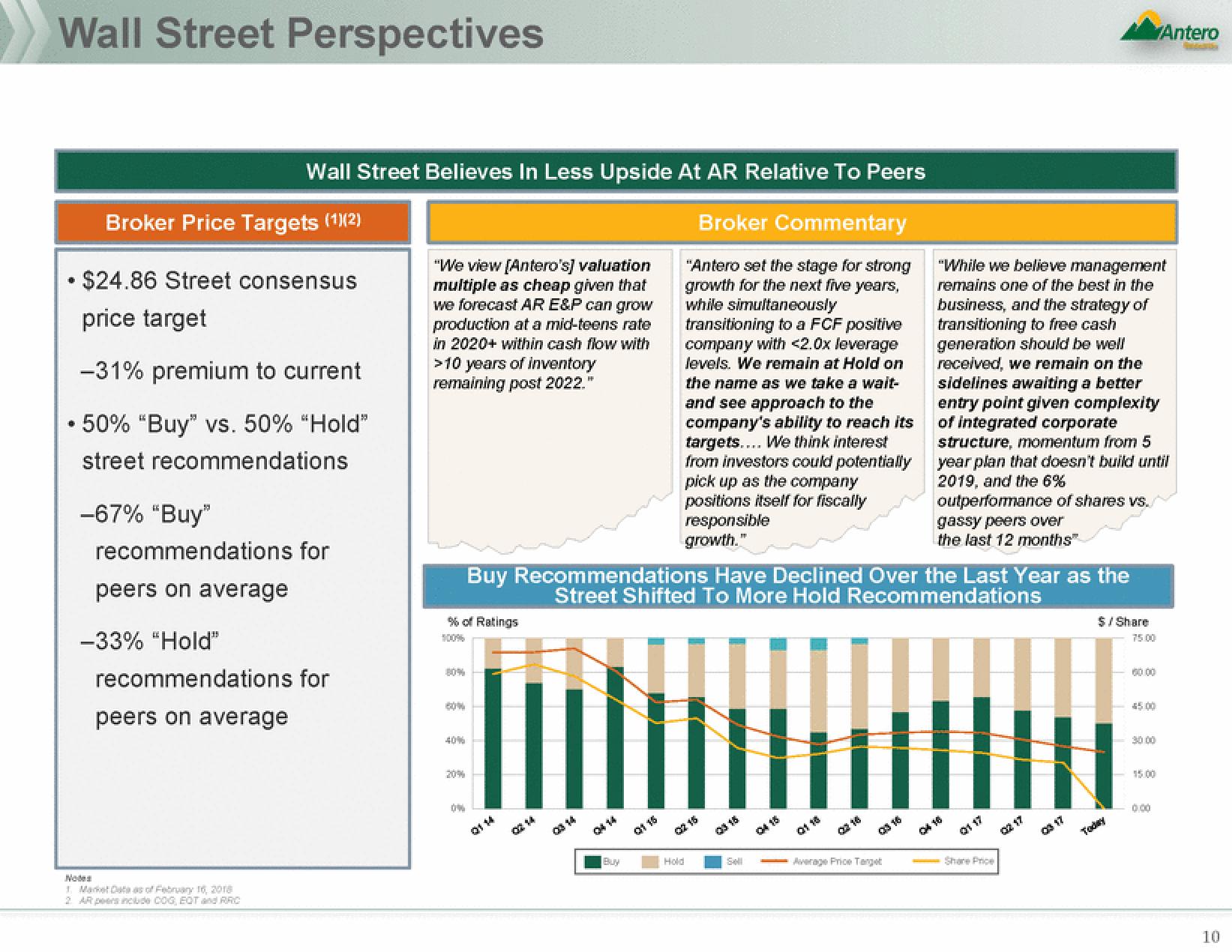

Wall Street Believes In Less Upside At AR Relative To Peers

Broker Commentary

"Antero set the stage for strong

growth for the next five years,

while simultaneously

transitioning to a FCF positive

company with <2.0x leverage

levels. We remain at Hold on

the name as we take a wait-

and see approach to the

company's ability to reach its

targets.... We think interest

from investors could potentially

pick up as the company

positions itself for fiscally

responsible

growth."

Broker Price Targets (1)(2)

* $24.86 Street consensus

price target

-31% premium to current

50% "Buy" vs. 50% "Hold"

street recommendations

-67% "Buy"

recommendations for

peers on average

-33% "Hold"

recommendations for

peers on average

Notes

1. Market Data as of February 16, 2018

2 AR peers include COG, EOT and RRC

"We view [Antero's] valuation

multiple as cheap given that

we forecast AR E&P can grow

production at a mid-teens rate

in 2020+ within cash flow with

>10 years of inventory

remaining post 2022."

% of Ratings

40%

0%

Buy Recommendations Have Declined Over the Last Year as the

Street Shifted To More Hold Recommendations

NJIH

02 14

03 14

Buy

Q1 15

Q2 15

Hold

Q3 15

Sell

04 15

Q116

Q3 16

Average Price Target

"While we believe management

remains one of the best in the

business, and the strategy of

transitioning to free cash

generation should be well

received, we remain on the

sidelines awaiting a better

entry point given complexity

of integrated corporate

structure, momentum from 5

year plan that doesn't build until

2019, and the 6%

outperformance of shares vs.

gassy peers over

the last 12 months"

Share Price

Q3 17

$/Share

Today

60.00

45.00

30.00

Antero

15.00

10View entire presentation